Danbury, Connecticut, has launched an investor relations website, BuyDanburyBonds.com, in advance of Tuesday’s $39 million sale of bonds and notes.

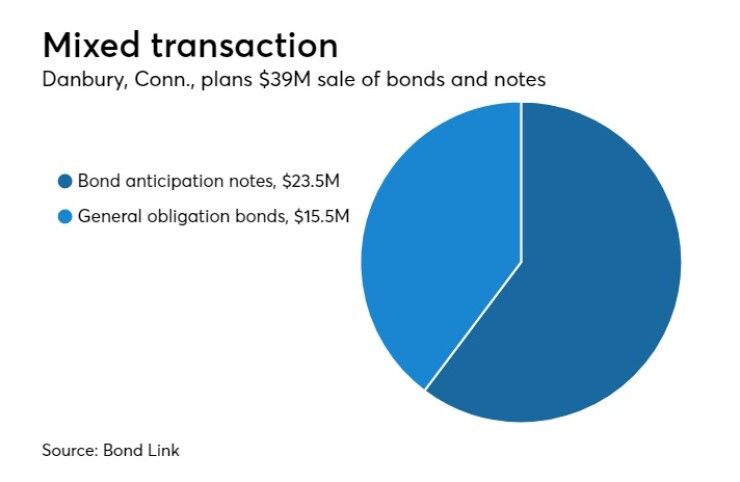

The sale will include $23.5 million in bond anticipation notes and $15.5 million of general obligation bonds, both competitive. Closing is scheduled for July 18.

Boston-based Bond Link designed the new site, which Danbury Mayor Mark Boughton said is intended to drive participation in the city’s municipal bond financing programs and add transparency for bondholders and potential investors.

Phoenix Advisors LLC is financial advisor for the sale. Robinson & Cole LLP is bond counsel.

Danbury, Connecticut’s seventh-largest city with an 85,000 population, has GO ratings of Aa1 from Moody’s Investors Service, AA-plus from S&P Global Ratings, and AAA from Fitch Ratings. All three assign stable outlooks.

“We consider Danbury’s economy strong,” S&P said in its presale report.

The city adopted a $259 million budget for fiscal 2019, with general-fund spending up $6.5 million, or roughly 2.6%. Spending focused on education, public safety, public works and health and human services.

“Investing and developing a cost-effective plan for the delivery of these municipal services has been a necessary, but arduous task,” Boughton said.

Property taxes generate roughly 74% of the city’s general-fund revenues while state aid accounts for about 21%. A 98% tax collection rate and limited dependence on state aid, according to S&P, insulates Danbury from fluctuations.

“Given the adjustments during the year and its current projections, we believe its budgetary performance will remain strong,” S&P said.

“However, we also believe it is operating in a tighter budget environment due to lack of predictability in state aid that could result in lower state revenues during our outlook period.”