New York Mayor Bill de Blasio calls borrowing to fill a worsening budget hole from COVID-19 a “last resort."

Gov. Andrew Cuomo, budget watchdogs and public finance veterans, such as Richard Ravitch, warn against such a move.

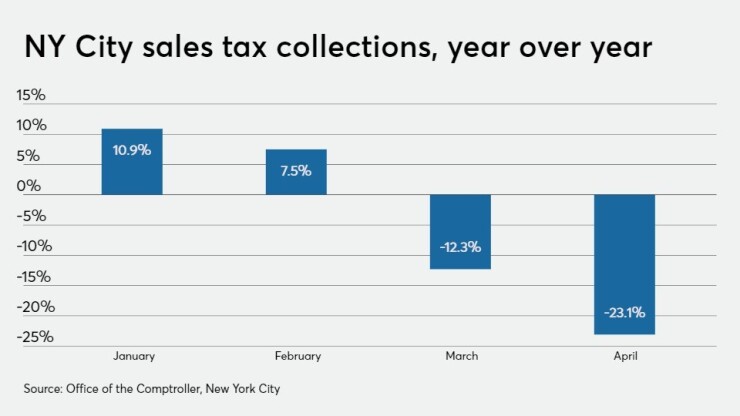

Yet, with the latest federal rescue bill stalled, de Blasio’s administration has asked the state legislature to enable additional bonding to keep the city running. The mayor, in Wednesday's press briefing, projected a $9 billion revenue loss through fiscal 2021. His administration had previously pegged the amount at $7.4 billion.

A

“This borrowing is not something we want to use or intend to use in the first instance, but we need some capacity to borrow," de Blasio told reporters. A parallel, he said is city borrowing after the Sept. 11 terrorists. In addition, said the mayor, New York State authorized $11 billion of borrowing for itself in April.

"This would be a multi-year authorization because this is a multi-year crisis," de Blasio added, noting, lack of additional aid could prompt layoffs or furloughs.

Cuomo, in his press briefing on Tuesday, dismissed borrowing for operating expenses as “fiscally questionable.”

The watchdog Citizens Budget Commission urged state leaders to reject the borrowing bill, saying the city hasn't dug deep enough.

“While the city arguably faces its biggest fiscal crisis in generations, city leaders have not yet taken sufficient action to reduce expenditures, which is necessary before borrowing for operations is considered,” CBC President Andrew Rein wrote to top lawmakers. “Borrowing at this stage in the crisis would relieve city leaders from their responsibility to make the hard choices necessary now to manage the city budget in this time.”

The 51-member City Council is considering de Blasio’s $89.3 billion executive budget, which it must approve by June 30.

According to Rein, city-funded spending will continue to rise in fiscal 2021 and the city projects adding employees between fiscal 2021 and 2024. “This does not demonstrate the assertive approach necessary to tackle the city’s serious fiscal problems, and borrowing for operating expenses should not be authorized as an ‘easy way out’ of making hard choices,” Rein said.

A massive federal appropriation is the only answer, said Ravitch, who helped guide the city out of its 1970s crisis, which mushroomed in no small part from repeated borrowing to cover its operating budget.

“Borrowing is not a solution to this problem. We cannot borrow what will amount to billions and billions of dollars,” Ravitch, a former lieutenant governor and a member of de Blasio’s eight-member Fair Recovery Task Force, said at a CBC online forum. “When we have to pay it back, it will require an enormous increase in expenditure, which is something we don’t want to saddle the city’s future with.”

De Blasio said that unlike the 1970s, the city manages itself much better. "The city of today is a strong, careful city that is smart when it comes to our finances."

Since the pandemic escalated, Moody’s Investors Service and Fitch Ratings revised their outlook on the city’s general obligation bonds to negative. Moody’s rates city GOs Aa1, while Fitch and S&P Global Ratings rate them AA.

The TFA has $38.9 billion of future tax secured debt outstanding, according to Stringer’s office. City GO debt is $38 billion.

Stringer, meanwhile, has urged the de Blasio administration to restart the capital program with a focus on projects that will enhance the state of good repair of city infrastructure.

Every $100 million in construction spending creates 484 direct construction jobs and 181 indirect jobs, Stringer said in a

“There is little justification for stopping the capital program on the basis of our current cash position,” Stringer said, noting the city’s central treasury cash balance was $5 billion as of May 18.

Stringer cited the Transitional Finance Authority’s mid-May sale of more than $1 billion in new money bonds, with yields on 20-year bonds below 3%.

“Should we be doing everything we can to match expenditures to revenues? Of course,” Stringer said. “But the budgetary costs of financing the capital program are manageable as long as the cost of capital remains below long-term trend revenue growth.”

Deferred capital maintenance, Stringer added, is more costly in the long run.