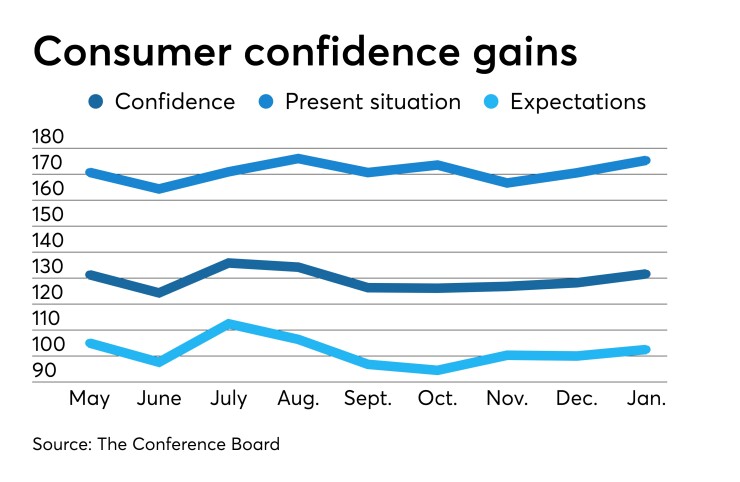

Consumers remain confident, as the consumer confidence index rose to 131.6 in January from an upwardly revised 128.2 in December, the Conference Board reported Tuesday.

Consumers have been fueling economic growth, and the rise in confidence suggests this pattern will continue.

“This index has remained in an elevated range (120-138) since mid-2017 that is higher than all values observed in the prior expansion, which we view as impressive,” said Berenberg Capital Markets U.S. Economist Roiana Reid. Contributing to the high levels, she said, are gains in real wages, low unemployment, high levels of jobs created, and greater work flexibility.

The December index was first reported as 126.5. Economists polled by IFR Markets expected a 128.0 read.

The present situation index gained to 175.3 from 170.5, while the expectations index grew to 102.5 from 100.0.

“Consumer confidence increased in January, following a moderate advance in December, driven primarily by a more positive assessment of the current job market and increased optimism about future job prospects,” according to Lynn Franco, senior director of economic indicators, at the Conference Board. “Optimism about the labor market should continue to support confidence in the short-term and, as a result, consumers will continue driving growth and prevent the economy from slowing in early 2020.”

The percent of respondents who consider business conditions good climbed to 40.8% from 39.0% last month, while those terming conditions “bad” fell to 10.4% from 11.0%. Those expecting conditions to improve in the next six months rose to 18.8% from 18.7% while those seeing things deteriorate fell to 8.4% from 8.8%.

On the business side, durable goods orders rose 2.4% in December after a 3.1% decline the month before, the Commerce Department said Tuesday, with orders excluding transportation down 0.1% after a 0.4% drop the month before. Economists expected a 0.5% gain in the headline number and a 0.2% rise excluding transportation.

But orders for non-defense capital goods excluding aircraft, which is seen as an indication of business spending plans, dropped 0.9% in the month, after rising 0.1% the month before. Economists expected a flat read.

“Core durable goods orders, which exclude aircraft and defense orders and more closely track overall business plans, fell 0.9% in December,” said Grant Thornton Chief Economist Diane Swonk in a note. “The biggest sources of weakness were computers and related equipment, machinery and motor vehicles. A bounce in vehicle orders following the GM strike was short-lived.”

And while a Phase One trade agreement with China was signed this month, it will take “more than a truce to lift the burdens [manufacturers] are shouldering.”

Richmond Fed

Manufacturing in the district posted a strong gain in January, as the composite index soared to positive 20 from negative 5 in December, the Federal Reserve Bank of Richmond’s manufacturing survey showed.

All three components of the index — shipments, new orders and employment — gained in the month, the Bank said. The rise in the index was the largest since February 2013.

The district’s service sector “grew moderately,” the Bank reported separately, as the revenues index fell to 10 in January from 17 in December.

In another Fed services survey released Tuesday, “The Texas service sector continued to expand at a steady pace in January, as revenue growth was robust and employment growth ticked up,” said Christopher Slijk, Federal Reserve Bank of Dallas associate economist. “Firms reported business conditions and outlooks as favorable overall, although retailers noted curtailed optimism and increased uncertainty compared to December.”

Home prices

Home prices rose, according to the S&P CoreLogic Case-Shiller index, with the 20-city composite up 2.6% year-over year in November, after a 2.2% increase the month before. The monthly 20-city composite index was up 0.5%.