Hawaii and the Los Angeles MTA came to market on Wednesday as California announced its big spring borrowing schedule.

California slates $6.34B bond sales

California State Treasurer Fiona Ma announced the state and two agencies will sell nine bond issues totaling about $6.34 billion beginning the week of March 4.

“Significant portions of the general obligation bond sales will be to finance older debt at today’s lower rates, thus saving taxpayers’ money and freeing up resources for other important projects and programs,” Ma said.

The schedule includes:

- $2.3 billion of state various purpose general obligation bonds in the week of March 4. The bonds will provide funding for projects and programs under various bond acts and will refund outstanding bonds;

- $80 million of veterans home purchase revenue bonds during the week of March 18. The bonds will provide funding for the California Department of Veteran Affairs’ (CalVet) Farm and Home Purchase Program;

- $800 million of taxable various purpose GOs in the week of March 25. The bonds will provide funding for projects and programs under various bond acts and will refund outstanding commercial paper notes;

- $235 million of Central Valley Project water system revenue bonds from the Department of Water Resources in the week of March 25. The bonds will refund the department’s outstanding commercial paper notes relating to the Oroville Dam Spillway response, recovery and restoration project.

- $25 million of lease revenue bonds from the State Public Works Board in the week of April 1. The bonds will provide funding to: the Board of State and Community Corrections for the Solano Jail project, also known as the Rourk Vocational Training Center, in the city of Fairfield and the California Department of Corrections and Rehabilitation for the Yolo Juvenile project, also known as Juvenile Hall Multipurpose Facility in the city of Woodland.

- $100 million of veterans GOs the week of April 1. The bonds will provide funding for the CalVet Farm and Home Purchase Program;

$2.2 billion of various purpose GOs the week of April 8. The bonds will provide funding for projects/programs under various bond acts and will refund outstanding commercial paper notes and bonds.

Additionally slated for sale are:

- $500 million of tax-exempt and taxable general revenue bonds from the Regents of the University of California in the week of March 11. The bonds will provide funding for 14 projects across the UC system and the rollover of taxable notes;

- $100 million of IBank’s clean water and drinking water state revolving fund green revenue bonds during the week of April 22. The bonds will provide funding to the State Water Resources Control Board for the Drinking Water State Revolving Fund program, which provides financial assistance to local governments for safe drinking water projects.

“We are creating funding for a wide variety of vital infrastructure throughout the state. I am excited to be offering these bonds,” Ma said.

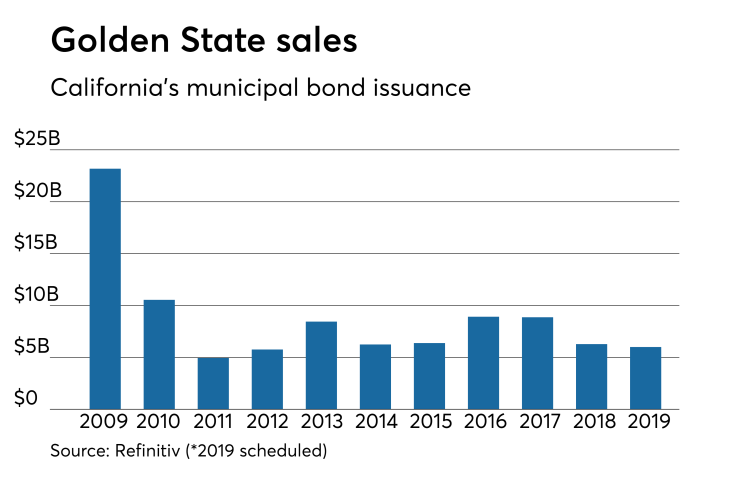

Since 2009, the state has sold about $90 billion of debt, with the most issuance occurring in 2009 when it offered $23.2 billion of securities. It sold the least amount in 2011 when it issued $4.9 billion of securities.

Primary market

Action was brisk in the primary on Wednesday.

Bank of America Merrill Lynch priced Hawaii’s $550 million of general obligation bonds after holding a one-day retail order period.

The deal is rated Aa1 by Moody's Investors Service, AA-plus by S&P Global Ratings and AA by Fitch Ratings.

Siebert Cisneros Shank priced the Los Angeles County Metropolitan Transportation Authority’s $545 million Proposition C sales tax senior revenue bonds.

The deal is rated Aa2 by Moody’s, AAA by S&P and Kroll Bond Rating Agency and AA-plus by Fitch.

RBC Capital markets priced the Desert Sands Unified School District, Riverside County, Calif.’s $100 million of Series 2019 Election of 2014 GOs.

The deal is rated Aa2 by Moody’s and AA by S&P.

RBC received the written award on the Dublin City School District of Franklin, Delaware and Union Counties, Ohio’s $125 million of Series 2019 GO school facilities construction and improvement bonds.

The deal is rated Aa1 by Moody’s and AAA by S&P.

Morgan Stanley priced the San Jacinto Community College District of Harris and Chambers Counties, Texas’ $142.685 million of Series 2019A limited tax general obligation building bonds and Series 2019B limited tax general obligation refunding bonds.

The deal is rated Aa2 by Moody’s and AA by S&P.

Wednesday’s bond sales

Hawaii

California

Texas

Ohio

Bond Buyer 30-day visible supply at $9.97B

The Bond Buyer's 30-day visible supply calendar increased $469.0 million to $9.97 billion for Tuesday. The total is comprised of $2.59 billion of competitive sales and $7.38 billion of negotiated deals.

Secondary market

Municipal bonds were stronger Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities.

High-grade munis were also stronger, with muni yields falling as much as two basis points across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation falling by one basis point while the yield on the 30-year muni maturity dipped by one basis point.

Treasury bonds were stronger as stock prices were lower.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 80.8% while the 30-year muni-to-Treasury ratio stood at 100.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,742 trades on Tuesday on volume of $15.19 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 11.575% of the market, the Empire State taking 12.789% and the Lone Star State taking 9.617%.

Treasury sells $50B CMBs

The Treasury Department Wednesday sold $50 billion 18-day cash management bills, dated Feb. 11, due March 1, at a 2.395% high tender rate.

The bid to cover ratio was 3.00.

The coupon equivalent was 2.431%. The price was 99.880250.

The low bid was 2.300%. The median bid was 2.380%. Tenders at the high were allotted 78.56%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.