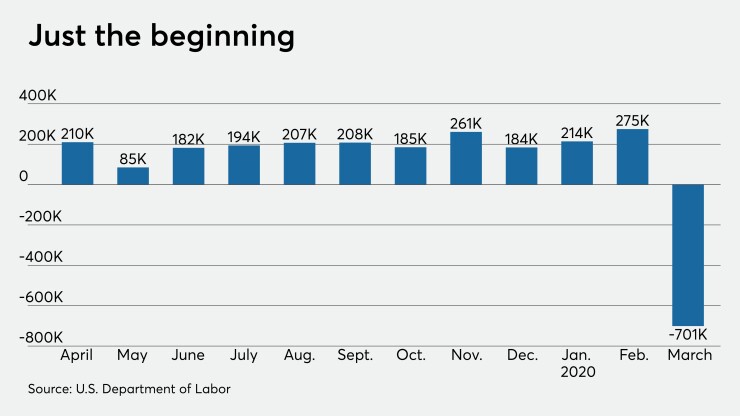

The coronavirus continues to hit the economy hard, as the number of nonfarm payrolls fell seven times more than expected, but economists are optimistic that when the lockdown is over, the rebound will be as sharp as the descent.

Nonfarm payrolls dropped 701,000 in March and the unemployment rate jumped to 4.4% from 3.5%, the Labor Department said Friday.

This was the first time since September 2010 that payrolls fell, ending a 113-month streak of gains.

Economists polled by IFR Markets were expecting 100,000 jobs lost.

“The changes in these measures reflect the effects of the coronavirus (COVID-19) and efforts to contain it,” Labor said in a release, but added, the survey period “predated many coronavirus-related business and school closures that occurred in the second half of the month.”

“These figures are spooky but not surprising,” said Beth Akers, Manhattan Institute senior fellow and former Council of Economic Advisors economist. “Unlike other nations that have subsidized payrolls, the U.S. is relying on the unemployment insurance program to keep workers afloat through this public health crisis and the subsequent shuttering of businesses. Job losses will undoubtedly continue. The open question is how quickly we can bring business back online once restrictions on economic activity have been lifted.”

"The unemployment number was worse than expected but these figures are expected to climb in the coming month,” said Karissa McDonough, chief fixed income strategist at People's United Advisors. "This flow of difficult data confirms that aggressive Fed action to support the credit markets is the right one as we don’t currently have clarity as to the duration of this crisis."

But Steve Skancke, chief economic advisor at Keel Point, said with 6.6 million new initial claims for unemployment this week, a 0.9-point jump in unemployment would seem good, but it doesn’t show the full picture.

He noted these new claims and the 3.3 million the week before aren’t included in this report. “In normal times, this survey delay isn’t a significant factor, but in the current situation, it can have important implications for decisions being made by public leaders, businesses, and consumers,” he said.

“All this is to be reminded that as we are making decisions, we need to be mindful as to the bigger picture and the impact of testing and surveys that may not be current or reflect what they purport to show.”

“The jump in the unemployment rate by almost a full percentage point exceeded expectations, but only points to the level of distress among many households,” said Mortgage Bankers Association Chief Economist Mike Fratantoni.

“Many respondents in the household survey indicated that they are on temporary furlough,” he added. “This does provide additional support for our forecast of a V-shaped path for the economy, the job market, and the housing market. We do expect those unemployed to be called back to their jobs when the crisis abates.”

And it will get worse before it gets better. “These look bad but the April figures will be horrendous,” said Brian Coulton, chief economist at Fitch Ratings. “The unemployment rate will surge above 10%. The jobs market and employment levels are a real time indicator of overall activity and right now we think activity is 20% down in the lockdown.”

“It’s shocking to me that the employment numbers are taking people by surprise,” said Ron Carson, founder & CEO of Carson Group. “Also, the unemployment claims are going to continue to skyrocket as we don’t have enough people to process the claims. This is why the government program is so critical right now if they want to avoid a cliff. I think we have to be prepared for this to get much worse before it does get better.”

Next month’s number may offer insight, “to see if the stimulus package will prevent further layoffs,” said National Association of Realtors Chief Economist Lawrence Yun.

Also released Friday, Institute for Supply Management’s Non-Manufacturing Report on Business’ headline index fell to 52.5 in March from 57.3 in February.

Most comments shared by ISM included references to COVID-19.