The $1.9 trillion American Rescue Plan will help public finance issuers as they recover from the COVID-19 pandemic and will be especially helpful to the Southeast region, which has felt economic pain and hardship across its travel, tourism, hospitality and leisure industries.

The bill President Biden signed in March is the sixth relief package Congress has passed in response to the economic devastation caused by coronavirus pandemic. Since March 2020, the federal government has approved nearly $6.5 trillion in funds for businesses and people as well as states and local governments.

In a report issued last week, S&P Global Ratings said the latest package will help municipal bond issuers stabilize operations, provide liquidity and accelerate capital projects. The funds directed to states and local governments will also help foster a smoother economic and financial landing from the turbulence and uncertainty of the pandemic, according to S&P.

About $650 billion from the newest relief bill will impact public finance sectors with $350 billion going directly to state, local and tribal governments, according to Hilltop Securities.

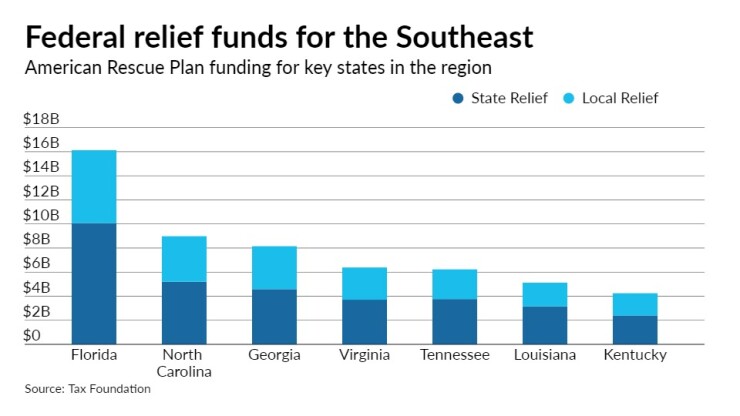

In the Southeast, almost $70.85 billion will be dispersed to state and local governments.

Florida, the Southeast's most populous state, receives the largest share at $16.13 billion, with the rest being broken down into totals of state and local aid for Alabama at $3.98 billion, Arkansas at $2.82 billion, Georgia at $8.15 billion, Kentucky at $4.25 billion, Louisiana at $5.12 billion, Mississippi at $3.04 billion, North Carolina at $8.98 billion, South Carolina at $3.69 billion, Tennessee at $6.23 billion, Virginia at $6.39 billion and West Virginia at $2.07 billion.

On March 24, S&P said its outlooks on all U.S. public finance sectors for 2021, except for higher education and not-for-profit healthcare, were revised higher.

"ARP dollars and a strong economic growth forecast led us to revise our sector view back to stable," said S&P analyst Jane Ridley. "Positive momentum from additional aid and an improving economy will buoy most issuers, but we expect some areas of stress will persist."

The Southeast had been seeing pretty good economic growth before the latest round of stimulus funding, Jennifer Johnston, senior vice president and director of municipal bond research at Franklin Templeton, told The Bond Buyer.

“They had had policies that allowed the economy to open more rapidly than elsewhere in the country. And this, combined with the federal stimulus that states and individuals have already seen states in the Southeast are in a pretty good position already,” Johnston said.

Sectors where the new relief funds will flow include infrastructure, K-12 schools, healthcare, higher education, mass transit and housing.

“There are a minimal amount of restrictions for the use of this money, unlike the 2020 CARES Act relief that was restricted to COVID specific items,” said Tom Kozlik, director of municipal credit and strategy for Hilltop.

Johnston said that Florida intends to use a significant portion of the ARP funds for infrastructure.

“We view infrastructure as a prudent use of ARP money,” she said. “On top of that, we have the current American Jobs Plan and the infrastructure bill that are also under consideration, so we’re going to expect when that is passed that there will be additional monies coming to the Southeast and that will be intended for infrastructure as well.

"We expect the Southeast to be focusing, and Florida specifically, on a lot of infrastructure projects, which given the fact that we’re heading into hurricane season already, there’s a lot to be done and this is going to be very helpful," she said.

In March, Florida Gov. Ron DeSantis sent a letter to the state Legislature proposing how to use some of the ARP funds. DeSantis’ recommendations included providing assistance to Floridians in need as well as making investments in infrastructure, education and workforce development.

DeSantis’ recommendations total $4.1 billion, of which he wants $1.4 billion used in the current fiscal year with the rest being set aside to be used at a later time or for emergencies.

DeSantis recommended spending more than $500 million for economic development and recovery initiatives. To boost the tourism industry and promote development, he has proposed $258.2 million in relief for Florida’s seaports, $150 million for the Florida Job Growth Grant Fund, $50 million for the Visit Florida program and $50 million for the Economic Development Transportation Fund.

So far this year, Florida’s recovery has outpaced earlier forecasts and is predicted to hit pre-pandemic economic growth levels by mid-year.

While CNN/Moody's Analytics' "Back-to-Normal" Index value for the U.S. fell 0.4% to 85.9% week over week as of April 6, Florida's economy was closest to being fully "normal at 100" with an index value of 97.4%. Regionally, the Southeast's economy compared to other regions nationally is closest to pre-pandemic levels, with a weighted average index value of 91.2%, up 9.0% from Jan. 1.

Still, Florida's unemployment rate stood at 4.7% in March, with a year-over-year rate of 5%. At the height of the pandemic in April 2020, the state's jobless rate touched 14.3%. As of April 21, the state had seen 2.18 million cases of COVID-19 with 35,209 deaths.

The governor’s

Florida’s general obligation bonds carry triple-A ratings from S&P, Moody’s Investors Service and Fitch Ratings. As of June 30, 2020, Florida had $19.2 billion of direct debt outstanding, according to the state Division of Bond Finance.

But despite improvements in overall credit stability for state and local governments, tax collections from hospitality and tourism taxes remain depressed, according to S&P.

This is especially true for states in the Southeast where these sectors play a big part in the regional economies. However, signs of recovery are gaining a foothold in leisure and hospitality even as some pressures remain.

“As states took measures to contain the spread of the coronavirus, broad business closures coupled with unevenly deployed mobility restrictions in the early months disproportionately left the tourism sector among the hardest hit,” S&P said.

“Even now, as a large share of states have effectively reopened all segments of their economies, it's uncertain to what degree a segment of the population will be averse to resuming leisure activities and travel as they did before the pandemic,” Ridley said.

From a broader national economic and revenue standpoint, S&P noted that pandemic-accelerated changes in where and how Americans work will require ongoing focus to determine if there are permanent shifts that affect credit quality.

“We absolutely think the Rescue Act funds will help public finance credit quality,” Hilltop's Kozlik said, “however this could prove to be only temporary.”

He said investors should remain wary.

“We are cautioning observers that this upswing could only be temporary for some entities, especially those entities that do not balance revenues and expenditures,” he said.

Investors will be closely watching how state and local governments use these new stimulus funds, according to Johnston and Ben Barber, director of municipal bonds at Franklin Templeton.

“Productive uses could include economic development, capital spending, and support of COVID-19 vaccine distribution and relief programs,” they said. “Unproductive uses of the relief funding would include starting new spending programs that will continue and require funding in future fiscal years, after the funding dries up.”

While the stimulus will be positive for everyone, Johnston and Barber said, states and municipalities that use the money for revenue replacement may benefit the most.

“This stimulus aid is a one-time infusion of money and if the funds are used for recurring programs, then governments would have to find new funding sources for those programs going forward, which could be problematic, particularly for poorly managed entities,” they said.