The new fund managing suburban Chicago and downstate police pension assets won’t make an end-of-the-month consolidation deadline but it’s seen an uptick in local funds ready to begin the transfer process after

The increased willingness to abide by the 2019 law comes after Kane County Circuit Court Robert K. Villa rejected arguments that the consolidation of more than 600 local government police and firefighter funds outside Chicago violated the state’s pension clause that protects benefits from being diminished or impaired.

The case is facing its next legal test as the group of local police funds behind the 2021 lawsuit filed an appeal of Villa’s decision Wednesday, although no arguments have yet been laid out. The losing side was expected to appeal, and the case is expected to eventually land before the Illinois Supreme Court.

“While the case plays out in court, the staff of the Illinois Police Officers’ Pension Investment (IPOPIF) continues to work with local Article 3 pension plans to move their assets to the consolidated fund,” the fund said in a statement Thursday. “In fact, since the ruling in favor of the defendants, we have been fielding numerous inquiries from local plans who now wish to start the process of transferring investment assets.”

As of May 31, IPOPIF had received $1 billion in assets from 46 funds.

“We expect those numbers to more than double by the end of June,” the fund said. Nearly $10 billion of assets are managed by local police funds that eventually would be subject to the consolidation laid out in Public Act 101-0610.

In contrast, the new Firefighters’ Pension Investment Fund reports 90% of local funds have completed the transfer process. The firefighters’ fund had more widespread support among local systems when the legislation was being debated while some police funds and pension associations opposed it.

The fire fund said it had hoped Villa’s ruling would put the challenge to rest as it carries some cost.

“Although FPIF has been able to manage a cost-effective, efficient transition process, the litigation has resulted in unexpected costs to FPIF, which will ultimately be borne by the local pension funds,” the fund said in a statement. The fund expects more than $25 million in annual fee savings alone from the consolidation.

Fund director William Atwood said he expects most of the 23 funds that have not yet transferred their assets to FPIF will do so July 14.

Of the 296 downstate and suburban fire funds, 260 had transferred their funds by the end of May and an additional 13 firefighters pension funds transferred their assets to the new portfolio this month with 23 remaining.

"We are aware that many of those funds were prepared to transfer those assets if the court ruled in our favor," Atwood said in an email. "Given the timing of the judge’s ruling, it would not have been possible to prudently schedule a final tranche for June. As a result, we have scheduled a tranche for the transfer of assets for July 14, 2022. We are confident that most, if not all, of the 23 remaining funds will transfer on that day." The approximate portfolio value of the funds yet to transfer is $250 million.

Gov. J.B. Pritzker won

The plan has modest fiscal goals such as reducing administrative costs and raising investment returns, but rating agencies considered it a positive credit step because municipal budgets are strained by rising payment demands that have forced some to raise taxes, cut services, issue pension obligation bonds, and sell off assets. It also represented one of the rare actions taken by the state to help local governments on the pension front.

While benefits would continue to be managed by local boards, some police funds and their advocacy organizations resisted the change and a group of

In Arlington Heights Police Pension Fund et al v. Jay Robert Pritzker et al, the plaintiffs represented by Konicek & Dillon argued that benefits are damaged because the law “strips plaintiffs of their autonomy and their authority.”

The state, represented by Attorney General Kwame Raoul’s office, countered that fund management doesn’t enjoy the same status as “benefits” with constitutional protections.

The court sided with the state in his

“In this case, the court finds that it cannot extend the term ‘benefits’ beyond the reach of prior Illinois Supreme Court cases (that this Court is aware of) to find the challenged legislation unconstitutional against the Pension Clause's protections,” Villa wrote.

Villa said prior high court opinions have considered “benefits” as those that “directly affect the value of a plaintiff’s pension benefit.”

The lawsuit also had argued that the legislation violates the constitution’s takings clause by taking or damaging plaintiff’s property without just compensation because the transition costs are being covered by loans through the Illinois Finance Authority which must be repaid by the consolidated funds. Villa also rejected that argument saying “there are no allegations or evidence presented that plaintiffs currently drawing their pension benefit have suffered a present or will suffer a future loss in benefit payment.”

“We’re pleased with the Circuit Court’s ruling, and we’ll continue to defend the statute on appeal,” AG spokeswoman Jamey Dunn-Thomason said in an email Friday.

While the police fund will miss the deadline, it’s a symbolic marker as there are no punitive actions levied.

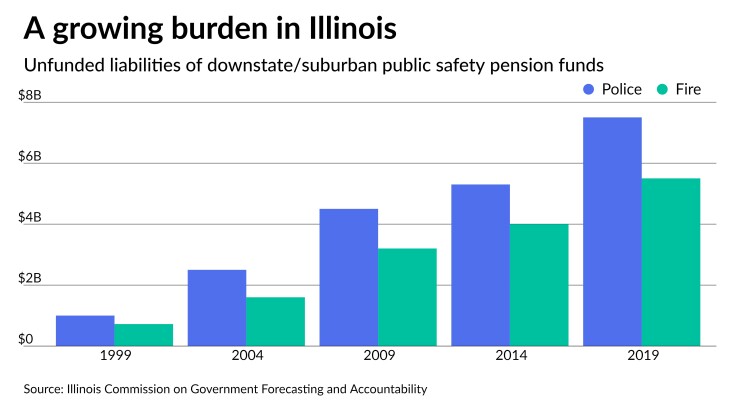

The unfunded liabilities of Illinois’ suburban and downstate public safety pensions

The funded health of the public safety pension funds has tumbled over the years. In 1991, the collective ratio was at 75.65% and peaked at 77.31% in 1999. The police funds ended 2019 at 54.98% and firefighters were at 54.35%. The health of some individual funds, however, are far weaker with ratios only in the teens.

Police accounted for $7.5 billion of the total and firefighters for $5.5 billion, according to the most recent