Want unlimited access to top ideas and insights?

The municipal market was essentially in free fall on Wednesday under mounting, severe selling pressure as COVID-19 fears and fallout continue to deepen.

The world is a different place than it was a mere two weeks ago. The stock market sold off enough on Wednesday to again trigger automatic circuit breakers and shut down trading.

The airlines are asking for bailouts, the auto industry is temporarily closing down, and the federal government is likely to provide over $500 billion of direct payments to American taxpayers as it shut borders between Canada and directed two military ship hospitals to the East and West Coasts.

The

Specifically in the municipal market, all benchmarks were rising at a faster clip than most participants could digest, but perhaps at not high enough levels. Benchmarks showed again that the short end was being hit hardest — 30 basis points up on the one-year and at least 10 up on the long end, but the entire curve was being cut drastically. The primary market was again at a standstill.

“The market is getting pounded. AAA cuts don’t properly show the weakness,” a Chicago trader said. “There is an obvious mounting of sell orders confronting a morose dealer community, and most bids are probably so ridiculous that they can’t be hit.”

As has been the story of late, “liquidity for all these orders does exist but at levels that are, frankly, unimaginable.”

The Municipal Securities Rulemaking Board

customer sales of $10 million or more. The MSRB data can put that figure in perspective: from Jan. 2-March 6, on average there were 24 customer sales per day of that same size. Typically block trades are $1 million-plus.

It is clear that the short end of the curve is bearing the brunt of the current cheapening in munis and the reasons are twofold.

“One rationale is that we are a retail-oriented market and investors want to raise and keep cash. The other rationale is that as bad as the coronavirus is the real crisis should continue to unfold in the near term,” Bond Buyer Contributing Editor John Hallacy said. “This scenario is difficult to contemplate now when we are in the eye of the storm. The long end is not being affected as much in part due to the fact that muni professionals dominate that part of the curve.”

Hallacy added that munis are not in lock step with the Treasury market but still remain somewhat of a safe harbor.

“Increased volatility and liquidity concerns in the financial markets due to the coronavirus has led many investors to sell off their municipal bonds to increase exposure or rebalance to equities,” said Dan Scholl, head of municipals at Wilmington Trust. “However, this is opening up unprecedented opportunities for other savvy investors to move in.”

He said that as municipal bonds yields have risen (more than 1.0% in the last few days) and Treasury yields have decreased relative to munis, the value of high-quality municipals is at record levels.

“Investors can gain access to munis secured by Treasuries at 300% to 500% of the corresponding Treasury yield,” he said.

Jeffrey Lipton, managing director and head of muni research and strategy at Oppenheimer, said that sentiment quickly and substantially shifted for Munis as the asset class underperformed the sell-off in the U.S. Treasury bond market.

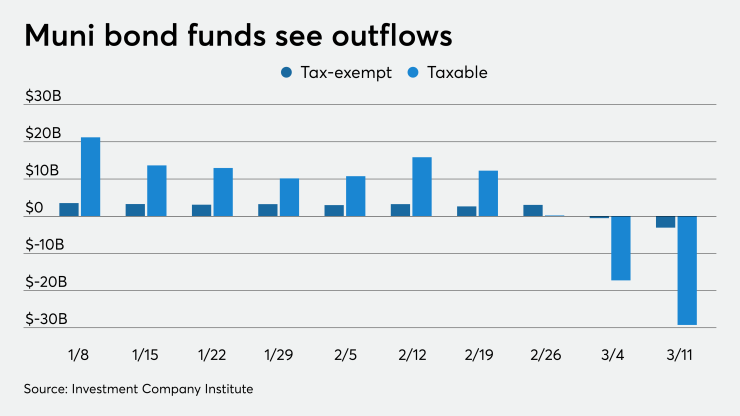

“Fund Flows reported a second week of outflows, reflective of the growing uncertainty surrounding muni credit and liquidity. Further volatility is likely as price discovery becomes more elusive,” he said. “We posit that the huge back up in rates over a very short time period and the potential for further rate volatility can provide reasonable investment opportunities for the discerning muni bond buyer. We have also indicated that any sustained disruption in fund flows would only add to the stockpile of sidelined cash.”

What can only be described as unprecedented, the municipal market might not be equipped to handle these disruptions.

“The bottom line is that the severity of the coronavirus pressures, plus the energy shocks, are creating risks and uncertainties for state and local credits that the rating agencies are going to be forced to respond to in a very rapid fashion, and that the muni market is unlikely to be able to handle without a period of painful illiquidity,” said veteran municipal strategist George Friedlander. “Potentially extending that illiquidity is the risk of more outflows from tax-exempt mutual funds after a huge outflow of $3.072 billion in the week ended 3/11. And, of course, any demand from the now-low-tax-rate banks will shrivel as their profitability collapses.”

Meanwhile, the drumbeat was increasing to encourage the Fed to buy munis as part of its $700 billion UST and mortgage-backed securities purchase announcement, with many saying that it was imperative to help state and local governments. Julia Coronado, president and CEO of Macropolicy Perspectives, said on CNBC Wednesday that municipals should be included in the Fed’s purchasing program.

Secondary market

“Short muni rates continue to skyrocket. One year yields are up around 30 basis points,” ICE Data Services said in a market comment Wednesday. “Elsewhere on the curve, rates are up anywhere from 10 basis points in the long end to 20 basis points in shorter maturities. Secondary market volumes remain steady as new-issue market stays on hold.”

Municipal percent of Treasury yields are at historical levels, ICE said, especially in light of the rapidity of the change.

“High yield spread continue to widen dramatically. Puerto Rico bonds are lower: Commonwealth 8% due 2035 are 4 ¼ points lower to $62 ¾ while the PREPA bonds are 2 7/8 points lower across the board,” ICE said

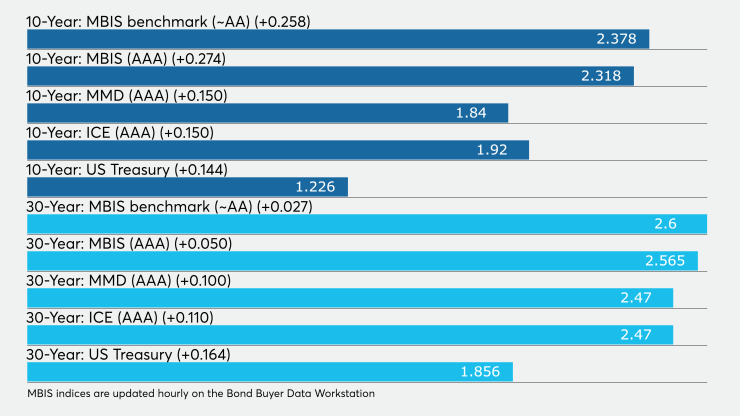

Munis were weaker on Wednesday on the MBIS benchmark scale, with yields rising 25 basis points in the 10-year and by two basis points in the 30-year maturity. High-grades were also weaker, with yields on MBIS' AAA scale increasing by 27 basis points in the 10-year maturity and by five basis points in the 30-year maturity.

Munis were weaker on Refinitiv Municipal Market Data’s AAA benchmark scale, as the yield on the 10-year muni GO was 15 basis points higher to 1.84%, while the 30 year GO increased 10 basis points to 2.47%.

BVAL saw the one-year cut by 13 basis points as of publication, 12 basis points cut in 10-year and 30-years.

The 10-year muni-to-Treasury ratio was calculated at 148.4% while the 30-year muni-to-Treasury ratio stood at 131.4%, according to MMD.

Stocks were way down on Wednesday, as all three major averages were in the red by at least 8%.

The Dow Jones Industrial Average was down about 8%, the S&P 500 index was lower by 7% and the Nasdaq lost roughly 6.08% late in the session on Tuesday.

Treasury yields were lower on the front end and higher on the medium to long end.

"There is no doubt that investors are now in full panic mode,” Francis Scotland, director of global macro research at Brandywine Global. “With the Dow Jones dropping from a 52-week high to a 52-week low in just ten days, it’s the fastest reversal ever recorded. The unprecedented volatility reflects the unprecedented nature of the virus.”

He added that what is clear is that the global economy’s stabilization last year has been snuffed out.

“With the global economy lurching into recession, the key issue is now how long it remains there. This is intrinsically tied to the spread of the virus and the efforts to contain the economic fallout. We can gain insight from how things have played out in China, where the economic downside has been severe.”

The three-month Treasury was yielding 0.018%, the Treasury two-year was yielding 0.512%, the five-year was yielding 0.807%, the 10-year was yielding 1.226% and the 30-year was yielding 1.856%.

ICI reports outflows again

Long-term municipal bond funds and exchange-traded funds saw a combined outflow of $3.072 billion in the week ended March 11, the Investment Company Institute reported on Wednesday.

It was second week in a row of inflows after 60 straight week of inflows into the tax-exempt mutual funds reported by ICI. The previous week, ended March 4, saw $518 million of outflows into the funds.

Long-term muni funds alone had an outflow of $3.026 billion after an outflow of $430 million in the previous week; ETF muni funds alone saw an outflow of $46 million after an outflow of $87 million in the prior week.

Taxable bond funds saw combined outflows of $29.228 billion in the latest reporting week after revised outflows of $17.244 billion in the previous week.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $19.720 billion after outflows of $44.122 billion in the prior week.

The biggest laggard of the week were bond funds, which saw an outflow of $32.300 billion this past week, after an outflow of $17.244 billion the week before.

Aaron Weitzman and Chip Barnett contributed to this report.