DALLAS — Fresh off a whirlwind of meetings with investors in Europe and Asia, Dallas-Fort Worth International Airport is pursuing a new marketing strategy for more than $10 billion of debt over the next five to seven years.

“We are hoping to get 20% international participation,” Michael Phemister, DFW's vice president for treasury management, told The Bond Buyer’s Transportation Finance/P3 Conference in Dallas. “That may be an unrealistic goal, but that’s what we’re aiming for.”

Facing a flood of competition from other airports selling bonds subject to the alternative minimum tax, DFW plans to bypass the traditional airport market and issue taxable debt, broadening the appeal to U.S. and foreign investors who typically pursue corporate bonds.

"The difference in yields between AMT and taxable we believe to be marginal and they’re just going to get tighter when the AMT market gets flooded with bonds," Phemister said Thursday.

DFW execs are also concerned about how tax-exempt bond proceeds are regulated, and the impact of last year’s tax reform on the muni market's appetite for new issues.

For high-income individuals, the AMT is a parallel tax code to determine the minimum liability a taxpayer would be required to pay after eliminating the deductibility of certain “preference items.” Interest on qualified private activity municipal bonds is included among the preference items.

In addition to airports, qualified PABs, all subject to the AMT, are issued for water and sewer service, solid waste facilities, single and multifamily housing, and certain small issue industrial developments and enterprise zones.

The turn toward taxable issuance is something DFW has been

With an estimated $70 billion of capital projects planned at major U.S. airports over the next decade, per J.P. Morgan, Phemister reckons that the AMT market is not large enough to absorb that amount of debt. The new tax structure enacted last year, with lower rates on wealthy people, also reduces incentives for sheltering income, a key draw for the tax-exempt bond market.

While DFW will continue to issue about $1.5 billion of tax-exempt bonds for refurbishing runways and other airfield improvements, bonds for a new terminal and projects that benefit airlines and other corporations will be taxable, Phemister said.

About half of the estimated $10 billion to $11 billion of bonds over the next five to seven years will be refunding and half will be for new money, Phemister said.

With $6.5 billion of outstanding debt, DFW has $5.2 billion of bonds that are callable over the next five years. If interest rates favor refunding, about $1.8 billion will be refunded as tax-exempt while $3.4 billion will be refunded as taxable. New money is expected to finance $3 billion to $6 billion of construction over the next 10 years.

After a couple of quiet years awaiting American Airlines’ plans at its home hub, DFW expects to bring about $1 billion per year to the market over the next four to five years, Phemister said, with the first of those issues, a $1.3 billion refunding of AMT bonds with taxable debt, coming next summer.

American also signed off on plans at its other major hub, Chicago’s O’Hare International Airport, where an $8.5 billion

Chicago is pricing $1.848 billion of general airport senior lien revenue and refunding bonds for the airport on Tuesday.

After opposing the O’Hare plan because competitor United Airlines was awarded five additional gates, American approved after Mayor Rahm Emanuel agreed to speed up construction of three additional gates at the end of an American concourse.

At the same time, American is constructing a $300 million campus on a 300-acre site near DFW and the airline’s existing headquarters. The campus is home to training and support buildings, including an operations center, flight academy and reservations center. The airline will begin moving into the new, high-tech headquarters next year.

American was awarded a $21.25 million tax incentive package from the city of Fort Worth. The new headquarters will be on the Fort Worth side of the airport, which is jointly owned by Fort Worth and Dallas. In June of 2014, the Fort Worth City Council approved a 15-year, $6.5 million tax incentive from the city for the campus. Fort Worth expects about $7 million in tax revenue over 15 years, officials estimate.

DFW’s most recent project was a $2.7 billion remodeling of its original terminals A, B, and E, completed this year. At American’s request, the airport skipped remodeling Terminal C, Phemister said. The latest plan calls for the demolition of C and construction of a new terminal in its place. The airport is also considering building a Terminal F.

“The airfield is in good shape, but we are out of gates again,” Phemister said.

DFW’s next round of debt will overlap with heavy issuance from the nation’s largest hub airports.

“The leverage that’s coming is obviously considerable,” said Peter Stettler, municipal credit analyst at Piper Jaffray & Co. “But some of these airports have not had a lot of major projects over the past 15 years. These projects are necessary and important.”

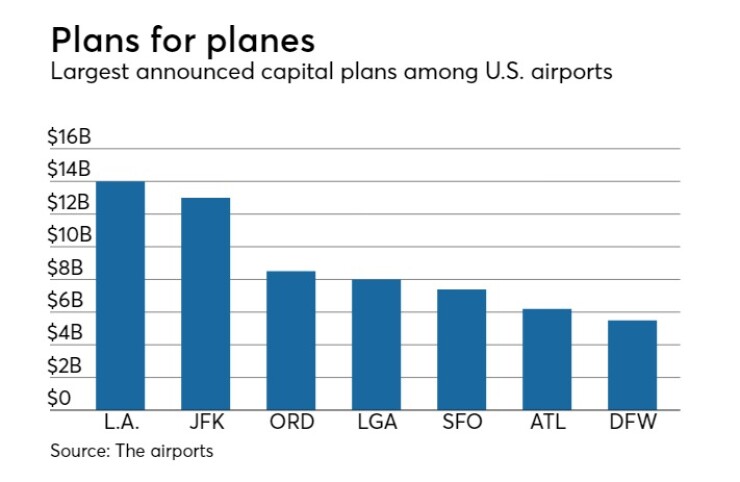

Along with the DFW and O’Hare expansions, New York’s aging JFK International Airport is launching a $13 billion renovation in 2020 that will include two new terminals. That project will coincide with an $8 billion redevelopment of New York’s LaGuardia Airport now underway.

A $14 billion redevelopment at Los Angeles International Airport targeted for completion in time for the 2028 Olympics includes a $1.6 billion investment by American Airlines in its facilities at the third busiest U.S. airport. American calls the LAX project the “largest individual investment at an airport in its 92-year history.”

Multibillion-dollar projects are also planned or in progress in Kansas City, Denver, San Francisco, Atlanta, Salt Lake City, San Diego, Seattle, Fort Lauderdale and Charlotte.

“There is a clear need for the projects,” said Moody’s analyst Earl Heffintrayer.

“When you take it altogether, the question is: Can the airlines afford this?” he told The Bond Buyer conference. With the cost per passenger for the projects ranging from $1.40 per passenger for Delta to $4 for United, the airlines are able to absorb the cost, he said.

Airport bond issuance this year is expected to total about $11 billion compared to an historical average of about $3 billion to $5 billion per year, Heffintrayer said.

DFW sees an opportunity to sell airport bonds to overseas investors looking for safety and a better yield than they might find in their home markets. In meetings with 25 investors in London, Paris, Seoul and Taipei over two weeks, Phemister and chief financial officer Chris Poinsatte provided a primer on airport credits.

“DFW believes there is international demand for high-quality U.S. infrastructure debt,” Phemister said.

The airport’s revenue bonds are rated A1 by Moody’s Investors Service, A-plus by S&P Global Ratings and Fitch Ratings, and AA-minus by KBRA.

“Compared to the credit ratings of U.S. corporate bonds, U.S. airport bonds are generally considered to be under-rated,” Phemister told investment groups. “No publicly owned U.S. airport has ever defaulted on its revenue-backed bonds.”