Municipal bond insurers were among the biggest casualties of the financial crisis.

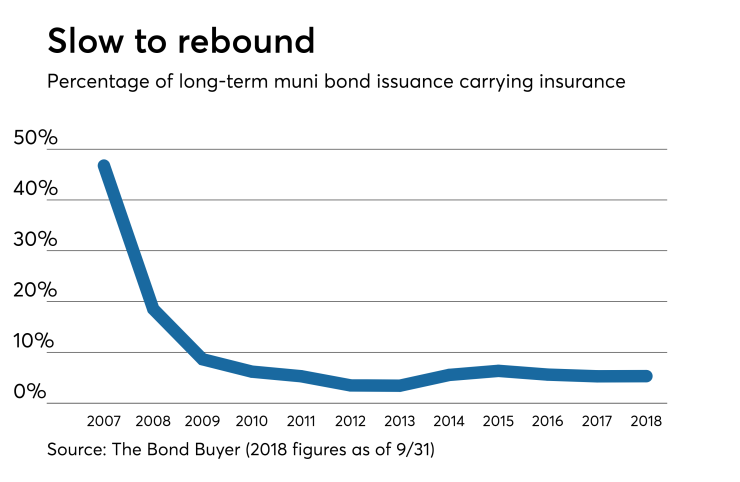

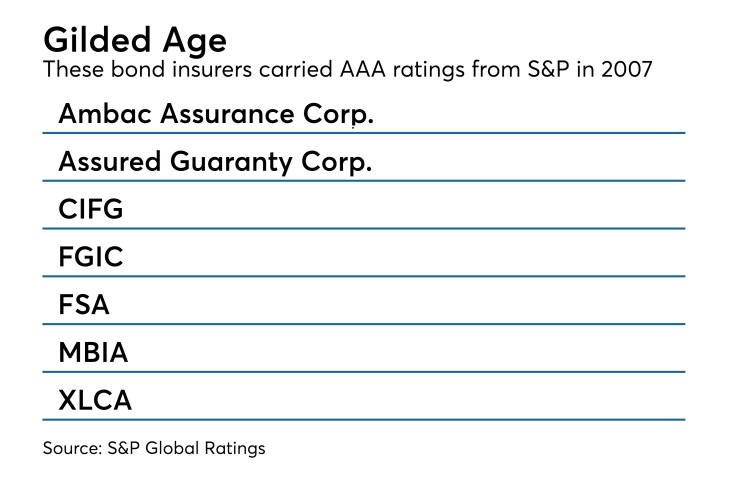

With seven triple-A bond insurers and at least 10 players writing new business, up to 57% of newly issued municipal bonds carried insurance in the years before the global collapse swept away most of the insurers.

The municipal industry, which had relied on the triple-A wraps to reduce borrowing costs, was forced to adapt to a 64% decline in insurance in 2007-2008, as companies like Ambac, MBIA and Financial Guarantee Insurance Co. were stripped of their gilded ratings, a consequence of ill-fated forays into risky mortgage backed securities and structured finance.

“It was a very scary time for everyone in the industry,” said Suzanne Shank, CEO of Siebert Cisneros Shank, an investment banking firm with a sizable municipal securities business.

Today, the ranks of municipal insurers have been reduced to two Double-A rated companies: Assured Guaranty, which purchased the former league leader Financial Security Assurance and continued selling in the muni market; and Build America Mutual, a mutually owned provider launched in 2012 by former officials of FSA. As of Sept. 30, the insurance penetration rate was 5.32% — about one-tenth the pre-crisis level.

The recovery of market share for municipal bond insurers has been hindered by two main factors: their lack of triple-A ratings, and the prolonged period of near-zero interest rates.

Some attempts to launch municipal-only insurance units stalled. At the time of the crisis DEPFA Bank proposed a muni-only insurer that would have only general obligation bonds and water and sewer bonds in its books. The bank never came up with a name for the insurer, and the initiative ended after indications that the unit wouldn't garner a top-tier rating.

MBIA Inc. started a municipal-only unit, National Public Finance Guarantee, in 2014. It stopped writing new insurance in 2017, after S&P Global Ratings lowered its financial strength rating to A from AA-minus and the long-term counterparty credit rating on MBIA to BBB from A-minus.

“People tend to focus on the 50% par penetration reached during a few years before the financial crisis, but in addition to much higher interest rates, there were all those other AAA insurers,” said Robert Tucker, senior managing director of communications and investor relations for Assured. “Now, there are no AAA bond insurers, even though, in our case, our financial position is actually stronger, with lower insured exposure, lower leverage and higher claims-paying resources.”

The near demise of bond insurance hasn’t slowed down municipal issuance. Total long-term muni issuance has dipped below $300 billion only once since the crisis and that was in 2011, when muni issuance totaled $286.65 billion.

Shank said the muni market adapted to the decline in insurers.

“In light of what happened, the disclosure today is much better,” she said. “In a sense, the bond insurers were surveillance, and that role has expanded in the marketplace today. Not only doing research and analysis on credits prior to sales, but through the life of the bond.”

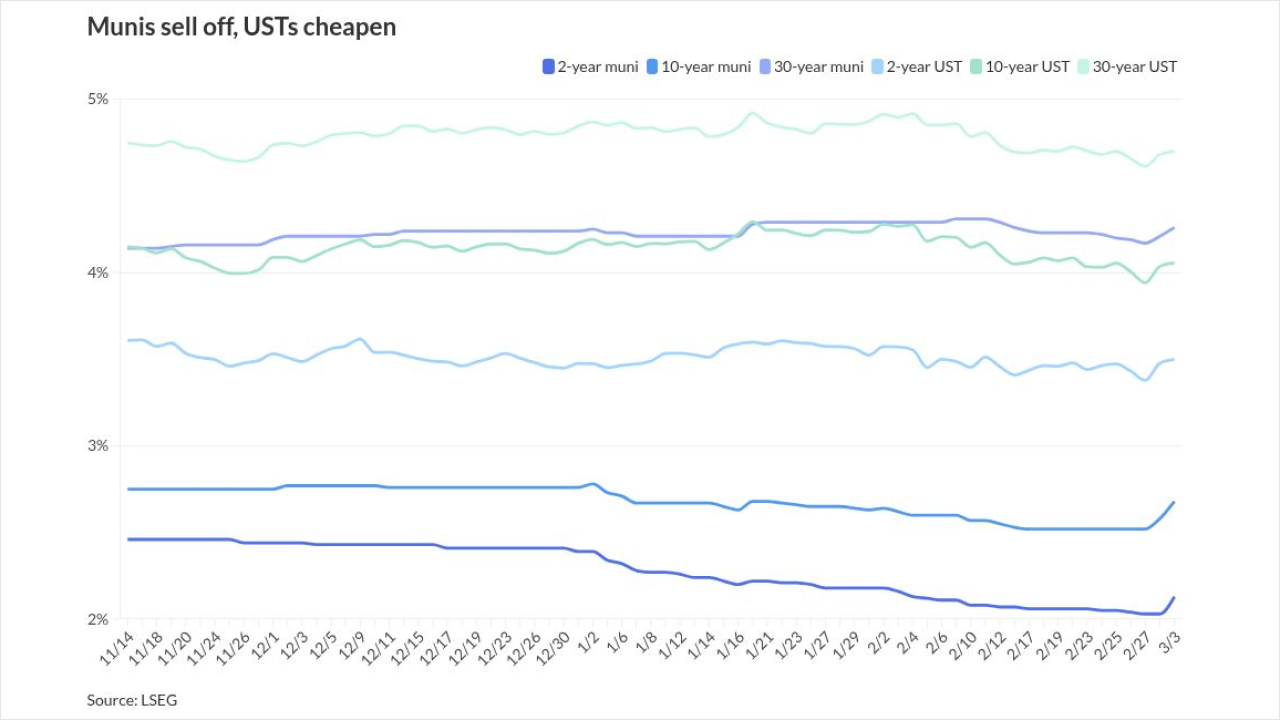

There are a few reasons insurance penetration is expected to rise in a higher interest rate environment. On the spread side, higher interest rates have historically been associated with wider absolute credit spreads, which will give insurers more capacity to charge premiums that deliver economic value to investors.

According to sources, that’s likely to be particularly pronounced in the higher-rated sectors, like AA-minus bonds, where there is a lot of volume where the industry’s double-A ratings can add value at the right price.

Another factor has to do with the buyer mix, as individual investors have been relatively less active in the market the last few years. Underwriting and trading desks say they are looking for at least 4% yields, and will get more excited at 5%. Because individuals benefit most from the guaranty (because they are not in position to do their own in-depth credit research), that shift should increase demand for insurance.

Rising interest rates and credit spreads will be more favorable for bond insurers, and now the Fed has bumped up the pace of rate increases since the tightening cycle began in late 2015. The Fed has raised the federal funds target rate six times since the start of 2017 and the market has baked in another hike for December of 2018. The Federal Open Market Committee’s Summary of Economic Projections suggests three increases will be needed in 2019, if economic data come in as projected.

Spreads between the S&P Municipal Bond Index and the S&P Municipal Bond Insurance Index show that the muni market places a higher value on insurance during uncertain times. Since 2008, the spread was the largest at around 30 basis points, in April of 2011, another difficult period for the markets. The spread between the two indexes was around 30 basis points once again in August and September of 2017, when the elimination of private activity bonds and advance refunding bonds were under consideration as part of tax reform. The spread for this year has declined from the high teens to closer to 10 basis points, as the market assigned less value to the wraps.

Stephen Winterstein, managing director of research and chief strategist at Wilmington Trust Investment Advisors, said the public, advocacy groups, retail and professional market participants and advisors need to be educated about how bond insurance works.

“It did its job through the crisis and continues to do so today,” said Winterstein. Municipals were not the problem when insurers ran into trouble, he said. It was the riskier structured finance products such as residential mortgage backed securities and collateralized debt obligations, which offered higher rates of return, that were the main culprits. Municipals had, and still have a very low default rate, Winterstein said.

“There were some real problems in a specific sector of the monolines’ pre-crisis business,” Assured’s Tucker said. “For example, residential mortgages were much more highly correlated than was being assumed by many market participants, and they also became very illiquid when the market started to experience stress. Those problems were compounded by the fact that practically everyone in the financial industry — including the rating agencies — didn’t fully understand those risks and had too much faith in financial engineering.”

Tucker said that another major issue was a significant amount of fraud in that market. “Neither Assured Guaranty nor FSA insured those deals, as we did not see how those deals made sense, or how one could fully analyze them,” Tucker said.

Dominic Frederico, CEO of Assured, said one of the lessons of the financial crisis is how important it is to stick to disciplined underwriting criteria and business models, no matter what others are underwriting or other parties are encouraging the firm to do.

“It also reinforces the importance of having a diversified business model, limiting risk concentrations both by individual exposures and by sectors, and having large and strong capital resources, access to additional capital, if needed, and plenty of liquidity,” Frederico said.

Assured has paid about $9 billion in gross claims and continued to write new business all through the crisis and until now.

“The fact that our financial resources today, at over $12 billion in claims paying resources, are larger than before the crisis proves the strength of our company and its business model,” Frederico said.

Build America Mutual officials say the company's mutual ownership structure provides a new way to insure municipal bonds, one that may help avoid the mistakes of the past.

“It was not exposure to municipal bond risks that led to downgrades in the bond insurance industry," said Sean McCarthy, BAM's chief executive. "It was the originally municipal-only companies that most aggressively diversified into structured finance and asset-backed securities who suffered severe losses that far exceeded their models and forced them out of business,”

McCarthy said it’s impossible and inappropriate to single out one industry sector or market participant as the root cause of the crisis.

“Across the market, there was an overreliance on models and not enough attention paid to conflicts between deal participants,” he said. “Looking back, it’s easier to recognize that not all structures merited a rating, and that it is impossible to align the interests of servicers, loan and mortgage originators, and investment bankers with those of the bond insurer.”

He said that going forward, insurers need to have a business model that works within their defined credit appetite.

“For BAM, that means we can support the municipal-only model because we have mutual owners whose top priority is protecting low-cost infrastructure financing and market access our guaranty provides, rather than realizing a high return on equity.”

Winterstein said if he buys insured bonds and something goes wrong — as happened when Puerto Rico defaulted — he will have an advocate at the bargaining table and the insurance company will have a good legal team looking out for his best interests. With uninsured bonds, he doesn’t "have that luxury,” he said.

Next: Local government isn’t all the way back