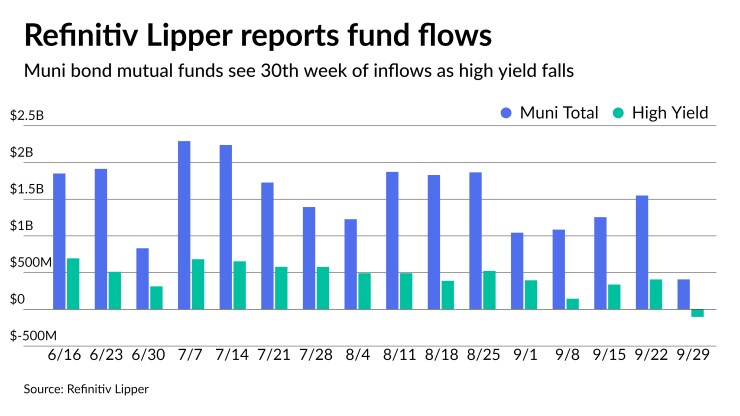

Municipals were little changed with a softer tone Thursday while municipal bond mutual funds saw a drop in inflows to $408 million and high yield saw its first outflows since March 3.

For 30 straight weeks, investors put cash into municipal bond funds although their confidence may be waning, according to data released Thursday. Refinitiv Lipper said inflows into municipal bond funds was down more than $1 billion from a week prior, while high-yield funds turned negative, seeing $103 million of outflows.

The lower inflows and high-yield outflows can be tied to the correction over the past week and may point to uncertainty from retail investors over broader market volatility.

Since the correction began a week ago, the 10-year AAA spot has settled around 1.11%-1.13%, 17 to 18 basis points above where it was a week ago. Yields in both UST and triple-A munis are at levels near or above where they landed after the last sell off in March.

U.S. Treasuries and equities have been volatile and stocks were mixed again Thursday with the Dow Jones Industrial Average off over 500 points. The 10-year UST stood at 1.502% near the close, below Wednesday's levels.

Ratios were in line with the moves, with the 10-year municipal-to-UST ratio at 75% and the 30-year at 80%, according to Refinitiv MMD. The 10-year ratio was at 73% while the 30-year was at 81%, according to ICE Data Services.

September returns across municipal indices were in the red. The Bloomberg Fixed Income Indices municipal index ended -0.67%, high-yield at -0.61% and taxables at -1.43%. Municipals in those sectors are still in the black for the year at 0.85%, 6.58% and 0.30%, respectively, but down significantly from the summer.

In the primary, Jefferies LLC priced for the Golden State Tobacco Securitization Corp. (Aa3/A+/AA-//) $1.839 billion enhanced tobacco settlement asset-backed bonds, with bonds in 6/2022 at 0.502%, 1.60% in 2026, 2.346% in 2030, 2.746% in 2034, 3.293% in 2042, 3% in 2046, all at par, subject to a make-whole call except for bonds in 2034 and 2042, callable June 1, 2031.

J.P. Morgan Securities LLC priced for the Department of Transportation of Maryland (Aa1/AAA/AA+/) $195.985 million of forward delivery consolidated transportation bonds with 5s of 12/2022 at 0.35%, 5s of 2026 at 0.78%, and 5s of 2028 at 1.15%, delivery 3/3/2022. The second tranche saw 5s of 12/2023 at 0.76%, 5s of 2026 at 1.12% and 5s of 2029 at 1.60%, delivery 11/3/2022.

Barclays Capital Inc. priced for the Municipal Electric Authority of Georgia (A2/A-/BBB+/) $178.885 million of exempts, bonds in 1/2023 with a 4% coupon yield 0.29%, 4s of 2026 at 0.70%, 5s of 2029 at 1.31%, 5s of 2031 at 1.59%, 5s of 2036 at 1.89%, 4s of 2041 at 2.25%, 5s of 2046 at 2.24% and 4s of 2051 at 2.43%.

Barclays also priced $134.17 million of taxables for the Municipal Electric Authority of Georgia. Details were not available.

New Castle County, Delaware, (Aaa/AAA/AAA) sold $87.305 million of general obligation bonds to Citigroup Global Markets Inc. with 5s of 10/2022 at 0.13%, with 5s of 10/2022 at 0.13%, 5s of 2026 at 0.54%, 5s of 2031 at 1.18%, 1.875s of 2036 at 1.99%, 2.125s of 2041 at 2.19%, 2.75s of 2046 at 2.34% and 2.5s of 2051 at 2.54%.

The issuer also sold $206.7 million of taxable general obligation bonds to J.P. Morgan Securities with bonds in 7/2023 at 0.29%, 2026 at 1.09%, 2031 at 1.90%, 2036 at 2.30%, 2041 at 2.70%, and 2045 at 2.83%, all at par.

Refinitiv Lipper reports $408M inflow

In the week ended Sept. 29, weekly reporting tax-exempt mutual funds saw $408.056 million of inflows, Refinitiv Lipper said Thursday. It followed an inflow of $1.550 billion in the previous week.

Exchange-traded muni funds reported inflows of $154.991 million, after inflows of $196.300 million in the previous week. Ex-ETFs, muni funds saw inflows of $253.065 million after inflows of $1.354 billion in the prior week.

The four-week moving average remained positive at $1.075 billion, after being in the green at $1.234 billion in the previous week.

Long-term muni bond funds had inflows of $77.576 million in the latest week after inflows of $1.054 billion in the previous week. Intermediate-term funds had inflows of $106.188 million after inflows of $212.343 million in the prior week.

National funds had inflows of $357.439 million after inflows of $1.381 billion while high-yield muni funds reported outflows of $102.940 million in the latest week, after inflows of $407.551 million the previous week.

Secondary trading and scales

Trading was mixed but mostly made for a steady yield curve. Connecticut 5s of 2022 at 0.14%. New York City 5s of 2022 at 0.13%. New York City TFA 5s of 2023 at 0.20%. San Antonio, Texas, 5s of 2023 at 0.17%-0.16%.

Tennessee 5s of 2026 at 0.55%.

Princeton 5s of 2029 at 0.91% versus 0.81% Monday.

California 5s of 2029 at 1.04%. Maryland 5 of 2032 at 1.24%. Austin, Texas, 5s of 2032 at 1.27%.

Cypress-Fairbanks ISD, Texas, 3s of 2036 at 1.60% versus 1.41% Friday.

Washington 5s of 2041 at 1.67%. Iowa Finance Authority green bonds 5s of 2046 at 1.76%. Massachusetts 5s of 2048 at 1.89%.

According to Refinitiv MMD, short yields were steady at 0.13% and at 0.20% in 2022 and 2023. The yield on the 10-year rose one basis point to 1.14% while the yield on the 30-year sat at 1.67%.

The ICE municipal yield curve showed bonds steady in 2022 at 0.15% and at 0.19% in 2023. The 10-year maturity sat at 1.11% and the 30-year yield rose one basis point to 1.68%.

The IHS Markit municipal analytics curve showed short yields steady at 0.13% and 0.18% in 2022 and 2023, respectively. The 10-year yield sat at 1.11% and the 30-year yield steady at 1.66%.

The Bloomberg BVAL curve showed short yields at 0.16% and 0.16% in 2022 and 2023. The 10-year yield rose one to 1.12% and the 30-year yield rose one to 1.67%.

In late trading, Treasuries yields fell as equities sold off.

The 10-year Treasury was yielding 1.502% and the 30-year Treasury was yielding 2.069%. The Dow Jones Industrial Average lost 546 points, of 1.59%, the S&P 500 lost 1.19% while the Nasdaq lost 0.44%.

Labor market challenges

Despite the belief that reopening of schools and the end of the added unemployment benefits would result in a labor market surge, the latest initial jobless claims figures suggest otherwise.

“For anyone who thought the hiring challenges would disappear when the COVID-era unemployment insurance programs ended, this should be a wake-up call,” said Luke Tilley, chief economist at Wilmington Trust. The third consecutive weekly increase in claims, he said, indicates “ongoing challenges in the labor market.”

The data “was very noisy and unlikely to change any expectations on the direction of the labor market recovery, pricing pressures, and supply chain worries,” said Edward Moya, senior market analyst for the Americas at OANDA.

“The eye-catching number was the 6.2 million drop in people participating in all unemployment insurance (UI) programs,” he said. “Now only 5.02 million Americans are participating in UI benefits, which could mean millions of Americans will be incentivized to return to the workforce.”

Claims rose to a seasonally adjusted 362,000 in the week ended Sept. 25 from 351,000 the week before. Economists polled by IFR Markets expected claims to drop to 328,000.

Continuing claims fell to 2.802 million in the week ended Sept. 18 from 2.820 million a week earlier. Economists expected 2.800 million.

“Today’s report gives us the first indication of impacts from ending of the Pandemic Unemployment Assistance and Pandemic Emergency Unemployment Compensation programs,” Wilmington’s Tilley noted. And while more than six million people have recently lost benefits as a result, “We have not yet seen evidence that these individuals have returned to the labor market en masse.”

Next week’s employment report could offer a glimpse into whether some of these people started looking for work. “We do expect an uptick in labor force participation in that report,” Tilley said, “but not a massive surge as many people are still facing challenges with child care, elder care, and may be reticent to return to work for fear of getting sick.”

Mark Hamrick, senior economic analyst at Bankrate, said the unemployment rate may dip, but job growth is expected to be “restrained.”

“There’s no doubt that the surge in the Delta variant, global supply chain issues and the mismatch between available (and not available) workers and a record number of job openings are all conspiring to produce a situation unlike we’ve experienced before,” he said.

Additionally, the end of benefits earlier this month may have been a factor in recent weak consumer confidence reads. While the declines have been attributed greatly to the rise in COVID cases, Wilmington’s Tilley said, “we should not be blind to the fact that 6.2 million people (equivalent to 3.8% of the labor force) stopped receiving government benefits this month and that could weigh on confidence.”

And while Wilmington remains optimistic about the outlook in general, third quarter consumer spending should be “very weak.”

Also released Thursday, the final second quarter gross domestic product was revised up a tick to 6.7% growth from the previous estimate, after 6.3% growth in the first quarter. Economists expected it to hold at 6.6%.

Finally, the Chicago Business Barometer fell to 64.7 in September from 66.8 in August. Economists expected a 65.0 level.

The biggest decline among the five main figures was in order backlogs, which slumped to 61.1 in the month from 81.6 a month earlier as a result of supply issues.

The report suggests most firms “have had to modify their supply chain strategy,” OANDA’s Moya said.

Chip Barnett contributed to this report.