The municipal bond market may be in store for a lot more issuance in the second quarter of the year, according to data released Wednesday by CUSIP Global Services.

The total CUSIP requests for all municipal securities, which include bonds, long- and short-term notes and commercial paper, rose 30.9% to 969 in March from 740 February. The rise is mostly attributed to a 37.9% increase in CUSIP requests for bonds.

“The big story this month is the strong growth we're seeing in requests for new muni identifiers," said Gerard Faulkner, the firm’s director of operations. "While March typically has a higher volume of muni issuance than January and February, this increase in demand for new muni identifiers is noteworthy following the declines we've been seeing ever since the Tax Cuts and Jobs Act was passed.”

On a year-over-year basis, however, total muni identifier requests dropped 27.6% to 2,441 from 3,373 in the same period in 2017.

Among top state issuers, CUSIPs for scheduled public finance offerings from New York, Texas, and California were the most active in March.

Secondary market

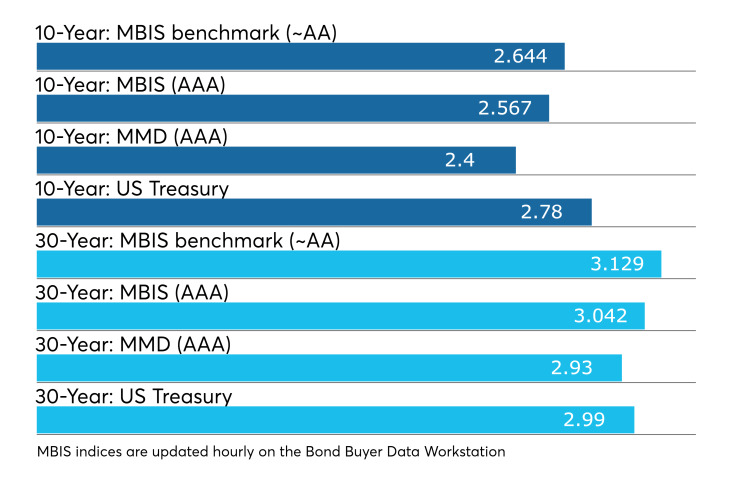

Municipal bonds were stronger on Wednesday according to a late read of the MBIS benchmark scale, which showed yields falling as much as two basis points all along the curve. Treasury bonds remained stronger as stocks continued to show weakness.

“The current market environment right now is this: accounts want to buy the new issues because the primary more accurately depicts the market over the secondary,” said one Mid-Atlantic trader. “The secondary has been more difficult with inventory overhang and nontraditional buyers who purchased the December deals all wanting to get out of bonds, but since our supply is down those with inventory don’t feel motivated to `hit the bid.' So it has been a slow go.”

Primary market

In the primary on Wednesday, the lion’s share of the week’s deals came to market, topped by offerings from New York City and Clark County.

Citigroup priced and repriced New York City’s $850 million of Fiscal 2018 Series F Subseries F-1 tax-exempt general obligation bonds and $67.7 million of Fiscal 2004 Series A Subseries A2 after holding a two-day retail order period.

“During a two-day retail order period for the tax-exempt bonds, the city received $327 million of retail orders, of which approximately $259 million was usable,” the city said. “During the institutional order period, the city received approximately $2.5 billion of priority orders, representing 3.8 times the bonds offered for sale to institutional investors.”

The city said that because of strong market demand for the bonds, yields were reduced for 16 different maturities.

“Yields were reduced by 2 basis points for the 2024 maturity, 2-5 basis points for maturities in 2028 through 2030, 6 basis points for the 2031 maturity with a 5.00% coupon, 4-6 basis points for maturities in 2033 through 2036, 2-3 basis points for maturities in 2037 through 2040 and 1-3 basis points for maturities in 2043, 2045 and 2046. Final stated yields ranged from 1.75% in 2020 to 3.69% in 2045 for a 3.625% coupon bond, 3.22% in 2045 for a 5.00% coupon bond and 3.71% in 2046 for a 3.50% coupon bond,” the city said.

NYC also competitively sold $250 million of taxable bonds. JPMorgan Securities won the $138.68 million of Fiscal 2018 Series F Subseries F-2 taxable) GOs with a true interest cost of 3.3058%. JPMorgan also won the $111.32 million of Fiscal 2018 Series F Subseries F-3 taxable GOs with a TIC of 3.6142%.

The city said the first subseries attracted seven bidders while the second subseries also saw seven bidders vie for the taxables.

The deals are rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

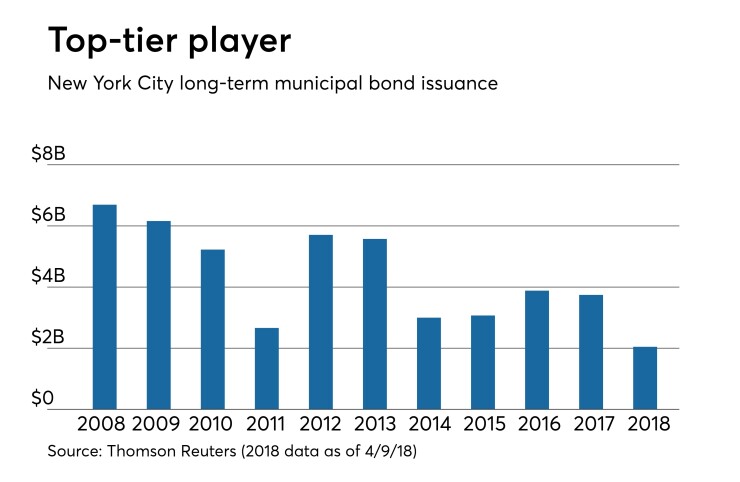

Since 2008, the Big Apple has sold about $47.8 billion of securities, with the most issuance occurring in 2008 when it sold $6.69 billion and the least (excluding this year) in 2011 when it sold $2.66 billion.

RBC Capital Markets priced and repriced Clark County, Nevada's $645.15 million of Series 2018A limited tax GO stadium improvement bonds additionally secured with pledged revenues. The deal is rated Aa2 by Moody’s and AA by S&P and Fitch.

RBC also priced the Texas Water Development Board’s $289.52 million of new series 2018 state revolving fund revenue bonds. The deal is rated AAA by S&P and Fitch.

Siebert Cisneros Shank & Co. priced and repriced the Fort Worth Independent School District's $163.68 million of Series 2018 unlimited tax school building bonds. The deal is backed by the Permanent School Fund guarantee program and rated triple-A by Moody's and S&P.

Wells Fargo Securities priced and repriced the Connecticut Health and Educational Facilities Authority’s $86.46 million of Series K-1 revenue bonds and $10.35 million of taxable Series K-2 revenue bonds for the University of New Haven. The deal is rated BBB by S&P.

Wednesday’s bond offerings

New York:

Nevada:

Texas:

Connecticut:

Previous session's activity

The Municipal Securities Rulemaking Board reported 43,735 trades on Tuesday on volume of $11.46 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 16.132% of the market, the Lone Star State taking 11.701% and the Empire State taking 11.098%.

Treasury auctions re-opened 10-year notes

The Treasury Department auctioned $21 billion of 9-year 10-month notes with a 2 3/4% coupon at a 2.795% high yield, a price of 99.611154. The bid-to-cover ratio was 2.46.

Tenders at the high yield were allotted 70.96%. All competitive tenders at lower yields were accepted in full. The median yield was 2.740%. The low yield was 2.188%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.