Connecticut replaced Moody’s Investors Service with Kroll Bond Rating Agency for its planned $800 million sale of special tax obligation bonds, scheduled for Tuesday and Wednesday.

State officials, looking to package the bonds separately from Connecticut's general obligation credit, were looking for higher rating than its general obligation bonds, according to Deputy Treasurer Lawrence Wilson. The state has received several general obligation downgrades over the past two years.

Kroll assigned its AA-plus rating with a stable outlook to the special credit. It rates the GOs AA-minus with a stable outlook.

“Connecticut requested a rating from Kroll for this STO bond sale and did not request a rating from Moody’s,” said Wilson. “Kroll’s rating of the STO bonds is based on its review of the bonds’ own merits, separate from the credit factors of the state’s general obligation bond program.”

S&P Global Ratings and Fitch Ratings continue to rate the special tax obligation credit, assigning ratings of AA and A-plus, respectively, both with stable outlooks.

S&P rates the credit higher than Connecticut GOs, to which it assigns an A-plus rating and negative outlook; Fitch rates Connecticut GOs A-plus and stable.

Proceeds will fund transportation projects. Goldman Sachs is lead manager.

Moody’s has been rating Connecticut’s special obligation bonds in line with its GO credit and did, in fact, downgrade the special obligation security concurrent with its downgrade for the GO debt in May, to A1 with a stable outlook.

"KBRA may rate a special tax secured obligation higher than the underlying GO rating, based on our assessment of authorizing statutes and legal provisions,” Kroll public finance managing director Kate Hackett said in an interview.

Imposing an automatic ceiling for non-GO securities “makes no sense to us,” senior managing director Karen Daly told investors on a conference call Thursday.

Connecticut’s move reflects a practice of rating-agency shopping that varies by security, said Thomas Schuette, co-head of investment research and strategy at Gurtin Municipal Bond Management.

”The savvy obligors and financial advisors have often taken non-GO securities to S&P, Fitch, and more recently, Kroll,” said Schuette.

“So when places like Connecticut come to market with a non-GO security that they know has security features that the market will like and that other rating agencies will look favorably upon, they will often avoid Moody’s.”

Moody’s declined to comment.

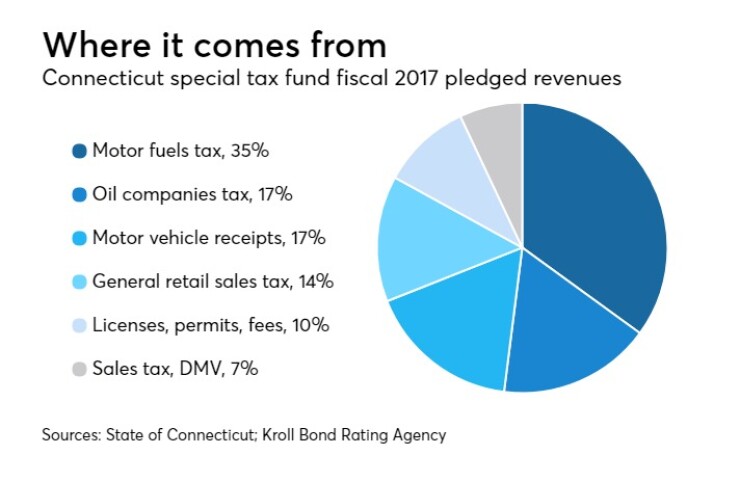

Kroll based its rating on legal framework; the nature of special tax revenues; economic base and demographics; revenue analysis; and coverage and bond structure.

“The STO bonds have unique credit-positive features, and we believe Kroll’s rating methodology highlights these strengths to potential investors,” said Wilson.

According to Kroll, fiscal 2017 pledged revenues will provide maximum annual debt service of 2.4 times after this issuance. Annual debt service coverage, said Kroll, will be at least 2.3 times through 2022, based on projected pledged revenues and planned future issuance.

While Kroll recognizes the passive nature of the pledged revenues and the potential for volatility in certain pledged revenue sources, the state’s coverage covenant to maintain 2 times debt service coverage from pledged revenues in every fiscal year mitigates those risks.

Gov. Dannel Malloy has called on state lawmakers to replenish the special transportation fund. Two weeks ago he held up $4.3 billion of projects pending a new revenue stream. A report from the state's Department of Transportation and Office of Management and Budget last month projected the fund's balance to run a $13 million deficit by fiscal 2020 and plummet into a $388 million hole two years later.

According to Hackett, both senior- and second-lien bonds are payable before the usage of any funds for transportation, so the STF’s predicament does not affect debt payment.

"The bonds are payable from a separate lien on pledged revenues,” she said. “The collection of the revenues is not exposed to the general fund operations of the state."

Wall Street has hammered Connecticut with several downgrades over the past two years over budgetary imbalance and debt, including unfunded pension liability. Most recently, S&P on Oct. 13 lowered its outlook on state GOs to negative.

Connecticut was four months late with its fiscal 2018 budget. After considerable political bickering among lawmakers, and with the Senate split 18-18 between Democrats and Republicans, Democrat Malloy signed a $41.3 billion biennial spending plan on Oct. 31.

Malloy, a two-term governor, will not seek re-election.

State lawmakers in special session last June enacted several adjustments to the special transportation fund, the most extensive of which is the five-year phase-in, beginning in fiscal 2021, of new motor vehicle sales taxes deposited to the STF. The General Assembly also set a referendum for November asking voters to establish a lockbox for STF monies.

“This whole issue has been very much in front of the public for the past several years,” Hackett told investors. “It’s very high profile.”

Connecticut and Kroll go back to the rating agency’s entry into the municipal bond market in 2012. Kroll assigned its first rating to the state’s GOs.

Founder Jules Kroll’s namesake investigations firm once pursued hidden assets linked to dictators Saddam Hussein and Jean-Claude Duvalier. He said the muni industry needed a shake-up.

In a Bond Buyer

“"I think the basis of our coverage of Connecticut is that we really tell their story and that's what we continue to do,” said Hackett.