While volume for the last full trading week of 2019 is on the decline from previous weeks, the calendar still boasts an above-average $6 billion of new deals.

Primary market

The Dormitory Authority of the State of New York dominates the new issue slate with its sale of $3.2 billion of general purpose personal income tax revenue bonds. The deal consists of $1.997 billion of tax-exempt Series 2019D (Aa1/NR/AA+/NR) and Series 2019E (Aa1/NR/AA) PITs and $1.269 billion of taxable Series 2019F (Aa1/NR/AA+/NR) PITS.

Morgan Stanley is set to price the bonds on Tuesday.

Barclays Capital is expected to price two issues for the Massachusetts Institute of Technology (Aaa/AAA/NR/NR) on Tuesday.

The deals consist of $300 million of Series F taxable corporate CUSIP bonds and $137 million of Massachusetts Development Finance Series 2020P revenue bonds.

Citi foresees $440B of muni supply in 2020

Gross municipal bond volume is poised to grow by 6% to $440 billion next year, with the share of the taxable market rising to $95 billion, according to Citi.

At its 2020 Municipal Market Outlook held in Manhattan on Thursday, Vikram Rai, head of municipal strategy at Citi, said tax-exempt issuance is expected to come in at $345 billion, with $240 billion of new money issues and $105 billion of refunding deals.

The taxable share of the market is expected to be made up of $32 billion of new money and $63 billion of refundings. Gross taxable muni issuance is expected to be up 132% versus the five-year trailing average, Citi said.

Among reasons for the expected rise in gross issuance, Rai cited a full slate of taxable advance refundings of tax-exempt bonds, more tax-exempt current refundings of Build America Bonds and a moderate gain in tax-exempt new money issuance.

Lower rates are expected to spur taxable advance refunding deals, while tax-exempt supply will remain meager compared with the average of about $398 billion in 2015 to 2017.

Net issuance looks like it will be positive, but just barely. Citi expects overall net issuance to be $59 billion in 2020.

“Since next year will see both an increase in gross supply and a decrease in redemptions ($381 billion leaving the market versus $400 billion in 2019), 2020’s growth is set to be the most since 2010, when BABs flooded the universe.”

Citi expects about $77 billion in previous advance refunded bonds will be called in 2020, along with $126 billion in calls from current refundings, which include about $23 billion in callable BABs.

Separately, BofA Global Research predicts that 2020 will be another strong year for the muni market.

“Beyond an expected surge in taxable supply, we believe 2020 is shaping up to be a year much like 2019, and one with distinctions measured only by degrees,” a BofA report released on Thursday said. “We forecast 10-year AAA rates falling to 0.80% in 2020; total supply of $430 billion; and demand outstripping supply by a wide margin.”

BofA says next year’s volume will consist of $270 billion of new money bonds and $160 billion in refundings.

“We expect tax-exempt muni issuance to be $300 billion in 2020, taxable issuance of $105 billion and AMT issuance in the $25 billion range,” the report said. “By sector, the education and general purpose sectors are the two largest by our issuance targets, but we are anticipating significant growth in both the transportation and healthcare sectors. Lastly, we expect record muni green bond issuance in 2020.”

Citing Bloomberg data, BofA said about $9.5 billion of muni green bonds were issued through Dec. 2 this year, more than doubling the $4.2 billion issued in 2018 but less than the $10.7 billion issued in 2017.

“For 2020, we estimate that between 2.2% and 3.0% of total muni issuance — or between $9.5 billion and $12.9 billion — will be green bonds,” the report said. More likely than not, it will be towards the higher end of that range. Further, we expect that issuance to continue to come predominantly from California, New York, Massachusetts and Washington.”

However, BofA said it doesn’t expect to see a premium paid by investors for munis with proceeds specifically earmarked for projects and activities that promote climate and other environmental sustainability purposes.

Lipper reports muni bond fund inflows

For 49 straight weeks, investors have poured cash into municipal bond funds, according to data released by Refinitiv Lipper on Thursday.

Tax-exempt mutual funds that report weekly received $1.558 billion of inflows in the week ended Dec. 11 after inflows of $614.882 million in the previous week.

Exchange-traded muni funds reported inflows of $159.285 million after inflows of $203.703 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.399 billion after inflows of $411.179 million in the previous week.

The four-week moving average remained positive at $1.553 million, after being in the green at $1.625 billion in the previous week.

Long-term muni bond funds had inflows of $1.052 billion in the latest week after inflows of $464.451 million in the previous week. Intermediate-term funds had inflows of $296.005 million after inflows of $84.099 million in the prior week.

National funds had inflows of $1.372 billion after inflows of $504.030 billion in the previous week. High-yield muni funds reported inflows of $453.630 million in the latest week, after inflows of $171.625 million the previous week.

Secondary market

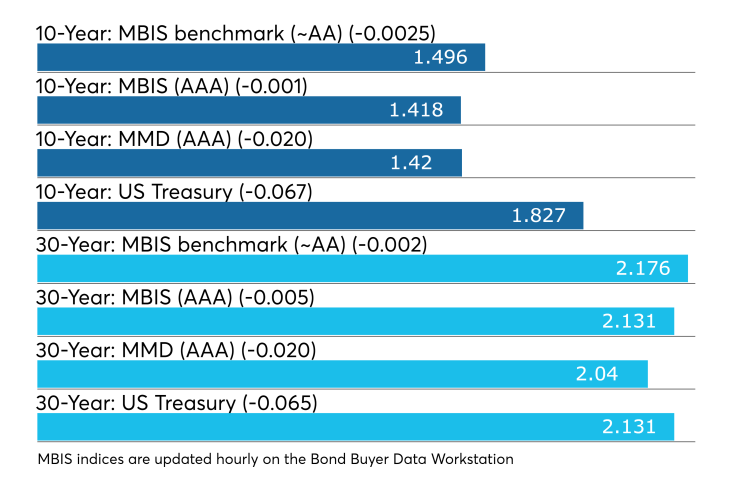

Munis were stronger on the MBIS benchmark scale, with yields falling by one basis point in the 10-year maturity and by less than a basis point in the 30-year. High-grades were mixed, with yields on MBIS AAA scale falling by two basis points in the 10-year maturity and rising by two basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO fell two basis points to 1.42% while the 30-year dropped two basis point to 2.04%.

The 10-year muni-to-Treasury ratio was calculated at 78.1% while the 30-year muni-to-Treasury ratio stood at 90.5%, according to MMD.

Stocks were trading higher as Treasuries weakened.

The Dow Jones Industrial Average was up about 0.08% as the S&P 500 Index rose 0.06% while the Nasdaq gained 0.05%.

The Treasury three-month was yielding 1.577%, the two-year was yielding 1.679%, the five-year was yielding 1.744%, the 10-year was yielding 1.902% and the 30-year was yielding 2.326%.

Previous session's activity

The MSRB reported 35,701 trades Thursday on volume of $14.32 billion. The 30-day average trade summary showed on a par amount basis of $11.77 million that customers bought $6.41 million, customers sold $3.29 million and interdealer trades totaled $2.07 million.

California, New York and Texas were most traded, with the Golden State taking 13.931% of the market, the Empire State taking 12.25% and the Lone Star State taking 9.718%.

The most actively traded security was the Metropolitan Washington Airport Authority’s Series 2019B revenue 3s of 2050, which traded 185 times on volume of $66.395 million.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Dec. 13 were from Colorado, District of Columbia and Texas issuers, according to

In the GO bond sector, the Vauxmont Metropolitan District, Colo., 3.25s of 2050 traded 27 times. In the revenue bond sector, the Metropolitan Washington Airports Authority 3s of 2050 traded 66 times. In the taxable bond sector, the Texas Private Activity Bond Surface Transportation Corp. 3.922s of 2049 traded 133 times.

Week's actively quoted issues

Puerto Rico, South Carolina and California bonds were among the most actively quoted in the week ended Dec. 13, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5s of 2058 were quoted by 25 unique dealers. On the ask side, the Columbia Waterworks and Sewer System, S.C., revenue 4s of 2044 were quoted by 154 dealers. Among two-sided quotes, the University of California taxable 3.349s of 2029 were quoted by 23 dealers.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.