Georgia will competitively sell more than $1.1 billion of general obligation bonds on Tuesday to provide funding for state capital projects.

The state’s bonds garnered triple-A ratings from Moody’s Investors Service, S&P Global Ratings and Fitch Ratings. All three assign stable outlooks to the credit.

"Securing the highest state bond rating for yet another year is a testament to decades of conservative leadership at the state level and our balanced approach in protecting both lives and livelihoods throughout the COVID-19 pandemic,” said Gov. Brian Kemp.

Of the states that issue GOs, only nine have the triple/triple gilt-edged ratings and Georgia has had triple-A ratings from Moody’s since 1974, from S&P since 1997 and from Fitch since 1993.

Moody’s, S&P and Fitch all cited the strength of the state’s economy with a positive employment trend, growth of the state’s rainy day fund, a balanced approach to primary revenue sources, and consistent funding of obligations as factors contributing to their ratings.

The $1.107 billion of bonds will be offered in four separate competitive sales.

The state will offer $412.47 million of Series 2021A Bidding Group 1 tax-exempt GOs, $366.47 million of Series 2021A Bidding Group 2 tax-exempts, $174.57 million of Series 2021B Bidding Group 1 taxable GOs and $153.53 million of Bidding Group 2 taxables.

Public Resources Advisory Group and Terminus Municipal Advisors are the financial advisors. Gray Pannell & Woodward is the bond counsel and Kutak Rock is the disclosure counsel.

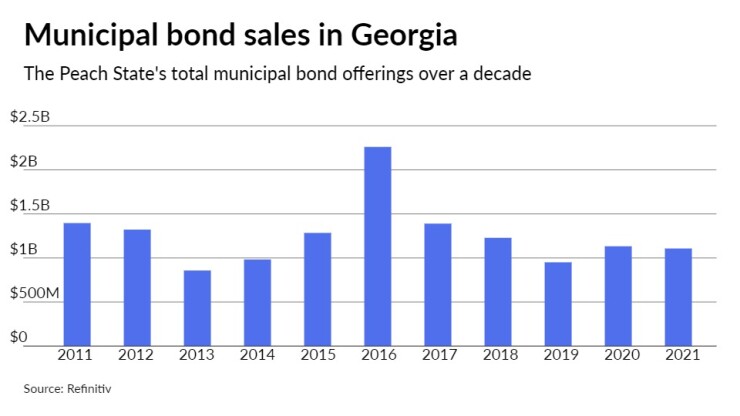

Since 2011, the Peach State has sold almost $14 billion of bonds, with the most issuance occurring in 2016 when it sold $2.3 billion of debt. It sold the least amount in 2013 when it issued $858 million.

Proceeds will fund various state capital outlay projects, make grants to governmental entities for capital outlay projects, and buy, retire and refunding some outstanding state GOs.

"Georgia has a history of buying some of its paper on the open market when it is advantageous. Holders approve," said John Hallacy, founder of John Hallacy Consulting LLC.

Capital projects to be funded include higher education, K-12 education, public safety, economic development, transportation, water and sewer, public libraries and other uses, according to the bond investor roadshow.

The state has a large and diverse economy, according to the preliminary official statement and is the eighth largest state economy in the U.S. based on 2020 GDP estimate of $620 billion. It’s also the eighth largest state in terms of population with 10.7 million residents.

Its Hartsfield-Jackson Atlanta International Airport is one of the most traveled in America.

"The airport brings a lot of economic activity to the state," Hallacy said.

The state's general fund revenues have increased 5.32% annually over the 10 years ending in fiscal 2020.

The amended fiscal 2021 budget anticipated a state general fund revenue decline of 2.5% over the fiscal 2020 general fund revenue collections due to the economic uncertainty around the COIVID-19 pandemic.

Through April, the state's revenue collections have exceeded their expected performance, according to the roadshow. The fiscal 2022 budget estimate now provides for a $1.4 billion general fund increase compared to the fiscal 2021 base budget.

Additionally, both the Employees Retirement and Teachers Retirement systems are fully funded with actuarially determined employer contributions.