No sooner did New York Gov. Andrew Cuomo finish his budget presentation — laced with invective toward the federal government — did questions about it emerge.

Skeptics asked just how much the state can reasonably expect from Washington, even with a presumed New York-friendly incoming president and Congress; whether Cuomo is overplaying his hand by threatening to sue the federal government if the state receives less than the $15 billion aid it seeks to cover a budget hole; and whether that gap estimate is in fact accurate.

Watchdogs Citizens Budget Commission and Reinvent Albany are calling the state to improve its own lot and with more transparency, while the ranking member of the state Senate finance committee, Thomas O'Mara, called the governor's speech "bizarre and frustrating."

Cuomo, a third-term Democrat, threw down the Washington card along with Tuesday’s $`193 billion fiscal 2022 budget proposal. Speaking one day before Joe Biden’s scheduled swearing in as president, Cuomo said the state’s financial woes from COVID-19 is Washington’s doing for failing to prepare for the pandemic.

He also wants the feds to eliminate the cap on state and local tax deductions, or SALT. The measure, he said, has cost the state $30 billion over four years.

Cuomo has pegged the deficit at $15 billion, although state Comptroller Thomas DiNapoli’s December cash report suggests a more optimistic picture. Cuomo's estimate "is not the true deficit of New York State," said O'Mara, R-Big Flats. "We need a realistic plan based on numbers that aren’t just out of thin air."

While acknowledging the grim effects of the pandemic, CBC president Andrew Rein added that “no matter the level of federal aid, the state should be pursuing structural spending reforms to ensure that its finances are stable coming out of the recession."

The work-in-progress spending plan, which lawmakers must approve by April 1, assumes a worst-case $6 billion in federal funding. Under this scenario, the state would look to boost tax revenue by $2 billion and cut spending by 5% including such areas as education, healthcare and other critical services.

The unknowns, along with an early budget cycle that makes it an outlier among states, could make the usual 30-day budget amendments more significant this year. State Comptroller Thomas DiNapoli's office expects to critique the plan within days.

"We remain troubled that there is continued opacity around the amount of funding that the state has withheld from crucial agencies like the MTA," Reinvent Albany senior research analyst Rachael Fauss said, referring to the state-run Metropolitan Transportation Authority, which operates the New York City mass-transit system.

Budget documents, Fauss said, suggest that $1 billion less in state revenue will be available to the MTA than was planned for in the fiscal 2021 budget, and do not show how much funding has been withheld that could be repaid.

"Perhaps most troubling is that the budget adjustment process is proposed to continue for the FY22 budget, this time without the ability of the legislature to reject any cuts, giving the governor unilateral authority over withholdings if the federal government does not provide $6 billion to New York State," Fauss said.

Less-than-expected federal aid could trigger a push for a so-called millionaire’s tax that Cuomo and budget director Robert Mujica are reluctant to embrace, while progressive lawmakers in Albany including Senate Majority Leader Andrea Stewart-Cousins, D-Yonkers, are pushing for it.

“Before considering personal income tax increases, the state should adopt other less harmful measures identified by CBC,” Rein said. “These include reducing aid to wealthy school districts, eliminating wasteful economic development spending, and shifting cash spending on capital projects to debt."

Peppering his speech with warlike pandemic references, Cuomo called this year’s budget cycle “really an economic reconciliation effort with the COVID crisis.”

According to Cuomo, the four-year financial plan shows a $39 billion revenue shortfall, with $21 billion in revenue loss over two years largely from business closings, stay-at-home work measures to combat the virus and unemployment.

Tax increases and borrowing, he said, would harm the state long-term. Revenue proposals, which he rolled out

last week, include sports betting and legalized marijuana. Sports betting could generate $500 million recurring annually, Cuomo said, while marijuana could generate $300 million per year once up and running.

Along with the budget, Cuomo has rolled out his usual laundry list of proposals over the past week to open the legislative session, including an expanded role for the Dormitory Authority of the State of New York, one of the largest municipal bond issuers.

Biden’s nearly $2 trillion recovery plan would provide $350 billion for state and local governments and $20 billion for mass transit systems. It would be the first fiscal relief package to include direct, unencumbered aid to state and local governments.

“Overall, this plan could boost state and local government credit quality and alleviate or in some cases eliminate budget shortfalls,” said Tom Kozlik, head of municipal strategy and credit for Hilltop Securities.

Separately, amid a coronavirus vaccine shortage, Cuomo on Tuesday

The budget features a $300 billion infrastructure package that includes $190 million for mass transit, including the Metropolitan Transportation Authority, and airports.

Roughly 30% of that would be state-funded, Mujica said, with the federal government and the private sector through public-private partnerships, providing the rest. The state portion, he added, would be funded through pay-as-you-go funding and debt.

Moody’s Investors Service rates the state’s general obligation bonds Aa2 with a stable outlook. S&P Global Ratings and Fitch Ratings each assign AA-plus with negative outlooks.

Cuomo said federal approvals for Manhattan congestion pricing, funding for the Second Avenue Subway, the Gateway Tunnel, the Buffalo Skyway and Interstate 81 in Syracuse are necessary for critical projects to advance.

The governor wants to open DASNY’s services to all nonprofits and school districts for needed capital improvements at lower costs during the COVID-19 crisis. The governor said this should enable them to spend limited resources on vital services.

DASNY also would be authorized to assist with providing finance for working capital needs.

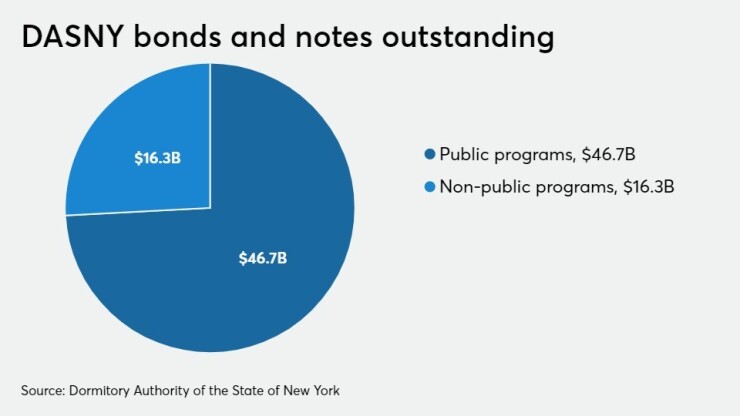

The authority is one of the largest issuers if municipal debt, with $63 billion of bonds and notes outstanding as of Dec. 31. That excludes Medical Care Facilities Financing Agency bonds and notes, which DASNY assumed in 1995.

Already, DASNY has financed and built community projects from residence halls at State University of New York, or SUNY, facilities such as Brockport and Polytechnic Institute in Utica to energy performance projects.

“DASNY's unique expertise in multiple areas provides important, efficient and cost-effective support for state agencies and health and education institutions across the state,” said its president and chief executive, Reuben McDaniel III.