Denver International Airport will price $925 million of refunding bonds to help ease its debt service burden during the pandemic-driven traffic decline.

The bonds will price in four series on Oct. 15 through negotiation with book-runner Barclays, led by managing directors James Henn and David Ardayfio and director Katherine Lee.

“The transaction is anticipated to achieve an average annual reduction in debt service of approximately $12.6 million per year from 2020 to 2025, with most of the savings to be realized in years 2020-22,” airport officials said in a roadshow presentation.

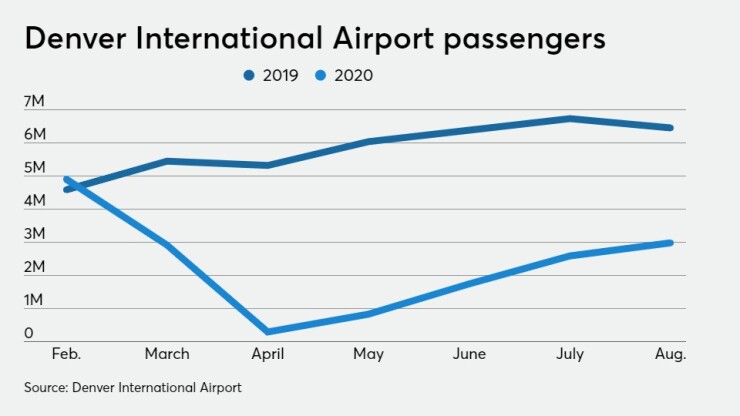

Denver joins other airports and issuers in seeking to slacken debt service over the next few years amid what is expected to be a gradual traffic recovery from the near standstill in the early days of the coronavirus pandemic.

On March 31, Fitch Ratings revised its stable outlook on DIA and other large hub airports to negative.

“The negative outlook reflects the sharp coronavirus-induced passenger declines in 2020, which resulted in increased risk in DEN's operating environment and continuing uncertainty over the likely timing and path to recovery in passenger activity,” Fitch Ratings analyst Mario Angastiniotis wrote ahead of this month's deal as the agency affirmed its AA-minus rating on DIA senior-lien debt and A-plus on subordinate lien obligations.

“A return to a stable outlook and affirmation of the ratings could be possible in the next one to two years if Fitch sees a sustained recovery in traffic and revenues return to 2019 levels once pandemic restrictions are eased.”

Moody’s Investors Service has a stable outlook on its A1 senior-lien rating and A2 subordinate-lien rating after lowering the outlook from positive on April 16. The agency rates $1.92 billion of senior debt and $3.2 billion of subordinate-lien bonds.

Even if revenues somehow fell to zero, Denver International has sufficient cash to cover 13 months of operations, Moody’s analyst Earl Heffintrayer said.

“The stable outlook reflects Moody's view that air travel will recover substantially by 2023 and that the enterprise's available liquidity and low annual debt service requirements through fiscal 2024 provide headroom during the worst of the disruptions caused by COVID-19,” Heffintrayer said.

Even before the pandemic crisis was declared on March 13, Denver International was facing a very eventful year as it celebrated its 25th anniversary.

A $3.5 billion capital program that included a $770 million remodel of the Jeppesen Terminal under a public-private partnership was disrupted when the partnership fell apart. Great Hall Partners, the consortium working on the terminal, discovered substandard concrete last year, prompting negotiations about how to proceed. When the two parties could not agree to terms, the airport halted the deal.

In March, the airport made a final $55.5 million payment to settle the $290 million in claims filed by Great Hall Partners. That was added to the $128.1 million paid in December 2019. The airport has reimbursed Great Hall Partners $183.6 million, which was in the range of $170 million to $210 million officials announced at the termination.

On March 10, three days before the pandemic emergency was declared, the airport announced that the new contractor Hensel Phelps would resume construction of the Great Hall Project that week.

After traffic fell 95% in April, the airport announced plans to accelerate its $1.5 billion gate expansion, using $560 million of existing bond funds. The bond proceeds came from a $2.1 billion issue in 2018.

The airport suspended airline payments for its gates from April through June, but all payments are due by the end of the year, according to the road show. Car rental companies were relieved of minimum annual guarantee payments from April through the end of the year and are being charged only a percentage of sales.

S&P Global Ratings also has a negative outlook on DIA’s bonds. It rates senior-lien bonds A-plus and subordinate-lien debt A.

DIA was eligible for $269 million in federal funds through the Coronavirus Aid, Relief and Economic Security Act stimulus package, which was signed into law on March 27. The CARES Act provides about $10 billion in grants for airports experiencing severe economic disruption caused by the COVID-19 health emergency. The CARES Act is the largest economic relief package in U.S. history.

Through July, enplanements have fallen about 53%, and total leverage is expected to rise above 15 times revenue in the near term and remain relatively elevated over the forecast period to 2025 under Fitch's rating case.

The upcoming deal includes series 2020A, B, C and D in senior and subordinate bonds.

The $158.5 million of 2020A series are non-AMT senior bonds, to refund the $115 million 2010A series bonds and $71 million of 2007 F1- F2 bonds to fix the interest rate. The maturity range is expected to be 2021-2027. The estimated savings will be $15 million in net present value.

About $60.7 million in 2020B senior amortizing bonds are being issued with maturities from 2021 to 2031 to refund $79 million series 2008C1 bonds.

The $401 million in series 2020C taxable senior bonds will be used to refund $360 million in series 2011A-B and 2012 A-B for estimated NPV savings of $31 million and to terminate swaps associated with 2008C1 bonds and refund $80 million of 2020 maturities for restructuring. Maturities will be 2021-2037.

About $304.7 million of series 2020D taxable subordinate debt will refund up to $80 million of 2020 maturities for restructuring purposes. Maturities are 2021-2037.

Harold Bean, managing director of Frasca and Associates, is financial advisor, working with Lupe Gutierrez, managing director of capital funding for the Denver Department of Finance, and George Karayiannakis, acting deputy chief financial officer for the airport.