Want unlimited access to top ideas and insights?

Despite trade issues, consumer confidence slipped only slightly in August, as “consumers have remained confident and willing to spend,” The Conference Board reported Tuesday.

Consumers have fueled the economic expansion amid soft business spending.

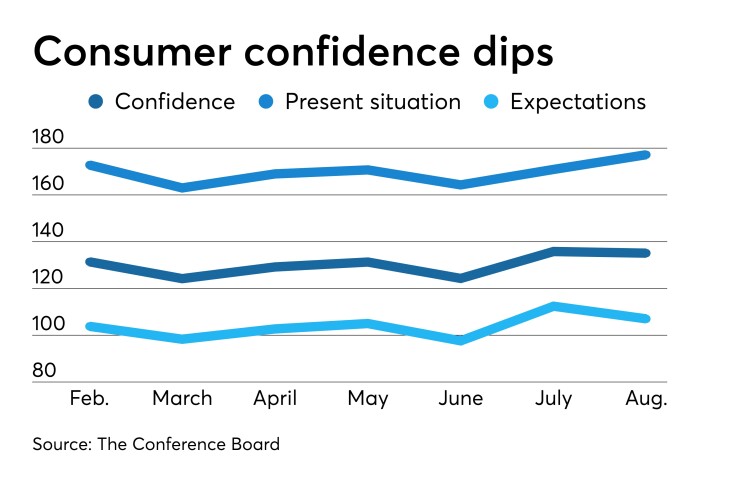

The confidence index slipped to 135.1 from 135.8 in July, while the present situation index jumped to 177.2 — its highest reading since posting a 179.7 in Nov. 2000 — from 170.9, and the expectations index fell to 107.0 from 112.4.

Economists polled by IFR Markets expected a 130.0 confidence index reading.

“Expectations cooled moderately, but overall remain strong,” said Lynn Franco, Senior Director of Economic Indicators at the Conference Board. “While other parts of the economy may show some weakening, consumers have remained confident and willing to spend. However, if the recent escalation in trade and tariff tensions persists, it could potentially dampen consumers’ optimism regarding the short-term economic outlook.”

Trade issues have been escalating and then abating. "If these were only short-term difficulties and one could see some kind of an ‘off-ramp’ for both sides to settle their differences, there would be more hope, but nobody in authority has thus been able to present a credible picture of what such a resolution would be that could be domestically acceptable in political terms in both countries,” said Nelson Dong, a senior partner at international law firm Dorsey & Whitney.

"From the outside, it is difficult to see how these rapid volleys of tariffs and counter-tariffs can help the two teams of government negotiators to reach any kind of deal that would be acceptable to both President Trump and President Xi or can avoid the spreading collateral consequences for many thousands of suppliers and customers on both sides of the Pacific or the knock-on effects in many other national economies,” he added.

The results of a prolonged trade war, he said, “can only combine to erode investor and consumer confidence, stall many needed investments, and increase the risks of negative local, regional or even global consequences.”

With the 2/10 yield curve inverting briefly several times now, trade issues and the Federal Reserve “dominate” headlines “as policy mistakes are causing financial market investors to pull back expectations for growth,” First Franklin Chief Market Strategist Brett Ewing says. “The economy continues to be held up by the final leg on its stool — employment — and what a strong leg it has proven to be.”

The Fed raised rates too high in 2018, even though “the administration was actively fighting a trade war with the second largest economy in the world, and the inverted yield curve was the result of their efforts,” he said. “While [Fed Chair Jerome] Powell did indeed pivot and save bulls in January, he hasn’t followed it up with bold enough action. While happy to get ahead of anemic inflation in 2018, Powell seems unwilling to accept what the bond market is telling him and to get ahead of this economic weakness. All that being said, we don’t believe that just because the yield curve inverted that a recession is inevitable; central bank intervention and a flatter curve in general make for higher occurrences of false readings.”

Ewing suggested President Trump should “hit the trade reset button. He has gone as far as he possibly can with tariffs without materially hurting the U.S. economy and his tweets that repeat the same things he said a year ago are beginning to look more and more desperate.”

Richmond Fed

Manufacturing rebounded in the district, the Federal Reserve Bank of Richmond’s survey showed. The composite index turned positive in August, at positive 1, up from negative 12 in July, as shipment and new orders gained, the Fed reported Tuesday. Employment declined.

Service sector activity expanded slower in August in the district, as revenues slipped to 6 from 11, while demand fell to 13 from 18.

Texas services

The Federal Reserve Bank of Dallas reported Tuesday the service sector weakened in August. Its Texas Service Sector Outlook Survey revenue index dropped to 7.8 in August from 20.9 in July.

Home prices

The Case-Shiller 20-city home price index for June was unchanged on a seasonally adjusted basis. For the year, the index rose 2.1%, down from 2.4% the month before.