The Internal Revenue Service has contacted the city of Castroville, Texas informing them of an examination of bond issuances that date back to 2015 and total $15.6 million.

"On May 21, 2024, the city received notice, dated May 15, 2024, from the Internal Revenue Service that the service is conducting an examination of the obligations," the city disclosed on EMMA. "The city anticipates to fully comply with the requests of the service made in the notice."

The notice requests a call from the city administrator, who has already responded.

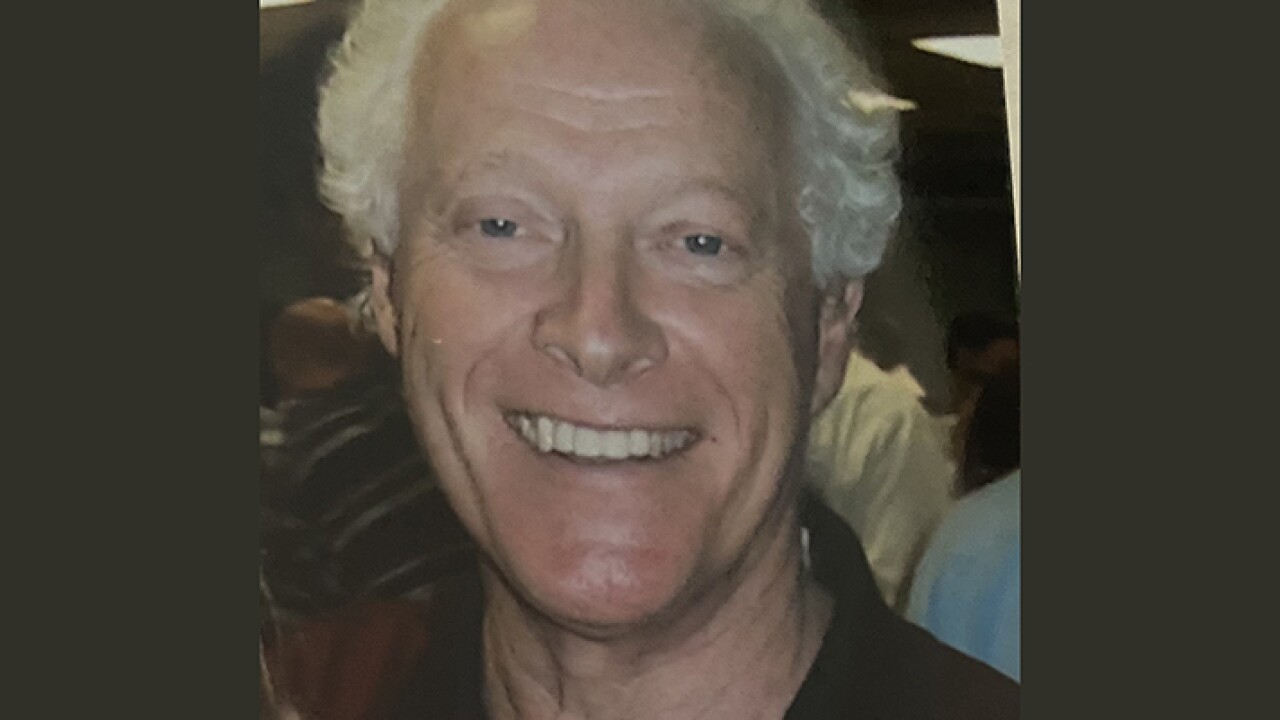

"My understanding is that it's pretty routine, we just got lucky," said Scott Dixon, the city administrator of Castroville. "I understand the IRS has hired a lot more agents. I think this thing will become a little more common for folks, but we're not overly concerned about it."

The bonds were issued in three tranches of utility system revenue bonds in the amounts of $3.05 million, $3.5 million, and $9.05 million.

The notice came under the banner of Securities and Exchange Commission Rule 15c2-12. "It is the SEC rule that governs continuing disclosure obligations of the issuer," said Rich Moore, tax partner at Orrick, Herrington & Sutcliffe. "I don't think that the opening of a routine examination by the IRS triggers a disclosure obligation under that rule, but many issuers take the approach that it is better to be safe than sorry with respect to disclosing this sort of thing."

The city believes they have their ducks in a row. "I think we've done a pretty good job of keeping our record straight," said Dixon. "It's just a matter of providing them all the details that they're looking for and making sure that we answer the questions."

The city is leaning on a team of consultants for advice on transactions that happened before they were hired. "This particular issuance actually preceeds our current financial advisor or current bond counsel and our current staff, so there's no one on staff that has recollection of the actual issuance," said Dixon.

The bond proceeds went to improving the city's wastewater treatment plant. Utility revenue bonds finance typically capital projects via customer fees, which provides the cash flow to service the debt.

In 2023 S&P Global Ratings assigned its AA-plus rating to the city's approximately $5 million series 2023 combination tax and revenue certificates of obligation. It also affirmed its AA-plus rating on the city's previously issued limited-tax GO bonds and certificates of obligation. They judged the outlook as stable.

Castroville is small city of about 3,000 people located about twenty miles west of San Antonio. It was founded in 1844 by Henri Castro and families from the French region of Alsace who have helped keep their culture alive.

Per S&P, "This location provides residents with direct access to job opportunities throughout the San Antonio metropolitan statistical area and it has resulted in strong tax base growth during the past three years. Ongoing residential development will bring well over 1,000 new homes to the city during the next several years while several industrial developments are underway or under discussion."