The municipal bond calendar will start the month with less than $1 billion of volume and only one deal totaling more than $100 million after weeks of massive supply ahead of one of the most contentious elections in recent U.S. history amid a global health pandemic.

Most issuers took advantage of the low-rate, high-demand environment in October to come to market ahead of election week and the uncertainty and volatility that will be coming afterward. The month saw over

IHS Markit estimates volume for the upcoming week at $759.6 million. The calendar is composed of $529.1 million of negotiated deals and $230.5 million of competitive sales.

Ashton Goodfield, head of municipal bonds at DWS Group, says that regardless of the election results the firm believes “it may make sense to remain bullish, viewing any weakness in the muni market leading up to, or following the election, as a buying opportunity as technicals are likely to remain strong over the medium term.”

And if Tuesday's elections were not enough to keep issuers on the sidelines, the Federal Reserve is holding its monetary policy meeting on Wednesday and Thursday and the Labor Department will release the employment report for October on Friday.

Primary market

The only large deal on the new-issue slate is coming from the Maine Turnpike Authority (Aa3/AA-/AA-/).

BofA Securities is set to price the $130 million of Series 2020 turnpike revenue bonds on Tuesday.

"Dominated by school districts, small issuer GOs, and some special districts," said John Hallacy, founder of John Hallacy Consulting LLC. "They are not the kind of credits to create much controversy during a difficult election week."

Secondary market

Some notable trades on Friday:

King County, Washington SD 5s of 2021 traded at 0.25%. NYC TFA subs 5s of 2024 at 0.57%-0.56%. Ohio GOs, 5s of 2025, at 0.38%-0.36%. NY EFC waters 5s of 2025 at 0.37%. Prince Georges County, Maryland, 5s of 2027 at 0.63%.

Maryland GOs, 5s of 2034, at 0.63%. NYC TFA subs 5s of 2037 at 1.90%-1.89%. On 10/22 at 1.92%. NYC TFA subs 4s of 2040 at 2.32%-2.33%. Arlington Texas Great Hearts 4s of 2045 at 2.07%. Conroe Texas ISD 2.25s of 2046 at 2.28%.

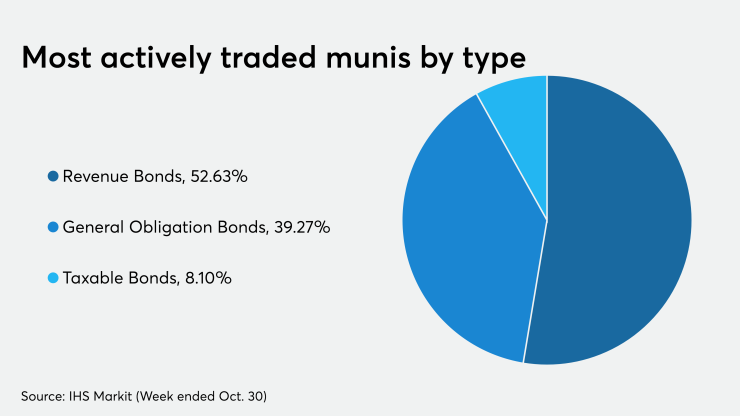

The most active bond types traded this week were revenue bonds, followed by GOs and taxables, according to IHS Markit.

“Heavier selling at month end has shown bid lists with a short-end centric focus,” said Kim Olsan, senior vice president at FHN Financial. “Thursday’s session had an estimated $220 million posted for sale due inside 2025, about 25% of the total. Selling is likely due to profit-taking, cash raises and curve extensions. The small give-up in yields is making it an easy range for sellers and for defensive inquiry offers welcome volume.”

She said the yield curve steepened in October.

“In the last month the curve has steepened in the five- 10-year area and is currently at 62 basis points — the widest five-year range on the curve," Olsan said. "A return of 1% handles in the 10-year area and reach for more TEY and relative value has caused some extension activity. Optionality is also playing a role with a good amount of allocations.”

On Friday, high-grade municipals were little changed, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields in 2021 and 2022 were flat at 0.20% and 0.21%, respectively. The yield on the 10-year muni was steady at 0.93% while the yield on the 30-year was flat at 1.71%

On the week, muni yields were down about three basis points. On Friday, Oct. 23, the 10-year yield was at 0.96% while the 30-year yield stood at 1.74%.

The 10-year muni-to-Treasury ratio was calculated at 109.2% while the 30-year muni-to-Treasury ratio stood at 105.6%, according to MMD

The ICE AAA municipal yield curve showed short maturities were steady in 2021 and 2022 at 0.21% and 0.23%, respectively. The 10-year maturity was unchanged at 0.92% and the 30-year was unchanged at 1.73%.

The 10-year muni-to-Treasury ratio was calculated at 108% while the 30-year muni-to-Treasury ratio stood at 106%, according to ICE.

The IHS Markit municipal analytics AAA curve showed short yields rising one basis point to 0.17% and 0.18% in 2021 and 2022, respectively, with the 10-year flat to yield 0.95% and the 30-year up one basis point to 1.72%.

The BVAL AAA curve showed the yield on the 2021 maturity up one basis point to 0.16% and the 2022 maturity up one basis point to 0.18% while the 10-year was steady at 0.92% and the 30-year up one basis point to 1.73%.

Treasuries were weaker as stock prices traded lower.

The three-month Treasury note was yielding 0.10%, the 10-year Treasury was yielding 0.86% and the 30-year Treasury was yielding 1.64%.

The Dow fell 1.60%, the S&P 500 decreased 1.98% and the Nasdaq lost 2.98%.

Bond Buyer indexes move lower

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell one basis point to 3.62% from 3.63% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields decreased three basis points to 2.34% from 2.37% from the previous week.

The 11-bond GO Index of higher-grade 11-year GOs declined three basis points to 1.87% from 1.90%.

The Bond Buyer's Revenue Bond Index dropped three basis points to 2.76% from 2.79%.