The last day of the month brings a host of economic indicators, which showed much good news for housing and labor, strong consumer confidence, but mostly softer manufacturing conditions.

“As a whole the data are not so surprising,” said Kathy Bostjancic, director of U.S. Macro Investor Services at Oxford Economics. “They confirm that wage growth is gradually firming, home price appreciation is moderating, and consumer confidence is ebullient given the strong labor market and healthy asset price gains.”

Employment costs grew 0.7% in the first quarter, matching the rise from the fourth quarter of 2018, according to the Bureau of Labor Statistics. This suggests a tight labor market that is forcing employers to slowly lift pay and increase benefits, though not at a pace that will make inflation soar. This will allow the Federal Reserve to remain patient and continue watching incoming data before deciding its next move.

The MNI Chicago Business Barometer dropped to a 27-month low of 52.6 in April from 58.7 in March. “Although the barometer has comfortably remained above the 50-neutral level for more than two years now, survey evidence points to a modest slowdown since last year,” according to the report. This matches Fed projections for economic growth near trend this year, after above-trend growth in 2018.

Four of the five components declined, with only order backlogs gaining, pushing over the neutral level after dipping into contraction territory in March.

The Midwest Economy Index from the Federal Reserve Bank of Chicago also suggested slower growth, as the index slipped to 0.22 in March from 0.29 in February, while the ISM-Milwaukee Report on Manufacturing grew to 55.04 in April from 50.05 in March on “stronger production and hiring activities.”

In the MEI, Iowa posted a negative contribution, while Michigan, Illinois, Wisconsin and Indiana posted positive contributions.

Texas service sector activity improved in April on a rise in revenues, according to business executives responding to the Federal Reserve Bank of Dallas’ Texas Service Sector Outlook Survey. “Overall, perceptions of current business conditions rebounded to positive territory, although retailers continued to note pessimism in their outlooks,” said Christopher Slijk, Dallas Fed assistant economist.

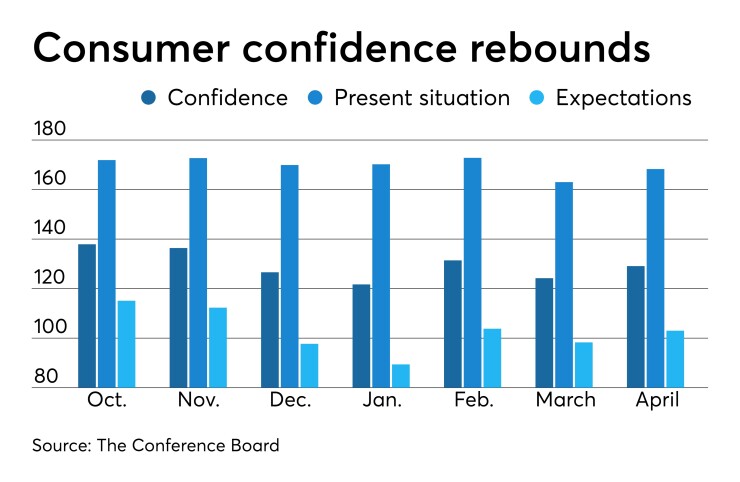

The Conference Board Consumer Confidence Index rose to 129.2 in April from 124.2 in March, while the Present Situation Index grew to 168.3 from 163.0, and the Expectations Index rose to 103.0 from 98.3 last month.

Confidence grew in employment and future conditions. More respondents said business conditions are “good” than in the prior month, while fewer said business conditions are “bad.” Respondents stating jobs are “plentiful” climbed to 46.8% from 42.5%, while 13.3% said jobs are “hard to get,” down from 13.8% last month.

"Consumer Confidence partially rebounded in April, following March's decline, but still remains below levels seen last fall," said Lynn Franco, senior director of economic indicators at The Conference Board.

Home prices, as measured by the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, grew 4.0% on an annual basis in February, which was off from a 4.2% rise in the previous month. Pending home sales rose 3.8% in March, “reversing course from a month prior,” the National Association of Realtors reported. However, year-over-year pending home sales were off 1.2%, the 15th straight month this read has declined.

Mike Fratantoni, Mortgage Bankers Association SVP and chief economist, said “conditions are ripe for further sales increases in the coming months.”