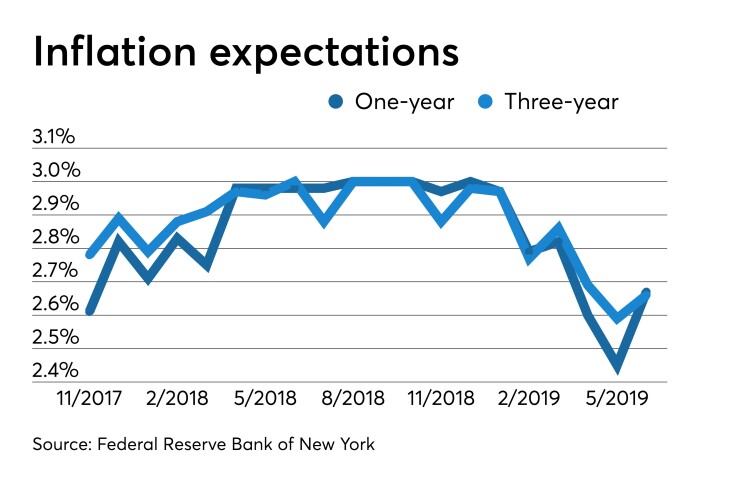

Consumers see inflation rising 2.7% in the next three years and expect the Fed to cut rates, according to the Federal Reserve Bank of New York’s June Survey of Consumer Expectations.

Median inflation expectations grew to 2.7%, up 0.2 percentage points, for a one-year horizon and to 2.7% for a three-year horizon, a 0.1-point increase. In April and May, expectations had fallen.

“Respondents were generally more upbeat about their financial situation and about the labor market, with expectations about the U.S. unemployment rate, finding a job, and losing one’s job all improving,” according to the survey released Monday.

However, consumers’ forecasts for the average savings account interest rate fell to the lowest since May 2015, suggesting they expect the Federal Open Market Committee to cut interest rates this year.

The likelihood of finding a new job if the current job was lost was at record high levels, the New York Fed reported. Median household growth was slightly above trend, at 2.9%.

Employment trends fall

The Conference Board’s Employment Trends Index dropped to 109.51 in June from 111.22 in May. The May figure was lowered from 111.63. The ETI is up 0.6% in the past 12 months.

The decline was led by an increase in the number of respondents saying jobs are hard to get. Gad Levanon, chief economist, North America, at The Conference Board, said the decline “is potentially the result of noise rather than a more significant signal” since one component fueled the decline, and it should be taken “with caution.”

Despite the drop, The Conference Board sees the labor market continuing to tighten.

While Friday’s jobs report was strong overall, the gain in average hourly earnings disappointed, suggesting “softening” wage pressures, according to Morgan Stanley Research. The Fed will still have new inflation data to review before making a decision. “If Fed policymakers are framing a July rate cut as an insurance move,” the decision becomes one of magnitude, the researchers write.

Downward GDP trend

The Federal Reserve Bank of San Francisco’s latest

“The estimated decline in trend growth in the construction sector alone accounts for 30% of the decline in trend GDP growth,” according to authors Andrew Foerster, a research advisor at the San Francisco Fed; Andreas Hornstein is a senior advisor at the Federal Reserve Bank of Richmond; Pierre-Daniel Sarte, a senior advisor at the Richmond Fed; and Mark Watson, an economics and public affairs professor at Princeton University. “Taken together, construction, nondurable goods, and professional and business services account for about 60% of the total decline in trend growth.”

Fed Listens

The New York Fed also released a summary of its Fed Listens events, which showed participants “were mixed” on the importance of the Fed’s dual mandate of price stability and maximum employment and which was more significant.

While participants see the labor market as “tight,” many were concerned about low- and moderate-income households, and suggested the Fed “focus on helping to create quality jobs with living and equitable wages, not just minimum wages.”

Another takeaway was that “price inflation” needs to “be predictable and stable.”

Participants also noted the impact of monetary policy is “disproportionate” since it’s based on the nation as a whole, and may not “accurately” reflect “the multiple and diverse local economies that exist in the country.”