The new-issue calendar is stuffed with all types of healthcare deals and taxable offerings, inflating its size up to almost $16.5 billion, once again the largest supply slate of 2020.

Healthcare deals and taxable sales feature prominently on the list of new deals, but offerings from the states of California, Hawaii, Illinois as well as tobacco bonds round out the slate along with some big competitive issues.

In secondary trading, municipals were little changed Friday, with yields on the AAA scales remaining mostly steady ahead of the upcoming supply surge. On the week, muni yields were only about one basis point lower.

"Muni trading has gone into its typical Friday 'I'm outta here' mode with light activity and no change in directional bias," said Peter Franks, senior analyst at Refinitiv MMD.

"A lot of the week's deals were higher-yielding — taxables, healthcare, transportation, aviation — names, which went off well," a New York trader said. "It will remain to be seen how much the market can take on some big investment grade GO deals, presumably that issuers were holding off selling but now they can't avoid the rate environment and upcoming election uncertainty. Better to get the deals done now, but we could see a bit of a back-up in rates with such a large amount of paper, including GO names, flooding the market."

Primary market

IHS Ipreo estimates volume for the upcoming week at $16.4 billion. The calendar is composed of $10.5 billion of negotiated deals and $5.9 billion of competitive sales. Refinitiv estimates the total to consist of $11.2 billion of tax-exempts and $5.2 billion taxables.

Topping the new-issue slate is Sutter Health of California’s (A1/A+/A+/NR) $1.99 billion taxable corporate CUSIP bonds. Morgan Stanley is set to price the deal on Thursday.

Close behind is Illinois’

Morgan Stanley is expected to price both deals on Wednesday.

Also Banner Health of Arizona (NR/AA-/AA-/NR) is coming to market with $607.655 million of Series 2020C taxable corporate CUSIP bonds. Morgan Stanley is set to price the bonds on Tuesday.

Other large deals of note include the

Wells Fargo Securities is set to price the deal on Thursday.

The state of

BofA Securities is expected to price the deal on Wednesday.

And those searching for a little bit more yield can look no further than West Virginia’s Tobacco Settlement Finance Authority which is issuing $708.625 million of taxable Series 2020 senior current interest tobacco settlement asset-backed refunding bonds.

Citigroup is expected to price the deal on Wednesday.

In the competitive arena, the state of California is selling $1.1 billion of various purpose general obligation bonds in three offerings on Thursday.

The sales are made up of $590.265 million of tax-exempt Bid Group B GO and GO refunding bonds, $321.625 million of taxable Bid Group A GO construction bonds and $198.89 million of taxable Bid Group C GO refunding bonds.

The state of Illinois is coming to market on Tuesday with $850 million of GOs in four offerings.

The sales consist of $325 million of Series of October 2020B GOs, $300 million of Series of October 2020C GOs, $125 million of taxable Series of October 2020A GOs and $100 million of Series of October 2020D GOs.

The Virginia Public School Authority (Aa1/AA+/AA+/) is selling $473.64 million of school financing bonds on Tuesday in two offerings.

The sales consist of $330.045 million of Series 2020C taxable refunding bonds and $143.595 million of Series 2020B tax-exempt school financing and refunding bonds.

Dallas, Texas, is selling $311.615 million of bonds in three sales consisting of $208.93 million of Series 2020A GO refunding and improvement bonds, $77.35 million of Series 2020B taxable GO refunding bonds and $25.335 million of Series 2020B obligations.

One deal that won't be coming, according to Bloomberg, is Fortress Investment Group's $3.2 billion sale of municipal bonds to build a

The upcoming week is certainly the highest volume of issuance since the onset of the pandemic, said MMD Refinitiv senior market strategist Daniel Berger, who added that there are six state issuers selling debt.

“Has the muni market run out of steam? Muni appetite may be waning as muni fund flows which had a great week in early October were lower this week,” he said.

However, he said the last quarter is typically when new-issue muni volume increases.

“In addition, it is worth considering that the pandemic which earlier led to an unprecedented level of volatility may be driving some issuers to continue to sell more bonds until there is more clarity about the fiscal relief package and its impact upon municipal issuers,” he said. “The difference [for the new week] is that more issuers of higher credit and a bigger profile have paid attention to their debt needs.”

Secondary market

Some notable trades on Friday:

Boston GOs, 5s of 2022, traded at 0.21%-0.20%. Fort Worth, Texas ISD 5s of 2023 traded at 0.22%. Maryland GOs, 5s of 2023, at 0.22%. NY EFC 5s of 2024 at 0.24%-0.23%. North Carolina GOs, 5s of 2025 at 0.28%-0.27%. North Carolina GOs 5s of 2029 at 0.80% after originally pricing at 0.84%.

Ohio waters, 5.25s in 2032 traded at 1.21% after originally pricing at 1.23%. Texas waters, 3s of 2036, traded at 1.67%-1.66%.

Large, $5 million-plus blocks of Washington GOs, 5s of 2039, traded at 1.61%-1.60%.

NYC TFA, 3s of 2046, traded at 2.50%-2.49%.

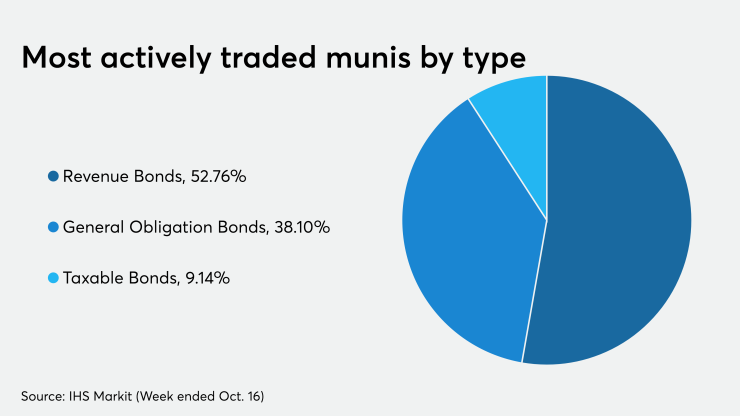

The most active bond types traded this week were revenue bonds, followed by GOs and taxable, according to IHS Markit said.

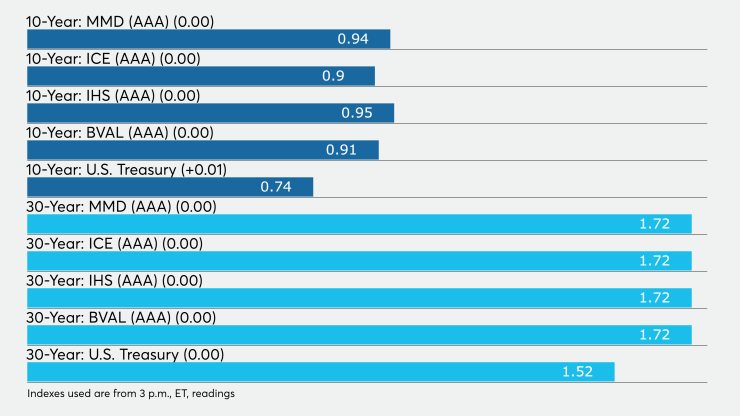

High-grade municipals were flat on Friday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Yields in 2021 and 2022 remained at 0.15% and 0.16%, respectively. The yield on the 10-year muni was unchanged at 0.94% while the 30-year yield was steady at 1.72%.

The 10-year muni-to-Treasury ratio was calculated at 127.2% while the 30-year muni-to-Treasury ratio stood at 113.1%, according to MMD

"Municipal bonds are ending the week mixed," ICE Data Services said. "Yields on the ICE muni curve are up in the front end by as much as a basis point. The back end is little changed."

The ICE AAA municipal yield curve showed short maturities weakened as the 2021 maturity rose one basis point to 0.15% in 2021 and rose one basis point 0.17% in 2022. The 10-year maturity remained at 0.90% and the 30-year was unchanged at 1.72%.

The 10-year muni-to-Treasury ratio was calculated at 123% while the 30-year muni-to-Treasury ratio stood at 113%, according to ICE.

The IHS Markit municipal analytics AAA curve showed yields at 0.13% in 2021 and 0.14% in 2022 with the 10-year yielding 0.95% and the 30-year at 1.73%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.11%, the 2022 maturity unchanged at 0.13%, the 10-year flat at 0.91% and the 30-year unchanged at 1.72%.

Treasuries were mixed as stock prices traded higher.

The three-month Treasury note was yielding 0.11%, the 10-year Treasury was yielding 0.74% and the 30-year Treasury was yielding 1.52%.

The Dow rose 0.95%, the S&P 500 increased 0.65% and the Nasdaq gained 0.50%.

Bond Buyer indexes mixed

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose two basis points to 3.62% from 3.60% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields was unchanged at 2.35% from the previous week.

The 11-bond GO Index of higher-grade 11-year GOs was flat at 1.88%. The Bond Buyer's Revenue Bond Index was steady at 2.77%.