Far West municipal issuers sold $99.1 billion of debt last year, a 16% increase from 2019, picking up the pace in the second quarter, according to Refinitiv data.

Bond sales in the nine-state region fell 18.8% year-over-year in the first quarter to $15.4 billion but jumped 47.8% year-over-year in the second quarter, rose similarly in the third quarter and flattened out in the fourth quarter.

Fear ground the municipal market

“As soon as the first brave souls got into the market and saw deals could get done, it accelerated,” said John Hallacy, founder of John Hallacy Consulting LLC. “The big story was rates last year. That drove a lot of volume. I think the biggest month was in the September to November range. Earlier in the year, everyone was dealing with uncertainty and they were nervous about whether they could get deals done.”

Many issuers moved spring sales planned in mid-March and April to the day-to-day calendar as they watched the bond market for signs rates had stabilized enough to re-enter.

California went day-to-day on a $1.4 billion deal ultimately priced April 16 by BofA Securities and JP Morgan. It was the region’s 5th largest sale for the year.

“We were the first major issuer to step back into the market,” said Tim Schaefer, deputy treasurer for public finance. “We weren’t naive about it. We recognized there was some danger, but we also recognized that California bonds are high-grade and widely held and supported by investors and broker dealers.”

When that deal and others were well-received, other issuers followed.

The second-quarter surge was driven, Schaefer said, by municipal bond mutual funds, which posted 26 consecutive weeks of positive inflows after April.

“It created a buoyancy and spreads got tighter,” Schaefer said. “A lot of issuers took advantage of that.”

In September, California sold a $2.63 billion deal with Morgan Stanley as bookrunner for the region’s second largest deal of 2020, narrowly beaten by a $2.65 billion Regents of the University of California deal in July.

Hawaii had the largest deal outside California snagging the eighth spot with a $1.1 billion taxable state general obligation deal priced by BofA Securities and Morgan Stanley in October.

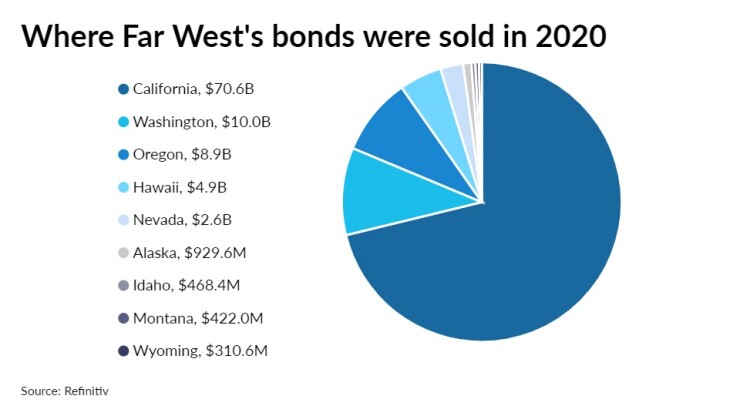

California issuers sold $70.6 billion maintaining the state’s status as the nation’s largest issuer ahead of Texas and New York, who took the number two and three slots, respectively.

The California treasurer’s office posted a 40% increase in volume to $17.6 billion compared to the previous year, Schaefer said. Of that $5.3 billion increase, about three quarters is attributable to bonds sold by the University of California to support capital projects, Schaefer said.

The UC Regents priced three new money deals totaling $4.4 billion to do renovations on five medical centers on three of the system’s 10 campuses, Schaefer said. Two-thirds of the $2.3 billion sold by California State University was for capital improvements, but its renovation projects were split among its 23 campuses, he said.

The amount of new money bonds sold through the treasurer’s office was slightly less than refunding, after being only one-third of volume last year, Schaefer said.

“That is a trend I expect you will continue to see with us doing less and less refunding going forward,” Schaefer said. “We have mostly picked off the low-hanging fruit.”

That said, the Far West issuers did a lot of refunding in 2020, and rates allowed them to conduct many advance refundings — no longer legal with tax-exempt bonds — on a taxable basis.

The volume of taxables more than doubled to $36.9 billion, while tax exempt sales fell 6.1% to $59.8 billion.

Across the nine-state region, refundings were up 70.3% to $33.7 billion. New money volume was up 10%.

“My feeling is with rates plummeting, everyone was looking at any and all refunding opportunities that remained even if that was on a taxable basis, and that contributed to most of the taxable muni sales,” Hallacy said.

The pandemic and the budget pressure it created led some issuers to structure refundings to achieve greater savings in the first two fiscal years, said Sara Oberlies Brown, co-manager of Stifel California.

Typically, issuers have structured refundings so the debt service on the new bonds is proportional to the old bonds, but Brown said she has seen a larger number of issuers structuring the new bonds to take the savings in fiscal year 2021 or the year after.

It's not the highly criticized scoop and toss, because it's not extending the maturity on the bonds.

“Debt service is no higher in the remaining years to maturity, but they are capturing the savings in the early years,” she said.

This wasn’t a tactic Brown remembers issuers employing in 2008. The COVID-19-driven downturn came on so much more suddenly, and there is an expectation that the economy will recover once people can safely travel again, return to their workplaces, and go on vacation and to conferences, she said.

Bond sales in the education sector were up more than 40% regionwide in 2020, while transportation sales dropped by almost 40%.

“With schools, I think it largely has to do with the GO bond authorizations they received prior to the onset of COVID-19,” Brown said. “We have heard that many school districts are taking the opportunity while students are not in the classroom to do some improvements as well as some projects that make it possible to bring students back in.”

Unlike in the prior recession, property values have grown, she said, which gives schools the ability to issue bonds, since they are backed by property taxes.

Taxable refundings are likely to continue for a while, Brown said, adding that if the federal infrastructure bill creates a Build America Bond-like program similar to what existed in 2009-10, that could also stimulate additional taxable bond sales, as does

“Taxable issuance certainly increased in 2020,” Brown said. “I think we will continue to see that in 2021.”

BofA Securities topped the senior manager rankings, credited by Refinitiv with $12.9 billion in 101 deals, followed by with JPMorgan and Citi.

Public Resources Advisory Group snagged first place among financial advisors, credited with $14.6 billion in 42 deals followed by PFM Financial Advisors and KNN Public Finance.

Orrick, Herrington & Sutcliffe retained its lead placement as bond counsel, credited with $35.4 billion on 250 deals, trailed by Stradling Yocca Carlson & Rauth in second and Hawkins Delafield & Wood in third.