With COVID-19 wreaking havoc on state and local government revenues, one of the ripple effects is how investors view credit and how to evaluate it, which may help the municipal bond insurance industry grow.

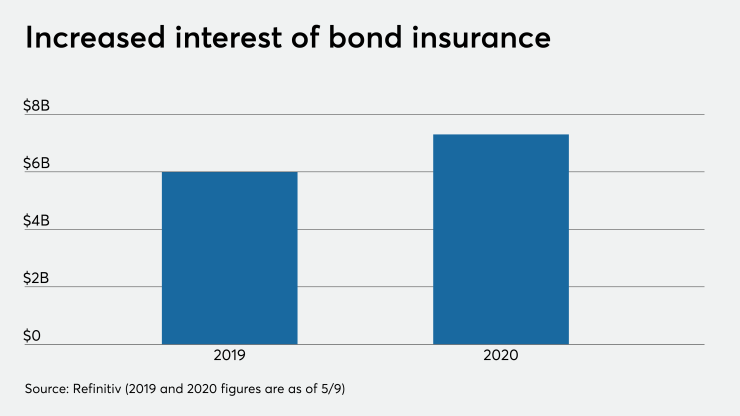

So far this year, the bond insurance industry is on a better pace than it was last year. As of May 9, both Assured Guaranty and Build America Mutual have accounted for $7.30 billion in 563 deals, up from the $5.99 billion spanning 490 transactions as of May 9, 2019.

"It’s clear in this current environment that investors are more focused on liquidity, credit and rating quality," said Bill Hogan, senior managing director, public finance at Assured.

Hogan cited the for example, the $400 million for the Dormitory Authority of the State of New York deal, rated Aa3/AA- by Moody’s and Fitch, respectively, along with another $150 million of additional primary market par they insured this week.

"We have also seen significantly stronger demand for our secondary market insurance," he said, adding that in the past six weeks, AGO has booked $309 million of secondary market par compared to $47 million for the same period during 2019.

"We believe that the market disruption that COVID-19 has caused has driven home to both investors and issuers the value of our guaranty and that this value should continue to be reflected in future quarter results in both primary and secondary markets," Hogan said.

U.S. municipalities reacted to their experience of the 2008 financial crisis by generally improving their operating and liquidity positions, which Hogan believes has even better prepared them to ride out this pause in economic activity.

"COVID-19 appeared after the longest recorded economic expansion, during which municipal governments’ tax receipts grew significantly, allowing them to improve their balance sheets and rainy-day funds," he said. "Having looked carefully at our individual insured transactions in the sectors we think most likely to be affected by the pandemic’s economic impact, we do not currently expect permanent unrecoverable losses, or liquidity claims this year that we cannot easily manage."

Assured has $4.26 billion of new issue par as of May 14.

Year-to-date in the primary, BAM has accumulated $3.84 billion of business and $1.0 billion in the secondary so far this year.

“BAM was built to apply the lessons from the Great Recession: Our insured portfolio consists solely of bonds for issuers who provide essential public services, and as a mutual insurer, we’ve focused on consistently building our financial strength and providing enhanced transparency," said Sean McCarthy, CEO of Build America Mutual. "That’s resonating with investors in this volatile market and we’re seeing increased activity, including a notable increase in insurance for bonds with underlying ratings in the double-A category."

The week of May 4, BAM insured more than $200 million in the primary market, and more than 7% of all new-issues in the market were sold with insurance, which is well above the rate seen in January and February. Through May 8, BAM's primary market business is up 53%, and secondary market business is up 63%.

"We’re also seeing strong demand in the secondary market, where investors are applying insurance to their existing holdings as part of their overall portfolio management and diversification strategies," McCarthy said. "We think those trends are going to continue at least through the end of this year. Even as the economy starts to reopen, municipal issuer cash flows tend to lag in an economic recovery, so there’s likely to be more volatility ahead and insurance can help investors manage that.”

Howard Cure, director of municipal bond research at Evercore Wealth Management said that he thinks bond insurance will grow, although how much depends on a few factors.

"The most important concerns the rating agencies and the monolines maintaining their ratings," Cure said. "I think the insurers have a relatively secure insured book and should not suffer significant losses and should be able to maintain their ratings, even with the potential for increased loses from Puerto Rico (pertaining mostly to Assured Guaranty)."

He added that he also thinks the market has increasingly come to realize the value of insurance in a credit-weakened market and investors see the value in the liquidity provided by having insured paper.

"Lastly, spreads for weaker investment-grade paper would need to remain wider than higher-grade paper," he said. "Up until the Coronavirus, there was real compression in the spreads. In other words, it was good to be a weak-credit issuer since there was not much of a spread penalty for this part of the market. By having and maintaining wider spreads, insurers can take a larger portion through their premiums charged and still be economically viable for the issuer and the market."

According to Matthew Gastall, investment strategist and Daryl Helsing, associate at Morgan Stanley Wealth Management, they said they would exercise caution and suggest that those participants looking to invest be highly selective, focusing on the high credit-quality positions they have now recommended for some time.

“Currently, we would maintain a heightened focus on four high-quality, 'bread and butter' areas that we often describe as the consumer staples of public finance,” they wrote in a recent report. “The aforementioned consist of pre-refunded and escrowed-to maturity bonds, high-quality essential-service revenue structures (water, sewer, public power), AA or higher-rated state GOs, and securities insured by either Assured Guaranty or Build America Mutual.”

Gastall and Helsing have written for many years that investors should consider securities supported by bond insurance, but remain primarily comfortable with the underlying ratings of those bonds that carry the assurance.

However, moving forward, they believe insurance provided by Assured and BAM offers investors considerable value in the current environment.

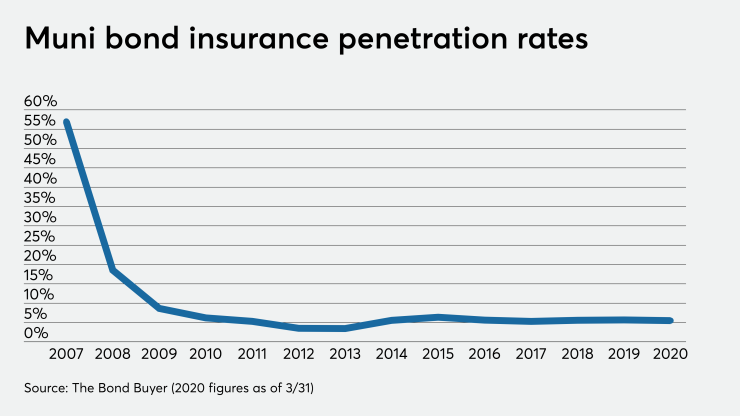

“The visceral impacts of the COVID-19 pandemic have been both sudden and concerning; the development likely reinforces that, whether it be investing or nearly any facet of life, we must always expect the unexpected,” they said. “Consequently, we believe bond insurance penetration of the primary market may now increase following the impacts of the pandemic, particularly if credit spreads widen, thereby rendering the insurance beneficial for investors, issuers, and the providers themselves. There are four important points that we would like to stress to support this advocacy.”

David Veno, director of North America insurance ratings at S&P Global Ratings agreed, saying that the bond insurance sector benefits from strong economic fundamentals through high wealth and economic diversification, while bond insurers' underwriting activities continue to be heavily weighted toward municipal issuers with strong records of favorable performance during economic downturns.

“Additionally, our view reflects stable long-term profitability, high barriers to entry, and strong regulatory oversight and frameworks,” he said. “While the COVID-19 pandemic is causing significant volatility in the U.S. financial markets and presents fiscal challenges ahead for all U.S. public finance sectors, we view the potential impact to U.S. bond insurers as somewhat low at this time.”

Veno added that there is very strong capitalization for the industry, which has benefited from conservative capital management practices in the past.

“Additionally, in the current macroeconomic environment, demand for the financial guarantee product appears to be growing in the U.S. public finance market,” Veno said.

Gastall and Helsing added that both only active insurers hold quality credit ratings that both support and exhibit the abilities of their current fiscal positions to pay claims and that their business models may stand to benefit from the pandemic’s recent and sudden developments.

“Also, the companies seek to closely evaluate the debt they insure, which infers that another perspective on an issuer’s political, legal, and fiscal abilities to pay debt service has been completed in the past,” said Gastall and Helsing. “Finally, and to use a terminology that would hopefully make any statistician proud, investors have a binomial probability of being supported by the abilities of both the issuer and the insurance provider to make the timely payment of principal and interest when due.”

They added that importantly, they still advocate that investors remain comfortable with the underlying ratings of bonds that are insured, and further diversify their exposure between multiple different issuers.

“Overall, when considering that the two aforementioned entities currently hold quality fiscal profiles, have the potential to grow, and provide a surety for credits that have likely been very closely evaluated, we would be remiss if we didn’t mention that such dynamics offer additional value to investors in the current environment,” Gastall and Helsing said.

Veno also commented that generally, insured U.S. municipal bonds have covenants that require issuers to take steps to ensure funds are adequate to meet debt service requirements, which may include a debt service reserve fund with up to a year's worth of debt service coverage.

“Once the new-issue market is reestablished, bond insurers may see an overall increase in business activity, given investors' focus appears to be on credit risk as a result of current macroeconomic conditions,” Veno said.