Municipals were little changed in a quiet summer Friday session ahead of a larger new-issue calendar and the final week of a volatile month, while U.S. Treasuries were weaker and equities rallied.

Triple-A yield curves were mostly flat to a basis point or two stronger in spots while UST were weaker with larger losses on the long end. Thirty-year muni to UST ratios fell.

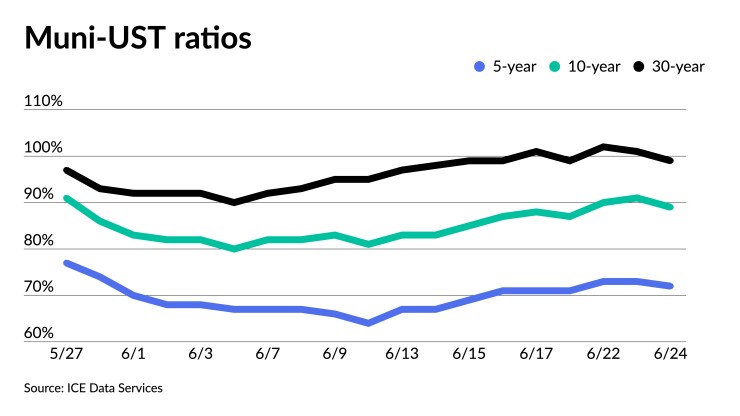

Muni-UST ratios on Thursday were at 71% in five years, 89% in 10 years and 100% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 72%, the 10 at 89% and the 30 at 99% at a 4 p.m. read.

Investors will be greeted Monday with an increase in supply with the new-issue calendar estimated at $8.010 billion in $5.924 billion of negotiated deals and $2.7087 billion of competitive loans to close out the second quarter.

The new-issue calendar for the week is led by $950 million of future tax-secured tax-exempt subordinate revenue bonds from the New York City Transitional Finance Authority (Aa1/AAA/AAA/).

The

Other notable deals in the primary include $369 million of bonds from the Municipal Electric Authority of Georgia and $318 million of GOs from the Beaverton School District No. 48J, Oregon.

In the competitive market, the North Dakota Public Finance Authority will sell $321 million of appropriation bonds; Seattle, Washington, will sell $264 million of revenue bonds; and the Clark County School District, Nevada, will sell $200 million of GOs.

After a hotter-than-expected inflation report and the subsequent Fed 75 basis point rate hike last week, “the resurrected muni market volatility proved to be short-lived,” said BofA Global Research strategists Yingchen Li and Ian Rogow.

“Signs of the muni bond market returning to normalcy appears strong, as the bold Fed action earned market confidence,” Yingchen and Rogow said in the weekly report. “The 10- and 30-year Treasury yields rallied strongly after reaching nearly 3.50%. long-term muni rates, which only came off a few basis points from a double top formation, should decline a lot more from here.”

Muni-UST ratios, they noted, rose slightly “from the more reasonable levels of early June, though the 10-year and shorter maturity ratios rise are more tempered.” Only the 30-year ratio topped 100%, which may prove attractive to some crossover accounts.

“When Treasuries rallied this week, tax-exempt yields also moved down in sympathy, but lagged, and MMD-UST ratios have continued to move higher,” according to Barclays PLC.

Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel said “long-dated tax-exempts are not far from the levels reached in mid-May, which attracted crossover interest at that time.”

“The 10s20s and 10s30s curves are close to the steepest point in many years," they said, adding that the long end looks attractive as a result.

“Near term, supply could put pressure on longer-dated munis, but to us, current levels are quite attractive already, and we expect muni yield curves to flatten by the end of the year, if not earlier,” Barclays strategists said.

BofA strategists say that a stable or bullish Treasury rates market "would be a prerequisite for the return of a more constructive muni rates market performance."

"Given the Fed's stance, that prerequisite has been met in our view," they said. "As such, strong performance of the muni rates market during the summer should be expected.”

A hawkish Fed, they said, is anticipated to “put more pressure on the economy and thus on credit spreads.” Credit spreads for single-A-rated, triple-B-rated and high-yield indexes widened 10 basis points or so for the month-to-date in June.

These moves “suggest that further widening should be expected as the economy slows,” they said.

“This year's mutual fund outflows have been consistent since the second week of January after the Fed abruptly signaled its intention to hike interest rates,” they said.

Year-to-date, total outflows exceed those during 2020's market dislocation, 2018's Fed tightening and 2013's Taper Tantrum, they said. The Investment Company Institute has mutual funds outflows at $82.8 billion year-to-date, while Refinitiv Lipper reports $45.7 billion of outflows so far this year.

Mutual funds outflows almost turned neutral in the first week of June, but suddenly resumed. “However, the resumption of large outflows proved to be just as short-lived as the muni rates resurge,” they said. “As the rally progresses, we likely will not need 10-year triple-A rates to be lower than recent lows in early June to see mutual funds turn positive.”

While tax-exempts, especially long-dated bonds, are becoming attractive again, the same isn’t true for taxables, according to Barclays strategists. Unlike corporate spreads widening this month, Foux, Pickering and Patel said taxable munis have barely moved, noting “the corporate/taxable muni yield differential is at one of its widest points in the past 12 months.”

If corporate spreads widen further in response to concerns about economic growth, they said, “it will be hard for taxable munis to hold their ground.”

Taxables have lost the most out of all muni structures with the Bloomberg taxable index seeing losses of 14.50% year to date while exempts have lost 9.31% since January.

Secondary trading

Georgia 5s of 2023 at 1.63%. California 5s of 2025 at 2.19%-2.17%. New York City 5s of 2025 at 2.20%-2.17%.

New York City 5s of 2026 at 2.31%. Triborough Bridge and Tunnel MTA bridges and tunnels 5s of 2026 at 2.46%-2.44%. Henrico County, Virginia, 5s of 2026 at 2.27%-2.23%.

Loudoun County, Virginia, 5s of 2031 at 2.76%-2.75%. Georgia 5s of 2031 at 2.75%-2.74% versus 2.83% original. Massachusetts 5s of 2032 at 2.85% versus 2.91% Thursday. Massachusetts 5s of 2033 at 2.95%.

Maryland 5s of 2034 at 2.97% versus 3.06%-2.95% Thursday. Washington 5s of 2035 at 3.15%.

California 5s of 2041 at 3.48%-3.47% versus 3.60% Tuesday. Charleston, SC, waters 5s of 2052 at 3.58%-3.53% versus 3.75% original.

AAA scales

Refinitiv MMD’s scale was unchanged at the 3 p.m. read: the one-year at 1.63% and 1.97% in two years. The five-year at 2.26%, the 10-year at 2.79% and the 30-year at 3.25%.

The ICE municipal yield curve was bumped two basis points: 1.65% (-2) in 2023 and 1.97% (-2) in 2024. The five-year at 2.31% (-2), the 10-year was at 2.75% (-2) and the 30-year yield was at 3.25% (-2) at a 4 p.m. read.

The IHS Markit municipal curve was unchanged 1.63% in 2023 and 1.97% in 2024. The five-year at 2.24%, the 10-year was at 2.80% and the 30-year yield was at 3.26% at 4 p.m.

Bloomberg BVAL was bumped one basis point two years and in: 1.66% (-1) in 2023 and 1.95% (-1) in 2024. The five-year at 2.28% (unch), the 10-year at 2.79% (unch) and the 30-year at 3.25% (unch) at a 4 p.m. read.

Treasuries were weaker.

The two-year UST was yielding 3.048% (+3), the three-year was at 3.137% (+2), the five-year at 3.180% (+3), the seven-year 3.197% (+4), the 10-year yielding 3.134% (+4), the 20-year at 3.522% (+6) and the 30-year Treasury was yielding 3.262% (+6) at 4 p.m.

Primary to come:

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Wednesday $950 million of future tax-secured tax-exempt subordinate bonds, Fiscal 2023 Series A, Subseries A-1, serials 2024-2028. Siebert Williams Shank & Co.

The Alabama Corrections Institution is set to price Tuesday $725 million of Finance Authority revenue bonds, Series 2022A, serials 2022-2023 and 2026-2052. Stephens.

The Municipal Electric Authority of Georgia (A2/A/BBB+/) is set to price Tuesday $369.005 million of Plant Vogtle Units 3 & 4 bonds, consisting of Project M bonds, Project J bonds, Project P bonds and taxable Project P bonds. Goldman Sachs.

The Beaverton School District No. 48J, Oregon, (Aa1/AA+//) is set to price Tuesday $318.172 million of general obligation bonds, consisting of $139.147 million of deferred interest bonds, Series 2022A and $179.025 million of current interest bonds, Series 2022B, insured by Oregon Bond Guaranty Act. Piper Sandler & Co.

The Alameda Corridor Transportation Authority, California, is set to price Thursday $273.500 million of lien revenue refunding bonds, consisting of tax-exempt senior capital appreciation bonds, Series 2022A (A3/A-/A/); taxable senior current interest bonds, Series 2022B (A3/A-/A/); and tax-exempt second convertible capital appreciation bonds, Series 2022C (Baa2/BBB+/BBB/). J.P. Morgan Securities.

The Sumter County Industrial Development Authority, Florida, (B1/B+/BB-/) is set to price Thursday $250 million of green exempt Enviva Inc. Project facilities revenue bonds, Series 2022, serial 2052. Citigroup Global Markets.

Texas (Aaa///) is set to price Tuesday $250 million of Texas Veterans Land Board veterans bonds, Series 2022, Weekly VRDB, term 2053. Jefferies.

The San Diego Unified School District, California, is set to price Thursday $235 million of 2022-2023 tax and revenue anticipation notes, Series A, serial 2023. Citigroup Global Markets.

The New Hope Cultural Education Facilities Finance Corp., Texas, is set to price Wednesday $197.915 million of Outlook at Windhaven Project retirement facility revenue bonds, Series 2022, consisting of $109.715 million of Series 2022A, $19.755 million of Series 2022B-1, $25.640 million of Series 2022B-2, $41.465 million of Series 2022B-3 bonds and $1.340 million of Series 2022C. Ziegler.

The Dormitory of the State of New York (/BBB-//) is set to price Wednesday $148.815 million of Yeshiva University revenue bonds, Series 2022A. Goldman Sachs & Co.

The Merrillville Multi-School Building Corp., Indiana, (/AA+//) is set to price Tuesday $145.495 million of ad valorem property tax first mortgage bonds, Series 2022, serials 2028-2042, insured by Indiana State Aid Intercept Program. Stifel, Nicolaus & Co.

The Willis Independent School District, Texas, (/AAA//) is set to price Monday $140.260 million of unlimited tax school building bonds, Series 2022, insured by Permanent School Fund Guarantee Program. FHN Financial Capital Markets.

The Alameda County Transportation Commission, California, (/AAA/AAA/) is set to price Wednesday $125.210 million of Measure BB limited tax senior sales tax revenue bonds, Series 2022, serials 2023-2041, term 2045. Citigroup Global Markets.

The Village Community Development District No. 14, Florida, is set to price next week $122.890 million of special assessment revenue bonds, Series 2022, terms 2027, 2032, 2037, 2042 and 2053. Jefferies.

The Barbers Hill Independent School District, Texas, (Aaa/AAA//) is set to price Wednesday $112.500 million of unlimited tax school building bonds, Series 2022, insured by Permanent School Fund Guarantee Program. Piper Sandler & Co.

Williamson County, Texas, (/AAA/AAA/) is set to price Monday $112 million of unlimited tax road bonds, Series 2022, serials 2023-2042. Raymond James & Associates.

The Nebraska Investment Finance Authority (/AA+//) is set to price Wednesday $106.980 million of non-AMT social single-family housing revenue bonds, 2022 Series D. J.P. Morgan Securities.

Competitive:

Denton, Texas, is set to sell $70.760 million of general obligation refunding and improvement bonds, Series 2022, at 11:15 a.m. eastern Tuesday.

Denton, Texas, is set to sell $110.360 million of certificates of obligation, Series 2022, at 10:45 a.m. Tuesday.

Seattle, Washington, (Aa2/AA//) is set to sell $263.825 million of municipal light and power improvement and refunding revenue bonds, Series 2022, at 10:45 a.m. Tuesday.

The Scott County School District Finance Corp., Kentucky, is set to sell $105.445 of school building revenue bonds, Series of 2022, at 11 a.m. eastern Wednesday.

The Clark County School District, Nevada, (A1/A+//) is set to sell $200 million of general obligation limited tax building bonds, Series 2022A, at 11:30 a.m. Wednesday.

Montgomery County, Pennsylvania, (Aaa///) is set to sell $155.220 million of general obligation bonds, Series of 2022, at 11 a.m. Wednesday.

Pueblo County, Colorado, is set to sell $126.355 million of Jail Project certificates of participation, Series 2022A, at 12 p.m. eastern Thursday.

The North Dakota Public Finance Authority is set to sell $320.800 million of taxable legacy fund infrastructure program bonds, Series 2022, at 10 a.m. Thursday.

Gabriel Rivera contributed to this report.