When Florida’s Legislature returns on Jan. 1, one of its first items of business will be to look at Gov. Ron DeSantis’ proposed budget of $99.7 billion for fiscal 2022-2023.

The governor’s recommended spending plan for fiscal 2022-23 is down 1.8% from the previous fiscal year’s adopted budget of

Under the American Rescue Plan Act, Florida is estimated to receive about $10.2 billion of funds, with counties getting about $4.2 billion, cities receiving $1.5 billion and other local governments getting $1.4 billion.

Florida general obligation bonds are rated triple-A by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings. As of Nov. 30, issuers in the state have sold over $15 billion of bonds this year, according to data from Refinitiv, ranking Florida at number five in the nation.

The governor’s office said the “Freedom First” budget provides record funding for K-12 education and promotes infrastructure and transportation initiatives, environmental projects and bonuses for first responders and law enforcement personnel.

The budget proposal also keeps historic reserve levels of $15.3 billion, including $10.6 billion in unallocated general revenue to respond to any unforeseen emergencies, $3 billion in the budget stabilization fund and $1.7 billion in unallocated trust funds.

The recommendation also includes four tax holidays, including a fuel tax holiday; a seven-day sales tax holiday; a 10-day back-to-school sales tax holiday; and a 10-day disaster preparedness sales tax holiday.

The nonpartisan nonprofit Florida Policy Institute noted the proposed budget lacked any meaningful changes to the state’s tax code.

“While Gov. DeSantis voiced support for continuing the state’s sales tax holidays, research shows that these provide little to no relief for people struggling to make ends meet,” FPI CEO Sadaf Knight said

She said the state’s continued rebound depends on changes to the tax system.

“Our long-term economic recovery in Florida will be hindered without comprehensive tax code reform,” Knight said. “When the federal funds for COVID recovery eventually dry up, it’s important that the state has measures in place — like closing corporate tax loopholes and allowing the corporate income tax reductions and refunds to expire in 2022, as they're supposed to — that ensure the wealthiest Floridians and corporations pay what they owe in taxes, while implementing reforms that provide real relief to low- and middle-income residents.”

Some of the more controversial elements of the budget revolve around illegal immigration and election integrity.

DeSantis has proposed $8 million to create a program that would “assist the state’s efforts to protect against harms resulting from illegal immigration, and may include the transport of unauthorized aliens located within the state to other states within the United States of America, or the District of Columbia.”

As a possible presidential contender in 2024, DeSantis has often sparred with President Joe Biden over a whole host of issuers ranging from immigration to taxes to vaccine mandates.

The Republican party dominates the Florida statehouse, controlling both the House and the Senate. And for the first time in state history, Republicans outnumber Democrats among registered voters,

Democrats have criticized the budget, saying it ignores the need for more services and doesn’t help provide affordable housing.

The governor’s budget also includes $39.8 million for state-level election oversight activities, with a focus on election integrity and security. This includes money for a new 52-member Office of Election Crimes and Security, which would be tasked to investigate election crimes and fraud. It also includes funds for cybersecurity initiatives and improvements to the election system.

“As cybersecurity threats continue to become more sophisticated, it is vital that Florida has the tools necessary to protect critical state resources and sensitive information,” the budget proposal says.

Separately, the budget includes $50.6 million to various state agencies for security intelligence, modernization and resiliency.

DeSantis also wants to create a “Crypto-Friendly Florida,” by providing $250,000 to support a blockchain title pilot program in the Department of Highway Safety and Motor Vehicles; $250,000 to Florida’s Agency for Health Care Administration for a pilot project using blockchain technology to authenticate Medicaid transactions and identify fraud; and $200,000 to the Department of Financial Services to let businesses pay fees using cryptocurrency sent directly to the Department of State.

Florida is aiming to encourage the use of cryptocurrency as a means of commerce which will furthering the state’s attractiveness to businesses and foster economic growth.

Both the city of Miami and Miami-Dade County have backed initiatives the support blockchain and

Focusing on infrastructure, the governor said being able to move people and goods quickly and effectively depends on developing and maintaining a world-class transportation infrastructure. He estimates that for each dollar invested in transportation there is a return of up to $4 in economic benefits to residents and businesses.

The budget includes $10.4 billion for the Florida Department of Transportation including $9.27 billion for the state transportation work program, a five-year plan for infrastructure projects that include roads, bridges, rails, seaports and public transportation systems.

The budget also includes $105 million for the rural infrastructure fund to support projects such as roads, storm and wastewater systems and telecommunications facilities.

For public education, the budget appropriates $23.9 billion in total funding for the Florida Education Finance Program, which includes a record $13.3 billion for the K-12 public school system.

Other investments include $600 million to continue the state’s priority to raise the minimum K-12 teacher salary to $47,500, as well as salary increases for veteran teachers and $1.4 billion for early child education.

It also includes $1 million in funding to establish an out-of-state law enforcement equivalency reimbursement to help cover the cost of law enforcement officers moving from other states to Florida.

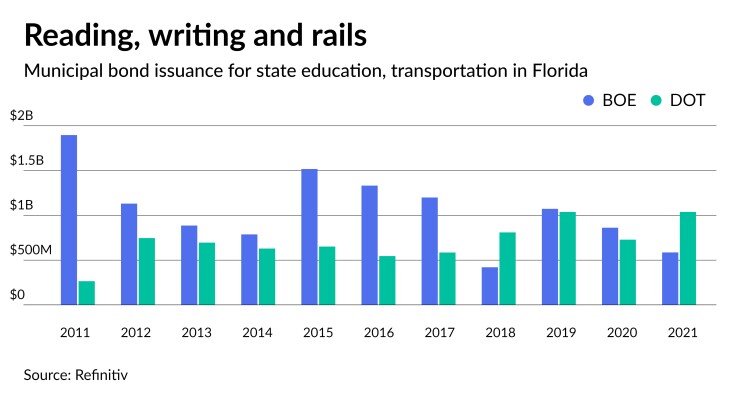

Since 2011, the state DOT has issued $7.7 billion of bonds while the state BOE has sold $11.7 billion.

For the Florida Retirement System, DeSantis is proposing an increase in employer contributions to the investment accounts of employees participating in the FRS investment plan by 3% of the member’s salary.

Based on Oct. 7 reduction of the investment return assumption to 6.8% from 7.0% by the FRS Actuarial Assumptions Estimating Conference, the unfunded actuarial liability of the FRS’ defined benefit program was $34.7 billion on June 30. Based on an actuarial liability of $209.6 billion and an actuarial value of assets of $174.9 billion, the program is 83.4% funded as of June 30.

The budget provides $100 million for the job growth grant fund to support local infrastructure and job training projects targeted towards economic recovery and development and $50 million in recurring funds for VISIT FLORIDA’s tourism marketing programs.

COVID-19 will remain an unknown factor in any budget negotiation process.

While Florida’s economy has been

Since the pandemic began, Florida has seen more than 62,000 COVID-19 deaths. Florida's per capita death rate of 288 per 100,000 residents is more than 20% higher than that of the United States, according to Johns Hopkins data recently compiled by the Financial Times.

Florida’s unemployment rate fell 0.2 percentage points to 4.6% in October. Since April 2020, Florida has recovered almost 90% of the jobs it lost during the pandemic.