CHICAGO — An already cash-strapped Illinois would subsidize debt service payments on $166 million of borrowing by the state’s Regional Transportation Authority under a plan announced by Gov. Pat Quinn yesterday to stave off fare hikes proposed by the Chicago Transit Authority.

Under the agreement, the RTA would receive authorization to issue debt to provide the CTA with $83 million in fiscal 2010 and another $83 million in 2011. The state would cover about $15.3 million of debt service for the first two years. Future assistance with debt service would be evaluated on an annual basis. The bond proceeds would free up federal capital funds for the CTA’s operations budget.

In exchange, the CTA has agreed to cancel its proposed fare hikes of between 25 cents and 75 cents per ride in its proposed $1.3 billion budget for 2010 and would hold the line on fares in 2011.

“Access to affordable and reliable public transportation is imperative for Chicago-area transit riders,” Quinn said at a news conference. “Today’s comprehensive agreement will stabilize public transit and will hold the line against any CTA fare increases for the next two years.”

The agreement between the state and the RTA and its service boards — the Chicago Transit Authority, Metra commuter rail, and Pace suburban bus service — also provides an $8.5 million subsidy in both 2010 and 2011 for Pace to fend off paratransit fare increases.

The deal may prevent fare increases but the funding won’t fully address the CTA’s $300 million deficit and the need for service cuts and layoffs. The authority’s proposed budget had eliminated the deficit through the fare hike, spending cuts, $90 million in service cuts, and through the use of $128 million in capital funds. The agency has dipped into capital funds for operations since 2006.

Quinn said state transportation officials remain in discussions with transit officials aimed at reducing the service cuts. He said recently approved state legislation on Medicaid funding frees up funds for the subsidies.

The borrowing plan escalates the governor’s growing reliance on debt issuance to provide a temporary salve to the state’s revenue struggles. Illinois this month will restructure $1.5 billion of bonds for near-term debt service savings and next year will borrow $3.4 billion to cover scheduled pension payments.

With $2.25 billion outstanding in cash-flow certificates that come due later in fiscal 2010, the state also wants to borrow another $1 billion in the coming months to pay overdue bills.

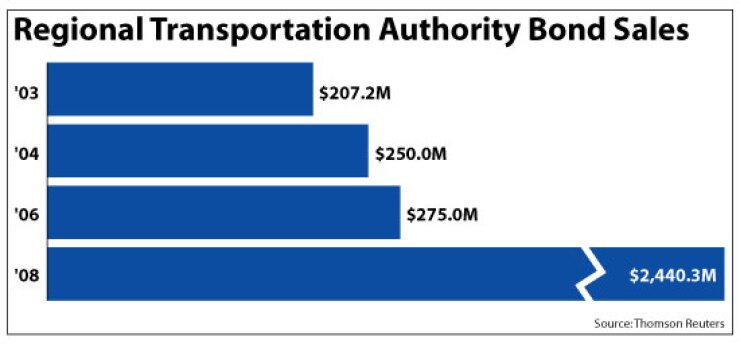

The RTA has $2.3 billion of outstanding general obligation debt that carries ratings of AA-plus with a negative outlook from Standard & Poor’s, a Aa3 from Moody’s Investors Service with a stable outlook, and AA-minus with a negative outlook from Fitch Ratings. The agency’s bonds are secured by a gross pledge of sales taxes and other state aid.

State lawmakers early last year approved a transit bailout package that included a sales tax hike and an increase in the Chicago tax on real estate transactions, but the recession’s impact has cut deeply into revenue collections while the CTA’s employee costs and operations continue to rise.

Revenue from sales taxes and the transit agency’s share of the city’s real estate tax are expected to fall $213 million below previous projections while labor contracts call for a 3.5% increase in wages. The CTA also faces increased debt service on its $1.8 billion of pension-related debt issued last year.

The CTA operates the second-largest transit system in the country. Moody’s recently downgraded the CTA’s $1.9 billion of pension-related debt to A1.

The bonds are rated AA-plus by Standard & Poor’s. The authority also has outstanding debt backed solely by federal grant funds.