New deals were rolling in, with timing benefiting issuers as the market firmed.

Strong demand will likely lead to oversubscriptions on the Pennsylvania Housing Finance Authority deal after a significant portion of the longer maturities were spoken for in Monday’s retail order period, according to John Mousseau, president and chief executive officer of Cumberland Advisors.

Orders were two times oversubscribed for the 2044 maturity, which was priced at 4% and seven times oversubscribed for the 2047 maturity, which was priced at 4.05% in the retail order period.

Mousseau predicted Tuesday’s institutional pricing would result in the 2047 maturity being bumped five basis points to 4%.

“Most deals have had very good follow through,” Mousseau said late on Monday.

“With January 1 rollover dwarfing new issuance, it’s usually a good seller’s market and this January is no different,” he added.

Others said cash flow is helping prop up the market even in low seasonal volume.

“Despite the narrative that muni net supply is routinely negative, market cash flow — maturities, calls, and coupons minus new issues — is generally positive on a monthly basis, which together with negative net supply supports prices,” Peter Block, managing director of credit strategy at Ramirez & Co. in a Jan. 14 report.

Municipal bond fund flows should reflect less volatility, ending 2018 in a net positive position with ample cash still on the sidelines and ready for deployment throughout the year, according to Jeffrey Lipton, managing director of Oppenheimer Inc. & Co. in a weekly report.

“We suspect that seasonal technicals will position the asset class well going into the early months of 2019 given the particular relevance of this year’s January Effect against a net-buyer backdrop,” Lipton wrote.

Weekly volume should grow and cash allocations to municipals should both be evident in quarter one, he noted.

“A meaningful chunk of this will likely come from the December and January redemptions and maturities as well as coupon payments that would logically give rise to strong reinvestment needs,” Lipton wrote.

At the same time, better relative value opportunities are likely to remain muted and elusive this year, he noted.

“However, as seasonal technicals ebb, cheaper opportunities could materialize in 2019,” he added. “While 2018 was a year of shifting institutional buyer preferences given a lower corporate tax rate and the accompanying diminution in the value of the tax-exemption, anticipated stability within this investor class could impede a move to higher long-end ratios or even push ratios lower, adding support to that part of the municipal curve.”

Demand will also support long term performance ahead, Lipton suggested.

“If our call for a stabilized institutional presence, notably from banks and insurance companies, proves correct in 2019, some potential performance may be unlocked, adding strength to the long end of the muni curve,” he wrote.

Citi priced the Massachusetts Department of Transportation’s $442.925 million of metropolitan highway system revenue refunding bonds on Tuesday. The bonds are rated Aa2 by Moody’s Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings.

RBC priced the Pennsylvania Housing Financing Agency’s $201.615 million of single family mortgage revenue bonds on Tuesday, featuring alternative minimum tax and non-AMT bonds. The deal is rated Aa2 by Moody’s and AA-plus by Fitch.

Citi also priced the Utah’s $129.175 million of general obligation bonds. The deal is rated triple-A by Moody’s, S&P and Fitch.

Sibert Cisneros and Shank priced Miami-Dade County, Fla.’s $230.85 million of water and sewer system revenue bonds for retail investors on Tuesday. The deal is rated Aa3 by Moody’s, AA-minus by S&P and A-plus by Fitch.

In the competitive arena, Wake County, N.C., sold a total of $268.66 million of GO refunding and GO public improvement bonds on Tuesday.

Citi won the GO refunding bonds with a true interest cost of 1.78%. Bank of America Merrill Lynch won the GO PIBs with a TIC of 2.76%. The deals carry top-tier ratings of triple-A from Moody’s, S&P and Fitch.

Tuesday’s bond sales

Secondary market

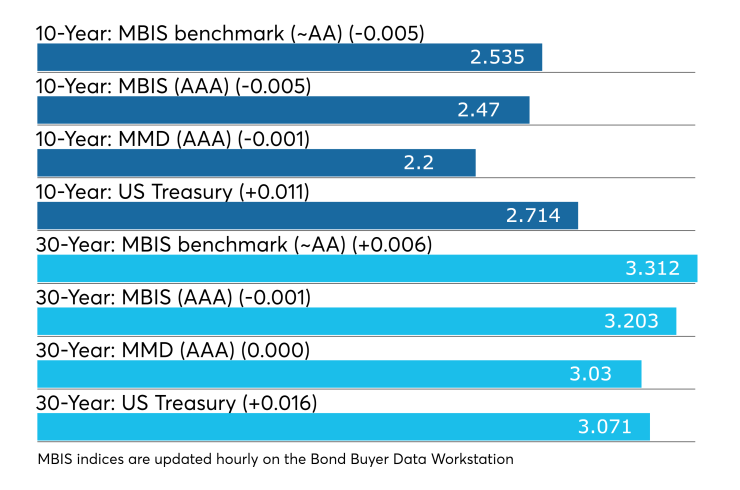

Municipal bonds were mixed Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as many as two basis points in the three- to seven-year, nine- to 13-year and 20- to 22-year maturities. The one-, two-, eight-, 14- to 18-year and 25-year to 30-year maturity saw yields rise by no more than a basis point. The remaining three maturities had flat yields.

High-grade munis were mostly stronger, with yields calculated on MBIS' AAA scale falling as much as two basis points in the three- to seven-year, nine- to 13-year and 17- to 30-year maturities. The remaining maturities saw yields go higher by less than one basis point.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation lower by as much as one basis point, while the 30-year muni maturity was unchanged.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 81.5% while the 30-year muni-to-Treasury ratio stood at 99.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 37,934 trades on Monday on volume of $7.838 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.969% of the market, the Empire State taking 11.982% and the Lone Star State taking 10.396%.

Treasury to sell $40B 4-week bills

The Treasury Department said it will sell $40 billion of four-week discount bills Thursday. There are currently $30.005 billion of four-week bills outstanding.

Treasury also said it will sell $30 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.