Want unlimited access to top ideas and insights?

CHICAGO — Illinois Gov. J.B. Pritzker will participate in the state’s upcoming meetings with rating agencies to outline his pension and budget proposals, which have prompted warnings they could drive further credit deterioration.

The meetings are set for next week, according to market sources. Illinois is the lowest-rated state by several notches with its general obligation debt at Baa3 with a stable outlook from Moody's Investors Service, BBB with a negative outlook from Fitch Ratings, and BBB-minus and stable from S&P Global Ratings.

Pritzker will attend the meetings with the finance team unlike his predecessor, Bruce Rauner, who left that task to his budget and capital markets team.

“Gov. Pritzker looks forward to taking advantage of this opportunity to share his goals, long-term vision and plan to improve Illinois’ finances, and he will aggressively advocate for the state,” Pritzker spokeswoman Jordan Abudayyeh confirmed.

The state's low ratings leave it with little room to maneuver to avoid a cut to speculative-grade status.

Several analysts said there’s no standard when it comes to a governor's attendance at rating meetings but one said there “is value” in hearing directly from a new leader on his or her vision.

The meetings come ahead of the first borrowing planned by the new administration and three weeks after Pritzker unveiled a nearly $39 billion general fund budget for fiscal 2020 and proposals to address $133.7 billion of unfunded pension liabilities.

The spending plan has been panned by civic groups, investors, and analysts for failing to make progress on structurally balancing the state’s budget and shorting pension contributions on the promise of future funding hikes.

The state will competitively sell $300 million of new money general obligation bonds later this month, tapping a $1 billion prior authorization to finance a pension buyout program in the fiscal 2019 budget.

The deal may grow. “We’ll be evaluating any potential refunding candidates based on market conditions,” Abudayyeh said.

The state uses both competitive and negotiated sales on its general obligation and sales-tax backed borrowing with statutes requiring that at least 25% of annual GOs be sold competitively.

Underwriting and financial advisory pools were selected in competitive request for proposals process in 2016 for a three-year term that ends in the fall and the bond counsel firms chosen for GOs and Build Illinois sales tax bonds were extended last year until 2021. “The administration will be evaluating the current underwriting and financial advisor pool in the near future,” Abudayyeh said.

The upcoming sale will test the market’s view of Pritzker's budget plan. Spreads did not fluctuate much after the announcement, but the market may be waiting for the final package to emerge from the legislature, which is expected in late May. Rating agencies have signaled no action would be taken until then.

Spreads moved just slightly to 185 basis points from 183 bps to the top benchmark on the 10-year and three basis points on the shorter end last week.

“There is nothing really alarming here,” said Daniel Berger, senior market strategist at Municipal Market Data/Refinitiv. “The muni market sold off and Illinois GOs sold off but there was no material change in its spread levels. It appears that the negative rating agency comments may have been expected by market participants.”

Illinois trading picked up this week with spreads wider by three basis points on 2033 maturities and longer on the curve Tuesday, Berger said, adding the latest movement appeared more market-driven than related to Illinois’ credit.

Pritzker wants higher spending on education, public safety, and social services he says are needed after the state went two years without a budget during the Rauner administration.

He has proposed $1.1 billion in new revenue with about one-third of it coming from one-time sources. He also wants to put off repayment of some interfund borrowing, and shift some Medicaid costs off the general fund and impose a new assessment on managed care organizations to raise $390 million.

The only measure aimed at bringing down the now $8 billion bill backlog is a proposal to issue $1.5 billion in bonds and use a $150 million ending balance.

Pritzker’s five-piece pension stabilization plan would shave $1.1 billion off next year’s $9 billion contribution by re-amortizing the existing schedule and extending it by seven years and extending an existing buyout program.

The plan also calls for issuing $2 billion in pension bonds under a new income tax-backed credit.

“We think that the proposed structure in Illinois would necessarily decrease and dilute the resources available to pay current GO bondholders — a credit negative,” Bank of America Merrill Lynch’s municipal analysts wrote in a review published in the firm’s Municipals Weekly.

Pension funding improvements would come from potential asset sales and transfers and an annual $200 million contribution should the state amend its constitution and shift to graduated income tax rates from its flat rate.

The latter is the cornerstone of Pritzker’s plans to stabilize the state’s fiscal foundation and negotiations are beginning this week with lawmakers on a rate structure that would be part of a constitutional amendment Pritzker wants to put to voters in 2020.

Fitch Ratings said in a commentary on the proposed budget that it could drive a downgrade due to the structural imbalance and S&P Global Ratings said if passed as proposed it could damage the state’s rating “trajectory.”

Moody’s Investors Service has not published a commentary and its lead Illinois analyst is taking a wait-and-see approach.

“In general we view the governor’s budget as a starting point,” said analyst Ted Hampton.

The rating agencies past state reviews have warned of a potential downgrade should the state see renewed growth in payment backlog or it reduces pension contributions to provide fiscal relief.

“To the extent the state continues to rely on scaling back its commitment to contribute to pensions, that will only make problems worse down the road,” Hampton said, adding that a move to reduce near-term contributions could be viewed as a credit negative but the rating agency will look at the full picture and wait for passage of a final budget package before deciding if it will take any action.

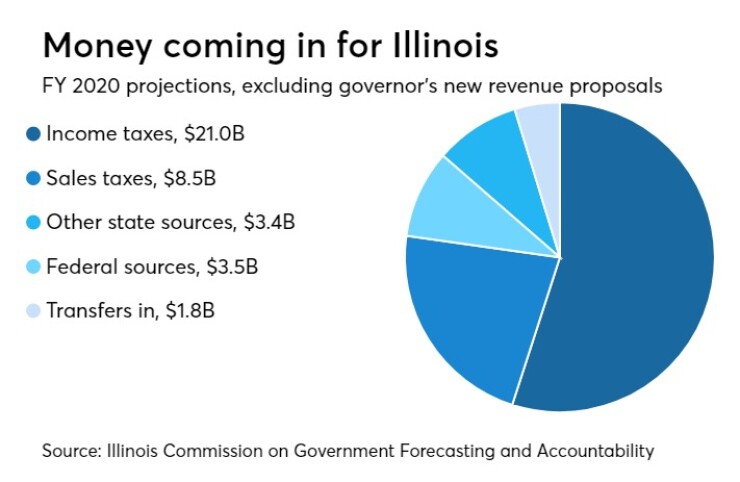

State revenues for the current fiscal year are now projected to fall $184 million short of previous estimates, according to a report presented to lawmakers Tuesday by Commission on Government Forecasting and Accountability Executive Director Clayton Klenke and Revenue Director Jim Muschinske.

While some revenues, like regularly proposed but thus far never executed sale of the state’s Chicago headquarters, are no longer expected, some state tax collections are coming in higher and offsetting the losses.

COGFA’s 2020 general fund revenue estimate is $717 million less than the administration’s projection, but that’s due to new revenue initiatives proposed by the governor that are not factored in because they require legislative action and thus hard to currently assess. The agency also warned of slowing growth could dampen collections.