Municipal bonds yields continued their descent and once again rewrote the record books, as the flight-to-safety movement on fears of COVID-19 that took place Friday picked up right where it left off.

Stocks were down in excess of 3% at press time while Treasury yields sank further, as spooked investors fled risky assets, such as equities, into safer investments like municipal and Treasury bonds.

“How low can they go? That’s the real question,” said one New York trader. “We have gotten barely any positive news on containment, curing or stopping the virus. Until we do, this is going to be the reaction markets will have.”

Secondary market

“Munis are continuing and accelerating their rally, moving almost lock-step with Treasuries out past 10 years,” ICE Data Services said in a Monday market report. “Across the curve, yields are four to eight basis points lower. Front end yields are flattening further, with the ICE muni yield curve completely flat out to five years and below a 1% yield out to nine-years. With the Treasury curve inverted in the front end, the muni percentage of Treasury yields have been steadily increasing. High-yield bonds are also on board with today’s move; yields [were] four to six basis points lower at midday.”

Munis were stronger on Monday on the MBIS benchmark scale, with yields dropping four basis points in the 10-year maturity and five basis points in the 30-year maturity. High-grades were also stronger, with yields on MBIS' AAA scale decreasing by four basis points in both the 10-year and 30-year maturities.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO sank eight basis points to 1.01%, setting a record low. The previous record, 1.09%, was set Friday. The 30-year GO muni fell nine basis points to a record 1.60%, beating the previous low of 1.69%, also set Friday. Just two weeks ago, The 10 year was at 1.18% and the long bond was at 1.83%.

The 10-year muni-to-Treasury ratio was calculated at 74.1% while the 30-year muni-to-Treasury ratio stood at 87.1%, according to MMD.

The three-month Treasury was yielding 1.548%, the Treasury two-year was yielding 1.268%, the five-year was yielding 1.223%, the 10-year was yielding 1.379%, inching closer to its all-time low mark of 1.32% in June 2016, and the 30-year was yielding 1.828%, hitting a record low.

Primary market

The muni market’s busiest week of the year is here. While most of the action is expected on Wednesday and Thursday, there was one larger deal on Monday and a few more will trickle in Tuesday before the floodgates open.

“The total size of this week's calendar is $14.2 billon, which is more than double the year-to-date weekly average issuance of $7.07 billion,” said Patrick Luby, senior municipal strategist at CreditSights. “But the market should have no problem digesting the increased volume.”

RBC Capital Markets won Owatonna Independent School District No. 761, Minn.’s $109.72 million of general obligation school building bonds with a true interest cost of 2.2469%.

Last week’s actively traded issues

According to

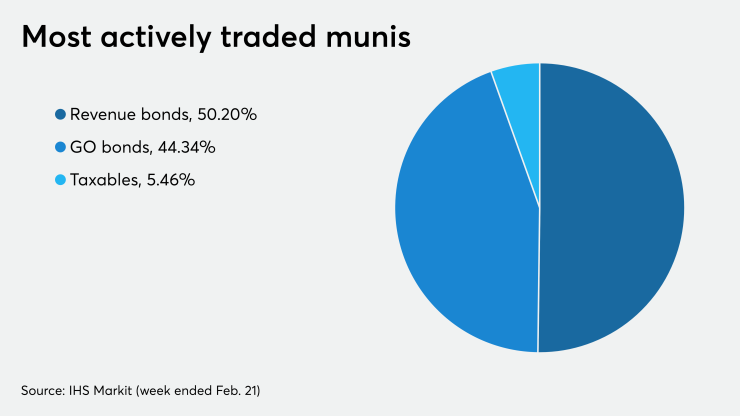

Some of the most actively traded munis by type in the week ended Feb. 21 from Puerto Rico, Kentucky and West Virginia issuers, according to IHS Markit.

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 traded 72 times. In the revenue bond sector, the Kentucky Public Energy Authority, 4s of 2050 traded 43 times. In the taxable bond sector, the Tobacco Settlement Finance Authority of West Virginia, 7.467s of 2047 traded 29 times.

Puerto Rico, Pennsylvania and Illinois bonds were among the most actively quoted in the week ended Feb. 21.

On the bid side, the Puerto Rico Commonwealth, GOs, 5s of 2041 were quoted by 24 unique dealers. On the ask side, the Pennsylvania State Higher Education Facilities Authority , revenue, 4s of 2044 were quoted by 241 dealers. Among two-sided quotes, the Chicago, Illinois, taxable, 7.781s of 2035 were quoted by 16 dealers.

Previous session's activity

The MSRB reported 30,658 trades Friday on volume of $12.05 billion. The 30-day average trade summary showed on a par amount basis of $12.07 million that customers bought $6.17 million, customers sold $3.85 million and interdealer trades totaled $2.05 million.

Texas, California and New York were most traded, with the Lone Star State taking 14.728% of the market, the Golden State taking 14.155% and the Empire State taking 12.173%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp., revenue restructured COFINA A-1 bonds 2014A, zeros of 2051, which traded 39 times on volume of $92.241 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.