As environmental, social and governance bond issuance grows globally, the buy-side is leading the charge in the municipal securities space, demanding more paper and creating investment vehicles tailored for ESG debt.

Buy-side participants are also requiring more disclosure from issuers to back up the validity of those investments. They want more data, and more concrete answers to their vast, growing and disparate list of questions.

“The buy-side says, ‘We want disclosure,’ very broadly, and we need to be more prescriptive about what it is we want,” said Andrew Teras, director of municipal research at Breckinridge Capital Advisors.

There has been strong demand from a segment of clients interested in ESG but, Teras noted, it can be challenging since ESG and sustainability mean different things to different clients.

“Some clients come to it from more of an impact approach or some want to invest in education bonds, and then other clients are focused on drought in the West,” he said.

Issuers, meanwhile, need clarity on what exactly investors — and ratings agencies and bond insurers and regulators — want them to provide, but they also expect a pricing benefit for their cooperation.

Government officials hesitate to provide certain levels of detail without fully understanding the potential regulatory repercussions of and the costs associated with doing so.

“Issuers are being asked for new and different kinds of information,” Teras said. “A lot of them want to provide this information, but it's not traditionally been provided.”

Factoring ESG considerations into investment decisions also

Incorporating ESG broadly into the municipal industry remains complex and the opinions on how to — or even whether to — take part vary to a large degree based on the participant’s vantage point.

And while agreeing on the types of information necessary to tell the muni ESG story is complicated, most participants say ESG is inextricably tied to the municipal bond market and the infrastructure it builds.

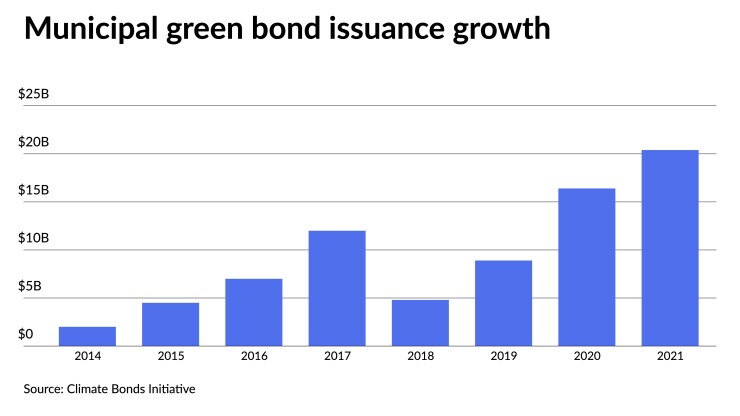

ESG growth

Global sustainable bond issuance has soared and will likely top $1.5 trillion this year, up from just $200 billion only four years ago.

May’s total ESG issuance was $3.117 billion per SDC Refinitiv data, and ESG issuance through May 31 stands at $10.789 billion versus $12.905 billion from January to May 2021,

“Although total ESG issuance was down slightly from April to May, it is still well above issuance from any month in Q1 and almost equal to the total issuance for the entire quarter,” a monthly ESG report from Refintiv MMD noted.

Last year’s total ESG issuance hit $42.059 billion. While that figure remains slight compared to the overall muni market —

Green bond designations continue to comprise the majority of ESG municipal issuance, accounting for $19 billion in par volume or 43.6% of ESG issuance last year, per an IHS Markit 2021 Muni ESG Recap report.

While there are no standard definitions of ESG in the space,

And what matters to those both buying and selling those bonds is how added data availability will affect industry growth. Two-thirds of respondents to a

“Demand in the municipal market is driven primarily by interest rates and tax considerations,” noted Robert Tucker, head of investor relations and communication at Assured Guaranty. “Some investors, however, may view municipal bonds as inherently having environmental or social purposes, such as mass transit, education, healthcare or renewable energy. And an expanding investor focus on ESG considerations could help expand the investor base.”

Indeed, there is

Foreign investors, particularly in Europe, have much higher regulatory thresholds to meet on what ESG investments they can make. The international regulatory environment, particularly Basel III, Solvency II and the Sustainability Development Goals adopted by most U.N. member countries, are of the some key reasons behind global investors’ interest.

“While starting from a low base, foreign holdings of muni bonds have increased in recent years, both in absolute terms and as a proportion of the overall muni market, according to Federal Reserve data," said Jasper Cox, investment practices analyst, Fixed Income at the Principles for Responsible Investment. "Given that investors and regulators around the world, including in the EU, are paying close attention to ESG factors, if this trend continues it may help propel these factors up the agenda in the US muni market too.”

With the growing interest in ESG investing, "we anticipate an increased appetite for ESG data,” Tucker said. “In our own business, we have had few direct ESG questions from U.S. muni investors, although the institutions we speak with generally understand that ESG plays a role in our underwriting analysis. In the taxable municipal bond market, European investors are generally under more formal requirements to include ESG criteria in their credit selection process.”

Various players in the muni space have created muni-specific funds dedicated to the growing ESG investor base and other data-centric ESG tools.

Michael Cohick, director of ETF product marketing at VanEck, said investors are clamoring for ESG in all asset classes, including munis. This demand prompted VanEck to

Others have followed suit, with State Street Global Advisors, sub-advised by Nuveen,

AllianceBernstein partnered with Vestmark, Inc., in January to

Bloomberg LP in December

Intercontinental Exchange also in December

For Breckinridge, which has been incorporating ESG into its investment strategies for over 10 years, the emphasis is on ESG risks and how those factors influence and relate to more traditional credit factors, such as the amount of cash in the bank and the aggregate value of an individual’s tax base.

Institutional investors are armed with more data to analyze some of these risks and at a more precise level, Teras said. That’s leading to more questions directed to issuers than they have historically been used to receiving.

In one effort to gather more information on the ‘S’ in ‘ESG,’ Goldman Sachs Asset Management, BlackRock, Lord Abbett, Morgan Stanley Investment Management and Vanguard have partnered with minority-owned municipal underwriters Loop Capital and Siebert Williams Shank & Co. to

And while it is no secret that

Issuer response to growing demands

Investors want “affirmation that their money is being used to increase the health and wellness of citizens, to increase the sustainability of nature,” said R. Paul Herman, CEO and founder of HIP Investor. “They want positive progress toward a cleaner environment, like cleaner power and energy utilities, making sure that water utilities are delivering high-quality water.”

Certain issuers have

But

But demand for the information, particularly among younger investors, will likely ensure that ESG is not going away as a factor in credit evaluations.

Within the ESG space, Herman said, investors want three things: transparency, performance and accountability. One way to achieve these is recurring reporting, something he said is missing from the muni space.

“Many of the muni issuers feel like that might be an increased cost burden, but the value to ESG-minded investors is high, and it shows that there's a seriousness to the commitment and a quantitative improvement,” Herman said.

The vast majority of the language in offering documents is standard disclaimer language from the bond counsels, Teras said.

“But the obligation is on both sides of the table,” Teras said. “A lot of the focus is on the perspective that issuers need to disclose more, but you also have to be realistic about what it is issuers can provide. It’s a two-way street.”

Specificity is key, he said. Issuers want to give the information but, Teras noted, if the request isn’t specific, it can get lost in the shuffle.

Pricing benefits, penalties and a broader investor base

Cohick said pricing differentiation will be driven by the industry and growing investor demand. As more millennials become investors with their own capital, he said, they will drive pricing premium for ESG and sustainability bonds.

Teras noted, “the jury is still out” on when there will be a pricing difference for issuing ESG debt.

At the moment, there aren’t widespread requirements from the institutional buyer base for ESG compliance.

Existing internationally recognized standards and certification protocols, when properly adhered to by issuers, can offer investors a more vivid consideration of the current designation and green bond principles, said Jeffrey Lipton, managing director of credit research at Oppenheimer Inc. But, he noted, they’re voluntary best practices and guidelines, not requirements.

From time to time, Teras said, research will suggest a little bit of a premium for issuing a green bond, but that's still somewhat inconclusive, he said.

Lipton said any meaningful pricing distinction would have to be considered within a broader widening of credits.

The same is true for pricing penalties. Penalties for lack of ESG could be issued here or there, but nothing widespread, according to Teras. And it won’t happen until later.

“Investors are being armed with a lot more data than we've had in the past,” Teras said. “To the extent that trend continues, and as that data starts to trickle down to every investor in the market, you could start to see some sort of pricing penalty for issuers with perceived ESG risk.”

Lipton said demand from the institutional buyer base will be a driver for better disclosure and transparency.

“They will want to see specific disclosures, and if issuers don't comply, perhaps we need to get the regulators involved to pass certain requirements, and if you don't have proper compliance, that could potentially result in the assignment penalties,” he said.

Benchmarking would move the needle on ESG in the muni space, said Will MacPherson, co-founder and partner of VMG Ventures.

Aggregating enough data to allow for an investor to compare where something falls against a mean would be beneficial for the industry. MacPherson said it starts with the buy side.

“They’re doing the analysis on all of this, they’re fielding the information, pulling the risk assessments,” he said.

“Establishing a universal definition for impact or ESG is near impossible at this point, more recently due to politics,” MacPherson said. “If we can do benchmarking then maybe we can at least establish some standards to see where an investment falls on a curve relative to the rest of the industry.”