While the issuance of green municipal bonds is creating buzz following the weekend's People's Climate Change marches, the category to date has shown mixed performance in the secondary market.

Though spreads have tightened consistently on Massachusetts' green bonds since they were sold in 2013, they've widened on some New York State Sales Corp. bonds sold earlier this year, according to figures from the Municipal Securities Rulemaking Board's EMMA website.

The secondary-market performance of green bonds, which typically fund environmentally sustainable projects, assumes outsized importance as two sizable green bond issuances are hitting the market this week. California included $200 million of green bonds in its almost-$2.1 billion general obligation deal on Tuesday.

JP Morgan, Barclays Capital and Morgan Stanley also were lead book runners on $370 million taxable green bonds for Massachusetts Institute of Technology as part of a $522.4 million total taxable bond deal for the university of Monday, according to Luke Hale, executive director on the syndicate desk in Morgan Stanley's municipal securities group. This is the first higher education green bond issuance to come to market, according to Hale.

The deals are expected to sell well, because issuance of the securities has been limited, while demand among the buy-and-hold investors who typically buy them has surged.

"There's pent up demand, a growing demand for that type of bond," Michael Schroeder, president and chief investment officer at Wasmer, Schroeder & Company, said in an interview. "The supply of [green bonds] while increasing versus two to three years ago, it's not increasing fast enough to meet that kind of demand."

Investors Hunt For Green

Municipal green bonds issued in the U.S. are a relatively new product. The first U.S. green bond came to market in 2013, when Massachusetts sold $100 million green bonds as part of a $600 million overall general obligation issuance.

Issuance of green bonds has picked up this year. In June the New York State Environmental Sales Corp. sold $213 million of green bonds, and the District of Columbia Water and Sewer Authority issued a $450 million century green bond in July.

Just last week Massachusetts did another, larger, green bond issue selling $350 million green bond bonds as part of an overall $776.92 million overall GO sale on September 18. As mentioned above, green bond issuance is picking up further this week.

Even though green bond issuance is picking up, the amount of green munis in the market remains low. Green municipal bonds currently make up less than 2% of most municipal green bond funds.

Taxable green municipal bonds account for only 1% of Calvert's Intermediate Green Bond Fund, and green muni bonds constitute 0.50% of Everence Financial's Praxis Intermediate Green Bond Fund.

Delmar King, fixed income investment manager at Everence Financial, said in an interview that there is not enough issuance of green bonds in general.

"At this point you could not have mutual fund with green bonds unless want to perform relatively close to Treasuries," he said. "There is really not enough issuance of [green bonds] that have enough yield to get a diversified portfolio."

Municipal green bonds account for 1.83% of Standard & Poor's Green Bond Index.

Tyler Cling, senior manager of fixed income indices at S&P Dow Jones Indices, said in an interview that the S&P index is a rules based index and, "on a market weighted basis, the [green] bonds outstanding in the market are what we are capturing."

The limited amount of green municipal bonds available has only increased investors' appetite for the product.

Massachusetts recent green bond deal was three times oversubscribed, William Daley, managing director in Morgan Stanley's municipal finance group, said in an interview.

"I do think municipal green bond issuance and the number of investors will increase over time, increasing competition for the securities and diversifying the buyer base," Hale said.

Mixed Performance

Though the demand for green bonds is ramping up, the bonds performance in the secondary market is inconsistent.

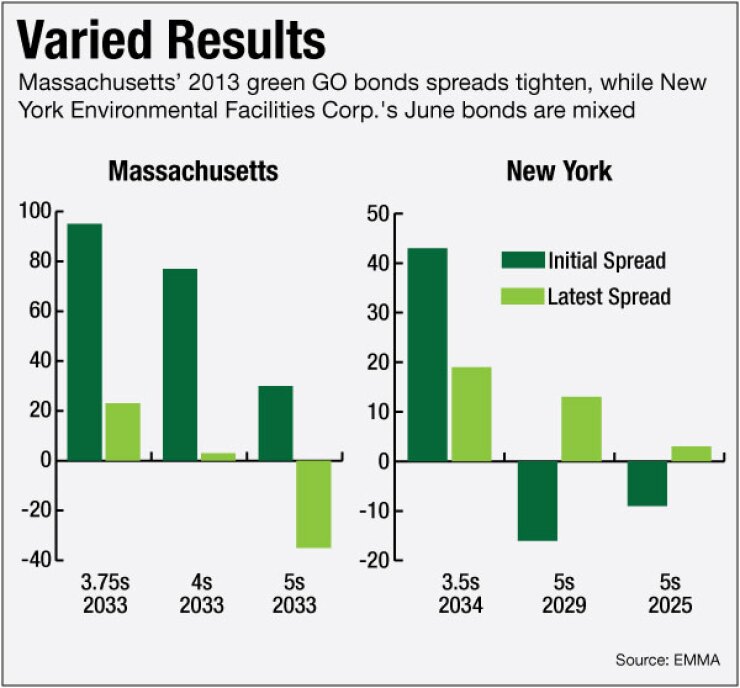

Yields on the three most actively traded bonds from Massachusetts' 2013 green bond issuance, identified by Markit, have all tightened since their initial sale. The spread between Massachusetts 4s of 2033 and the triple-A benchmark MMD scale have tightened by 74 basis points their first day of trading to July 31 when they were last traded, according to EMMA.

The spread on 5s of 2033 from the deal has tightened by 65 basis points as of its last trading day on Sept. 12, and the 3.75s of 2033's spread has come in between 72 and 32 basis points as of its last trading day on Sept. 19.

On the New York State Environmental Sales Corp.'s green bonds, spreads are more varied. A sample of six of the most actively traded bonds from the issue show that two of the bonds' spreads to the benchmark MMD scale have widened from their first to last trading, while two have tightened and two showed mixed results.

The 3.5s of 2034 from the deal's spread has tightened 24 basis points to the MMD scale from the bonds' first day of trading to when the 3.5s in 2034s were last traded on August 5, and the 5s of 2014's spreads also came in from 21 to 12 basis points when they were last traded on Aug. 27.

However, the deal's 5s of 2029 spread widened from 29 to 30 basis points as of their last day of trading on Aug. 8, and the 5s of 2025's spread widened by 12 basis points as of their last trading day on Sept. 11.

The spread on 2s of 2022 widened on their last trading day Sept. 17 from their highest traded yield to the benchmark scale by 11 basis points, and tightened by 13 basis points from the lowest traded yield to the scale. Spreads on 4s of 2014 when they were last traded on July 7 widened one basis point from their highest traded yield to the MMD scale, and tightened by 11 basis points from their lowest traded yield to the scale.

Most recently bonds with long maturities from Massachusetts' green bond sale last week on Sept. 18 were priced with yields lower than the MMD scale. The 5s of 2033 the deal's longest maturity yielded 2.74%, a spread of four basis points below MMD. The 5s in 2030 from the deal were priced at 2.68%, also four basis points below the benchmark scale.

Green Bond Investors Are Buy-And-Hold

The performance of the bonds in the secondary are important because the investors who purchase the green bonds are typically buy and hold investors, and unlikely to trade or flip the bonds in the secondary.

Daley said the Massachusetts green bonds sold in 2013 have not traded much in the secondary market.

"There are several reasons for this including the fact that they are highly rated GO bonds, which tend to attract buy-and-hold investors, while green bond investors in general are in same category, looking to buy and hold," he said.

He also said there was a lot of retail interest in the state's Sept. 18 green bond deal.

"There were $260 million of retail orders in aggregate from individual and professional retail buyers," he said.

Hale said the retail demand was stronger than other recent Commonwealth sales due to the green bond nature of the sale.