New York Mayor Bill de Blasio dismissed looking into the Federal Reserve’s Municipal Liquidity Facility to help the city recover financially.

“The Federal Reserve option is short-term borrowing. It needs to be paid back quickly,” de Blasio said at Wednesday’s media briefing. “It really in some ways is robbing Peter to pay Paul. It just forestalls the inevitable for a short period of time.

“What we need is long-term borrowing. And only Albany can authorize that.”

Two days earlier, de Blasio said he would delay 30-day layoff notices to 22,000 city workers while repeating his call for Gov. Andrew Cuomo and state lawmakers to approve additional borrowing of up to $5 billion to cover a budget gap triggered the COVID-19 pandemic has triggered.

Plummeting tax revenues and coronavirus-related cost increases have stuck the city with an estimated $9 billion gap through next year.

Albany so far has appeared frosty to the idea of further borrowing, although the mayor referenced increasing support for long-term borrowing over the past few days.

“Labor leaders are having intense discussions with the legislative leaders in Albany,” he said. “They understand that the layoff clock could start at any time, depending on what the situation is in Albany.”

Only the MTA and Illinois, which has the lowest bond rating among states, have tapped into the Fed’s program. New Jersey, the second-lowest rated state,

Moody's Investors Service rates New York City’s general obligation bonds Aa1. S&P Global Ratings and Fitch Ratings rate city GOs AA.

De Blasio said the city would need $2 billion just to stop this year’s layoffs and for the next fiscal year for that same group. In addition, uncertainty over further federal rescue assistance and cuts from the state, which is in its own budget crisis, present additional variables.

Andrew Rein, president of the watchdog Citizens Budget Commission, calls borrowing versus layoffs a “false choice.”

“Instead, the mayor should use the tools at his disposal, including greater efficiency, cost-cutting, and spending restraint at agencies; workforce reduction through attrition; and collaborating with labor unions on reasonable solutions,” Rein said.

The $88.2 billion fiscal 2021

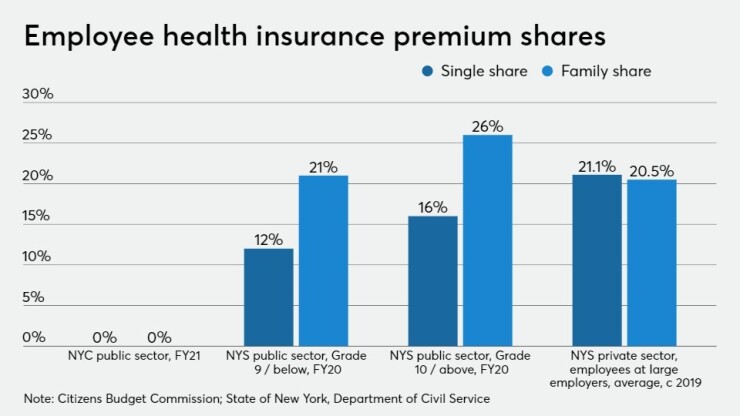

CBC cited 18 ways the city and labor unions can meet the target and avoid layoffs in a

“Savings from fully implementing these options far exceeds $1 billion,” Rein said. “Additional savings also should come from a much more assertive hiring freeze, which will allow attrition to reduce the workforce rather than layoffs.”

According to the watchdog Independent Budget Office, the last similar-size contraction of the city’s workforce occurred in the aftermath of the 2008 financial crisis, when Mayor Michael Bloomberg cut staffing by 7.5%, or 23,319 from July 2008 through December 2011.

The city workforce has since increased by 38,219, said IBO budget review analyst Robert Callahan, with nearly 90% of this growth since de Blasio took office in January 2014.

The city has $38.1 billion of GO debt, according to city Comptroller Scott Stringer’s office. The Transitional Finance Authority has $38.9 billion in future tax secured debt outstanding while the Municipal Water Finance Authority is holding $30.8 billion of debt.