Want unlimited access to top ideas and insights?

The overall economy grew for the 115th straight time, the Institute for Supply Management reported Monday.

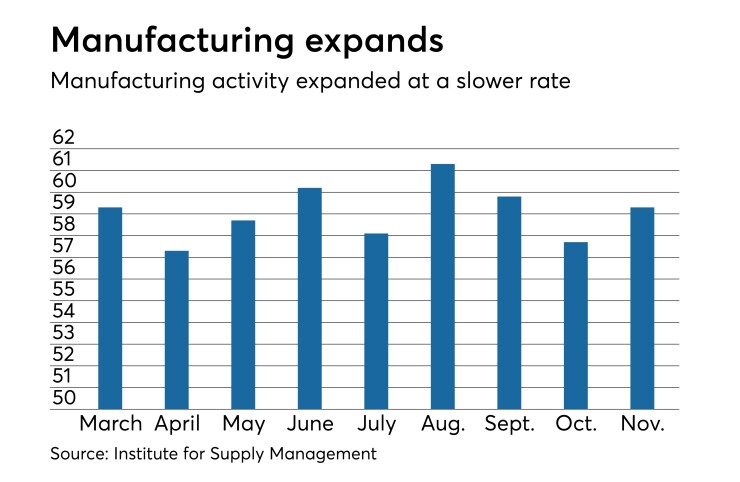

According to the ISM's monthly report on business, the ISM index increased to 59.3 in November from 57.7 in October.

Economists polled by IFR Markets predicted the index would be 57.5.

An index reading below 50 signals a slowing economy, while a level above 50 suggests expansion. A reading of 50 shows the sector was unchanged in the month.

The prices paid index decreased to 60.7 from 71.6, indicating higher raw materials prices for the 33rd consecutive month. The employment index grew to 58.4 from 56.8.

The production index rose to 60.6 from 59.9, the new orders index gained to 62.1 from 57.4; the supplier deliveries index slipped to 62.5 from 63.8; the export orders index held at 52.2; and the imports index declined to 53.6 from 54.3.

The inventories index rose to 52.9 from 50.7; the customers' inventories index decreased to 41.5 from 43.3; and backlog of orders gained to 56.4 from 55.8.

Respondents' comments included:

- “Shortages, longer lead times and capacity constraints [particularly in the electronic components marketplace] and tariffs continue to strain the supply chain and disrupt normal business practices and activities.” (Computer & Electronic Products)

- “Seeing a number [of] areas of slowdown that are concerning: truck market loosening [and] ISO depots full of empty containers, all signs of decreasing business activity.” (Chemical Products)

- “Production continues at increased levels.” (Transportation Equipment)

- “Labor shortages in our area are affecting production volumes.” (Food, Beverage & Tobacco Products)

- “Trade tariffs and commodity increases have greatly affected our ability to remain competitive in the market.” (Machinery)

- “Business [orders] steady. Many customers [moving] orders up due to price increases [from commodity costs and tariffs].” (Furniture & Related Products)

- “Business remains strong. Tariffs impact is fully reflected in Q3 results, and initiatives are underway to move work out of China into other low-cost countries.” (Miscellaneous Manufacturing)

- “A lack of experienced workers is having an impact on production, which impacts sourcing due to the skills gap in the manufacturing trades; particularly computer numeric controlled machinists, but also assemblers and welders. The challenge is meeting customer-delivery requirements for new and repaired equipment.” (Fabricated Metal Products)

- “Steel tariffs continue to put upward pressure on downstream materials (even when sourcing steel domestically). Long-haul trucking market seems to be normalizing after the implementation of the electronic logging requirements. Oil volatility is also beginning to make its way through downstream materials.” (Petroleum & Coal Products)

- “Continuing to increase imports in order to receive material in by the end of the year to avoid potential 25-percent tariffs.” (Nonmetallic Mineral Products)