BRADENTON, Fla. - In a further attempt to block Jefferson County, Ala., from returning to the bond market, a group of local taxpayers cross appealed a judge's recent ruling in a case that they won.

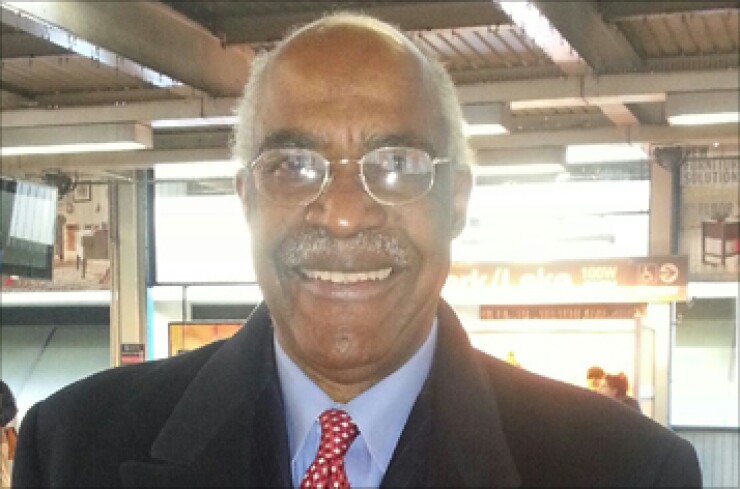

The appeal, to the Alabama Supreme Court, is meant to preserve several arguments that Circuit Judge Michael G. Graffeo did not rule on Dec. 16, when he struck down a state law that would have allowed the county to issue refunding warrants, according to attorney Calvin Grigsby.

"The reason for our cross appeal is to have all those issues in front of the court," Grigsby said. "If [the justices] overrule Judge Graffeo, they have to look at the other issues at that time."

Jefferson County, Ala., has also appealed the judge's ruling, which voided a state law that was the basis for a suit the county had filed seeking validation of $595.5 million of limited obligation refunding warrants.

The county had hoped to issue the debt in a private placement before the end of 2015, marking its return to the bond market since emerging from bankruptcy in December 2013.

Graffeo voided House Bill 573, a local act authorizing the refunding plan, because the required quorum of legislative votes was not obtained for the bill to pass and that violated the state constitution.

Taxpayers cited the quorum issue in their challenge of the validation suit, along with three other grounds that they said proved that HB 573 was unconstitutional.

After voiding HB 573 because of the voting violation, Graffeo said he "need not reach nor discuss the other three contentions" that were raised by the taxpayers.

Grigsby said that if the Supreme Court overturns Graffeo's ruling, his clients want the justices to consider all of their arguments as to why they think the bill is unconstitutional because the taxpayers will avoid having to file another lawsuit in an attempt to halt the county's financing.

"We just want to avoid any kind of legal maneuvering, so we put the cross appeal in now," he said.

The court has consolidated the cross appeal with the county's appeal, though justices have not ruled on whether they will consider the additional arguments.

The cross appeal has been filed by Jefferson County tax assessor Andrew Bennett, state Reps. John Rogers and Mary Moore, and county resident William Muhammad – the same group involved in an appeal of the county's bankruptcy case for the last two years.

Grigsby has said that he is representing the taxpayers in the HB 573 challenge to prevent the county from extending the life of what he called a "regressive" sales tax that hurts the poor.

Currently, the county has a one-cent sales tax dedicated to paying off school warrants issued in 2004 and 2005, of which about $595.5 million is outstanding.

Under the current maturity schedule, the school debt could be paid off in about 2027.

HB 573 would have allowed the county to sunset the school tax, and enact a new, general one-cent sales tax in order to refund the school warrants with a longer maturity schedule.

County officials have said that about 40% of the new sales tax collections would pay for debt service, and the remaining revenue would go toward the county's general fund, the Birmingham-Jefferson County Transit Authority, and the Birmingham Zoo.

The new sales tax revenue would provide the county additional income to pay for building, road and bridge repairs and improvements that have become backlogged since the bankruptcy filing, officials said.