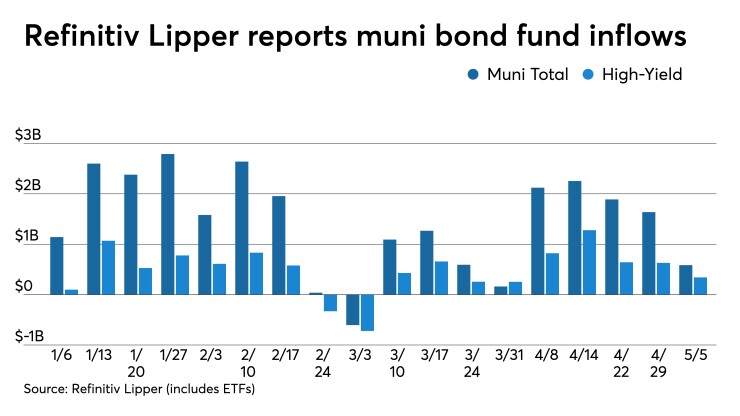

Municipal bonds were steady to firmer in spots as the final new deals of the week priced in an issuer-friendly market while Refinitiv Lipper saw inflows drop dramatically from a week earlier as the tax deadline approaches, and investors pause reinvesting to pay tax bills.

Municipal bond mutual fund inflows ticked in at $584.911 million after an inflow of $1.637 billion in the previous week. Inflows fell below $1 billion for the first time since March.

High-yield muni funds also reported a drop in inflows to $341.418 million in the latest week, after $629.772 million the previous week.

"I don't think this is a sign of the fund complex pulling back as much as it is simply a time to pause and pay some bills," a New York trader said. "The fundamentals haven't changed and there is little selling pressure to point to this week. It's still a heck of a time to be an issuer and a challenging time to be an investor with these yields and ratios."

Exchange-traded muni funds reported inflows of $113.428 million, after inflows of $460.339 million in the previous week. Ex-ETFs, muni funds saw inflows of $471.484 million after inflows of $1.177 billion in the prior week.

The four-week moving average remained positive at $1.591 billion, after being in the green at $1.976 billion in the previous week.

With few deals pricing Thursday, the secondary was relatively quiet and triple-A benchmarks were mostly unchanged.

The prospect of higher taxes is helping keep the potential for higher yields at bay as overwhelming demand continues to fuel brisk activity on the buy side, despite the rich ratios, according to Roberto Roffo, managing director and portfolio manager at SWBC Investment Company in San Antonio.

“The continuous chatter of higher taxes has increased the demand for municipal bonds, and the approximately $30 billion of new cash on a year-to-date basis will provide a backstop to any meaningful rise in municipal yields,” he said Thursday.

Municipal to UST ratios closed at 63% in 10 years and 70% in 30 years on Thursday, according to Refinitiv MMD, while ICE Data Services had the 10-year at 62% and the 30 at 71%.

The primary market again held rates steady as new issues fared well.

In the competitive market, Milwaukee (/A/AA-/) sold $179.9 million of general obligation promissory notes to J.P. Morgan Securities LLC. The first tranche, $149.89 million, saw 5s of 2022 yield 0.15%, 5s of 2026 yield 0.63% and 5s of 2031 at 1.28%. Noncallable. The second tranche, $30 million of general obligation corporate purpose bonds, carries Assured Guaranty Municipal Corp. insurance, with 4s of 2032 at 1.45%, 3s of 2036 at 1.71% and 2.25s at par in 2041.

J.P. Morgan repriced $118.9 million of general obligation bonds for El Paso, Texas, (/AA/AA/). The first series, $40.9 of exempts, saw 5s of 2025 yield 0.51%, 5s of 2026 at 0.62% (-2bps), 5s of 2031 at 1.26% (-4), 3s of 2036 at 1.67% (-6), 3s of 2041 at 1.90% (-3), and 3s of 2047 at 2.08%. The second, $61 million of exempt certificates of participation, saw 5s of 2025 at 0.51%, 5s of 2026 at 0.62% (-2), 5s of 2031 at 1.26% (-4), 4s of 2036 at 1.57% (-6), 4s of 2041 a 1.79% (-4) and 4s of 2047 at 1.93% (-5). The third, $16 million of exempt certificates of participation, saw 5s of 2025 at 0.51%, 5s of 2026 at 0.62% (-2), 5s of 2031 at 1.26% (-4), 4s of 2036 at 1.57% (-6), 4s of 2041 at 1.79% (-4) and 4s of 2047 at 1.93% (-5).

The larger new issues priced this week were generally well received and Roffo said managers are taking ample cash off the sidelines to purchase “anything they can that makes sense.”

Rich municipal-to-Treasury ratios are creating positive impacts for issuers, but negative consequences for traders and investors on the buy side.

Heavy demand for tax-exempt paper is keeping the ratios rich, while also supporting the primary market, according to Roffo, but a North Carolina trader said they are making it harder to find relative value.

“This demand has made it easy for new issues to clear the market at the current rich valuations,” he said. “Credit spreads have narrowed significantly due to the perceived credit strength of the overall municipal market from high-grade bonds to high-yield bonds,” he added.

That being said, there is still value in some of the smaller, lower-rated issues, Roffo noted.

“It’s a grind, and hard to find relative value,” the North Carolina trader said Thursday, adding, managers have to put money to work despite the unappealing ratios.

“When you're talking about a 55% ratio in 10 years, or when you have something that should trade at plus-55 that is trading at plus-35, trying to get excited about that is challenging,” he said.

That scenario is heightening the demand for paper, particularly high-yield bonds, he noted.

“There are multiple guys willing to pay tighter spreads to own some yield,” the trader said.

More activity occurred on Thursday than on the prior two days, as most of the large new issues were priced and free to trade, and cash-flush investors were ready for paper.

“Guys are putting money to work on specific buckets on the curve or structures,” he said. “They have to put money to work and are capturing some things here and there, but it’s a best of the worst scenario,” he said, noting that poor liquidity is also challenging the market.

The seeming unending heavy demand despite the rich climate on new issues can't be ignored.

For instance, he said the $1.04 billion Pennsylvania GO deal, came “extraordinarily tight," but was in high demand as there were small balances reoffered on the tax-exempt bonds Thursday.

In addition, a $188 million Iowa Finance Authority deal on Wednesday traded up and was well placed, especially the maturities that had any spread to the generic, GO market.

Going forward, the trader expects the current municipal climate to remain a “strong grind” in the near term, with little change.

“Hopefully, we will see some volatility cheaper and not tighter, but whenever it happens it will happen quickly,” he said.

Scales

On Refinitiv MMD’s AAA benchmark scale, yields were steady at 0.09% in 2022 and 0.12% in 2023. The yield on the 10-year was at 0.99% and the 30-year at 1.58%.

The ICE AAA municipal yield curve showed yields at 0.09% in 2022 and 0.13% in 2023, the 10-year at 0.99%, while the 30-year stayed at 1.57%.

The IHS Markit municipal analytics AAA curve showed yields steady at 0.10% in 2022 and 0.13% in 2023, the 10-year rose three basis points to 0.98% and the 30-year fell one to 1.58%.

The Bloomberg BVAL AAA curve showed yields steady at 0.06% in 2022 and 0.08% in 2023, with the 10-year steady at 0.95%, and the 30-year yield down one basis point to 1.57%.

The three-month Treasury note was yielding 0.02%, the 10-year Treasury was yielding 1.57% and the 30-year Treasury was yielding 2.24% near the close. Equities were mixed with the Dow gaining 201 points, the S&P 500 rising 0.39% and the Nasdaq off 0.17% near the close.

Kaplan holds his ground

A taper conversation remains the desire of Federal Reserve Bank of Dallas President Robert Kaplan, although several regional presidents and one Fed governor said Wednesday that the economy is far from recovery and accommodation is still necessary.

Speaking on Thursday, he said, "I would like to see us being able to start talking about how to taper, sooner rather than later.” Liftoff, he suggested, will occur next year, also a year earlier than most of his colleagues do.

Much like the others, Kaplan cited faster than anticipated progress. But while the others see it as the beginning of recovery, Kaplan fears falling behind the curve.

“I think it would be wise to begin discussion on our purchases, you don't want to be preemptive but you don't want to be so reactive that you're too late,” he said in a virtual event Thursday. Noting the others’ thoughts, he suggested trying to reach a middle ground because waiting too long to act can “impede the ability to reach our goals.”

“We would be well served to talk about it sooner rather than later,” Kaplan said. “We will be a much healthier economy when we start to wean off these purchases.”

The Dallas Fed’s base case calls for 6.5% GDP growth this year, unemployment near 4% and personal consumption expenditures high in the middle of the year, but near 2.25% by yearend.

As for inflation, he said, “I do not know if these price pressures are temporary or not and that is the most intelligent answer I can give right now.”

While he agrees with the Fed’s new framework, Kaplan said, its “implementation … gives the Fed less flexibility to change rates.” And while he believes, “we should remain highly accommodative, that does not mean a rate of zero.”

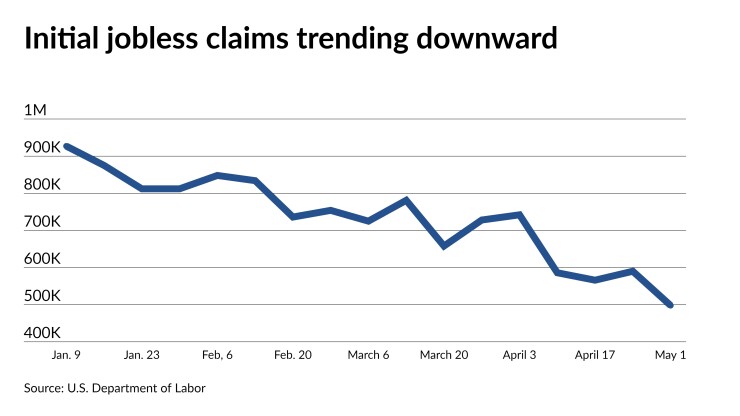

Separately, further signs of economic recovery came Thursday, as initial claims for unemployment dropped below 500,000 for the first time since March 2020, and nonfarm productivity rose at a healthy clip.

The markets are looking ahead to the employment report, which is expected to be strong, but would only be the second good report when the Federal Reserve is looking for a “string” of positive data before adjusting policy.

Initial jobless claims fell to a pandemic low of 498,000 on a seasonally adjusted annual basis in the week ended May 1 from an upwardly revised 590,000 a week earlier, first reported as 553,000.

Economists expected 540,000 claims in the week.

This is the lowest number since 256,000 the week of March 14, 2020.

Continued claims increased to 3.690 million in the week ended April 24 from a downwardly revised 3.653 million a week earlier, initially reported as 3.666 million.

“A bigger than expected decline in new jobless claims is a most pleasant surprise,” said Mark Hamrick, senior economic analyst at Bankrate. “The healing of the job market, including reduction of unemployed and those seeking and receiving jobless aid, is as important an economic thread as any being monitored amid the reopening story.”

More important is Friday’s employment report, with economists expecting nearly 1 million jobs added in April. Even if it “misses to the downside, anything above 500,000 will be encouraging,” said Wilmington Trust economists Luke Tilley and Rhea Thomas. “We expect strong job growth for the remainder of the year above 500,000 per month on average driven by a strong service sector.”

But even with a strong report, “we are still likely a long way from the Fed signaling the start of tapering,” they said, “with 8.4 million jobs to be recovered, 4 million workers who have left the labor force, and broader measures of unemployment.”

Wells Fargo Securities expects an even bigger rise … 1.1 million new jobs, said its senior economist Sarah House. “The unemployment rate should continue to decline, but we expect it to edge down only slightly to 5.8% as the growing number of job opportunities, easing health concerns, and reopening of schools bring more workers back into the labor force.”

In other data released Thursday, nonfarm productivity grew at a 5.4% seasonally adjusted annual pace in the first quarter after falling a revised 3.8% a quarter earlier, originally reported as a 4.2% decrease.

Unit labor costs fell 0.3% in the quarter after climbing a downwardly revised 5.6% in the fourth quarter of 2020, originally reported as a 6.0% gain.

Economists estimated a 4.2% rise in productivity and a 1.0% dip in unit labor costs.

Year-over-year, productivity gained 4.1% from the first quarter of 2020 and unit labor costs are up 1.6% annually.

“Demand roared back faster than businesses brought on workers,” House said. “The surge follows the typical pattern of a recovery but says little about the underlying trend in productivity.”

Productivity growth should “slow later this year as the jobs recovery progresses,” specifically in the leisure and hospitality sectors, she added.

Still to be determined is whether changes related to COVID-19 “boosted the lackluster pace of productivity growth that prevailed over the past decade, as companies have rapidly adopted new technology,” she said. “If the underlying trend in productivity does pick up, that could keep wage pressures from becoming inflationary.”