The Federal Open Market Committee meeting kept activity in the municipal bond market to a minimum on Wednesday, with participants waiting for the afternoon announcement on interest rates.

According to Jeffrey Lipton, managing director at Oppenheimer & Co. Inc., the meeting is directly linked to expectations for rate hikes and prospects for a more “hawkish bias” signaled in Chairman Jerome Powell’s statement and comments,

“For much of last week, longer-tenor munis had been confined to a tight trading range, while short maturities showed the most upward movement in yields with further cheapening of relative value ratios,” he wrote in a municipal report this week.

Lipton said indications of a more hawkish sentiment may continue to pressure tax-exempt yields higher — particularly on the short end of the curve.

Meanwhile, as tax-exempts navigate the final quarter of 2018, they will likely do so against a number of headwinds.

While there are varying expectations for supply throughout the balance of the year, he said he expects to see a constructive path that may help to support performance.

“We think that the light issuance this week will be well received as deployable cash remains available,” Lipton noted. “While reinvestment demand is expected to ebb through the final quarter, we see a contained diminution as tax-efficient investment holds its appeal for a large segment of the muni market.”

He added, municipal bond fund flows are likely to finish the year at a net-positive position.

“Moving throughout the fourth quarter, we do expect to witness episodic outflows, but again we are fairly confident that market technicals should sustain positive flows, which should help to support market recovery and performance,” Lipton said.

Federal Reserve flow of funds data would indicate the new lower corporate tax rate of 21% has contributed to institutional sales of longer maturity holdings, according to Lipton, who said that is a key contributor to negative performance on longer-dated bonds.

"Banks in particular have pared back their exposures to tax-exempts given a diluted incentive to owning these securities," he said. "We suspect that the rate of portfolio liquidations among banks will likely ease through the second half of the year with stabilization setting in sometime next year."

“While it is too soon to draw any enduring conclusions, we do think that any measure to extend the definition of HQLA to municipal securities would incentivize banks to buy and hold tax-exempt muni investments,” Lipton added.

Primary market

There was not much activity in the new issue space on Wednesday, with most deals being slated either on Monday and Tuesday before the Fed meeting or on Thursday after the Fed meeting.

Bond Buyer 30-day visible supply at $4.29B

The Bond Buyer's 30-day visible supply calendar decreased $1.23 billion to $4.29 billion for Wednesday. The total is comprised of $1.60 billion of competitive sales and $2.69 billion of negotiated deals.

Secondary market

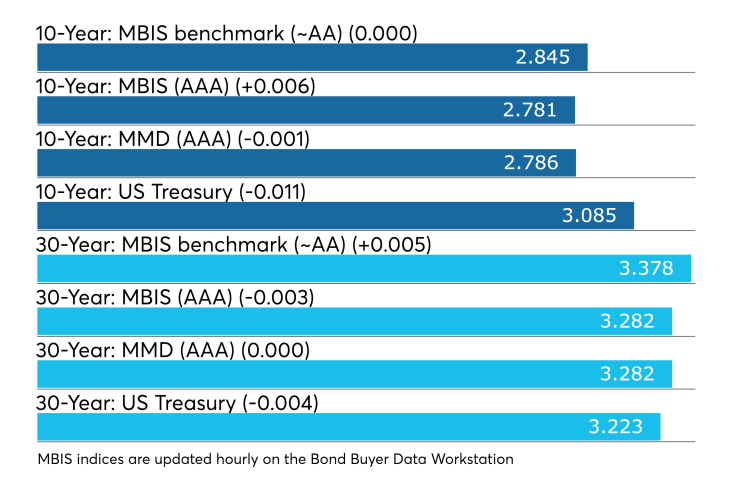

Municipal bonds were little changed on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose less than one basis point in the one- to 30-year maturities, except for the eight- and nine-year maturities which fell less than a basis point.

High-grade munis were mixed, with yields calculated on MBIS' AAA scale rising less than one basis point in the one- to five-year and 16- and 17-year maturities, falling less than a basis point in the seven-year, nine- and 10-year, 12-year, 22-year and 25- to 30-year maturities and remaining unchanged in the six-year, eight-year, 11-year, 13- to 15-year, 18- to 21-year and 23- and 24-year maturities.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were stronger as stock prices traded higher.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 87.4% while the 30-year muni-to-Treasury ratio stood at 101.1%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 45,632 trades on Tuesday on volume of $12.60 billion.

California, New York and Texas were the municipalities with the most trades, with Golden State taking 18.113% of the market, the Empire State taking 14.172% and the Lone Star State taking 9.671%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.