Florida plans to "opportunistically" take advantage of historically low taxable municipal bond rates in a $2.25 billion deal that a state official said should be attractive for yield-starved investors.

The deal will further capitalize programs that bolster the state's hurricane insurance markets.

The Florida State Board of Administration Finance Corp. will get expressions of interest from potential buyers on Tuesday. BofA Securities Inc. will be the book-runner on pricing Wednesday.

Proceeds will provide capital to pay claims, if needed, by the Florida Hurricane Catastrophe Fund, a state-run, tax-exempt trust fund that provides lower cost reinsurance to the private property insurance market, and the state-owned Citizens Property Insurance Corp., an insurer of last resort for homeowners.

The bonds are rated AA by Fitch Ratings and S&P Global Ratings, and Aa3 by Moody's Investors Service. All assign stable outlooks.

Although an investor presentation indicated that the fixed-rate deal may be structured with three series of $750 million maturing in 2025, 2027, and 2030, the offering could be upsized and maturities restructured depending on demand, said Ben Watkins, a member of the corporation's board and director of Florida's Division of Bond Finance.

"We're showing an offer of $2.25 billion that we could upsize if we like the pricing or downsize if we don't," Watkins said. "I think it'll be a very attractive opportunity for investors because historically the credit spreads have not reflected the underlying credit quality."

Watkins said that's because some people don't understand the issuer's name and its linkage to the so-called Cat Fund. “This is fundamentally a muni credit secured by taxes on insurance policies," he added.

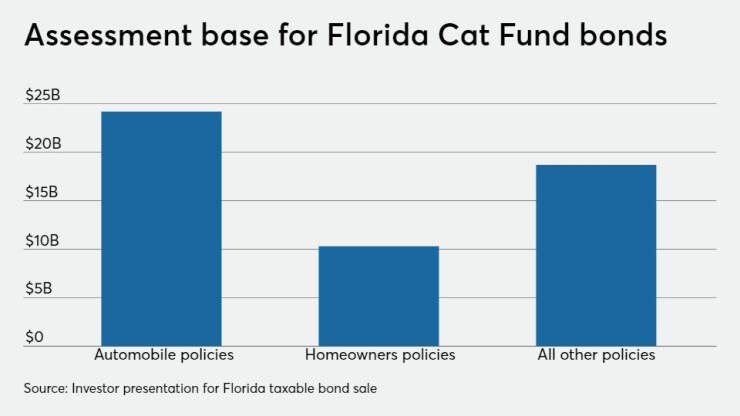

The bonds are secured by reinsurance premiums, investment income on unspent bond proceeds, and emergency assessments of up to 10% on most property and casualty insurance policies in the state. The assessment base totaled $53.2 billion in 2019.

Watkins said institutional investors, such as investment management firms, typically buy the corporation's bonds.

Sarasota, Florida-headquartered Cumberland Advisors, an investment advisory firm with over $3 billion in assets, has purchased the corporation's bonds in the past, said Patricia Healy, senior vice president of research and portfolio manager.

Cumberland may be interested in buying some of the bonds being sold this week, she said.

"It would depend on final pricing because it always comes down to that and where it falls out relative to other structures," Healy said. "We're fine with the credit [but] it could come rich."

Healy also said "it's kind of funny" that the bonds are being issued during hurricane season, which runs from June 1 through Nov. 30.

Watkins said he's fielded questions in one-on-one investor calls about selling debt soon after Hurricane Laura devastated Lake Charles, Louisiana, as a Category 4 major hurricane on Aug. 27, and he's been asked about increased hurricane activity due to climate change.

"Some of the questions have been around greater hurricane activity and all that, but that's only the noise around the credit and that's why we're endeavoring to tell the story because the credit structure is strong," he said, adding that he doesn't anticipate any problems pricing the deal. "None of that affects the Cat Fund or its ability to repay the bonds."

The Cat Fund has on hand $11.4 billion in its fund balance, which would be used first to pay claims if necessary. Its maximum liability to pay claims, per state law, is $17 billion.

"We're being opportunistic about taking advantage of historically low interest rates to provide a more permanent source of paying claims," he said. "That's the bottom line, it's a source of capital."

The Florida Hurricane Catastrophe Fund was created during a special legislative session in November 1993 to stabilize the state's flagging property insurance market after Hurricane Andrew decimated South Florida on Aug. 24, 1992.

The estimated $26.5 billion in damages forced some private property insurers out of business and led others to leave the state because of the risk.

The Cat Fund provides reimbursement for a portion of residential property insurers’ hurricane losses. Insurers in the state are required to participate in the fund by paying a premium for coverage.

Raymond James & Associates Inc. is the fund's financial advisor.

Co-senior managers on the deal are Citi, JPMorgan Securities LLC, Morgan Stanley & Co., and Wells Fargo Bank NA.

Nabors, Giblin & Nickerson PA is bond counsel. Bryant Miller Olive PA is disclosure counsel. Greenberg Traurig PA is underwriters' counsel.