Action got underway in the primary market as the competitive arena took center stage Tuesday, led by sales from Washington, Florida and Nevada issuers.

Primary market

The Shoreline School District No. 412, Wash., sold $206.81 million of unlimited tax general obligation bonds under the Washington state school district credit enhancement program. Proceeds will be used to pay costs of certain capital improvements.

Morgan Stanley won the bonds with a true interest cost of 3.4555%.

The financial advisor is PFM Financial Advisors; the bond counsel is Foster Pepper. The deal is rated AA-plus by S&P Global Ratings.

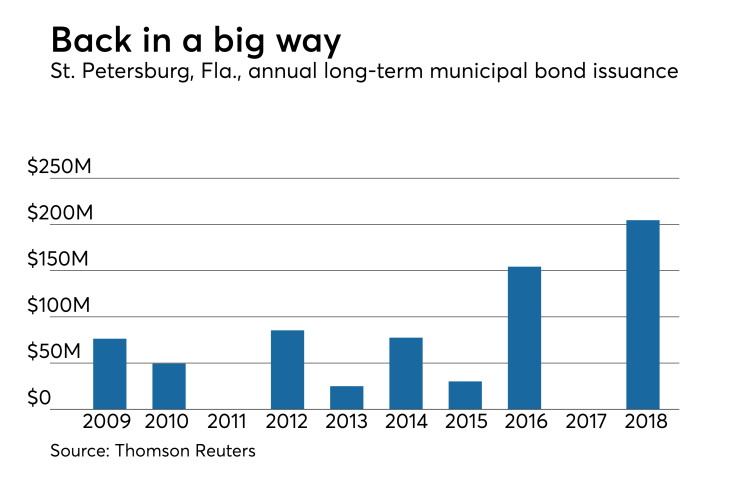

Saint Petersburg, Fla., sold $204.605 million of Series 2018 public utility refunding revenue bonds. The proceeds will be used to refund all of the city's outstanding Series 2017 public utility subordinate lien bond anticipation notes.

Bank of America Merrill Lynch won the bonds with a TIC of 3.711%.

The financial advisor is PFM Financial Advisors; the bond counsel is Bryant Miller. The deal is rated Aa2 by Moody’s Investors Service and AA by Fitch Ratings.

Since 2009, the city has sold roughly $703 million of securities – with the biggest year of issuance excluding Tuesday’s sale, taking place in 2016 when it sold $154.3 million. It did not come to market in 2011 or 2017.

Pompano Beach sold $102.42 million of Series 2018 GOs. Proceeds along with other city money will be used to finance certain capital projects.

Citigroup won the bonds with a TIC of 3.6475%.

The financial advisor is PFM Financial Advisors; the bond counsel is Greenspoon Marder. The deal is rated Aa2 by Moody’s and AA by S&P.

North Las Vegas sold $99 million of Series 2018 limited tax GO building refunding bonds additionally secured by pledged revenues. Proceeds will be used to refund some of the city’s outstanding debt.

BAML won the bonds with a TIC of 3.8092%.

The financial advisor is Zions Public Finance; the bond counsel is Stradling Yocca. The deal is insured by Assured Guaranty Municipal and rated A2 by Moody’s and AA by S&P.

The Fort Mill School District No. 4 of York County, S.C., had been slated to sell $100 million of Series 2018B GOs on Tuesday, but postponed the sale until Thursday, Sept. 13.

Proceeds will be used to defraying the costs of capital improvements to facilities of the School District. The financial advisor is Compass Municipal Advisors; the bond counsel is Haynsworth Sinkler. The deal is rated Aa1 by Moody’s and AA by S&P.

Tuesday’s bond sales

Florida

Nevada

Bond Buyer 30-day visible supply at $11.24B

The Bond Buyer's 30-day visible supply calendar increased $340.4 million to $11.24 billion for Tuesday. The total is comprised of $3.48 billion of competitive sales and $7.76 billion of negotiated deals.

Secondary market

Municipal bonds were weaker on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose less than one basis point in the one- to 30-year maturities.

High-grade munis were mostly weaker, with yields calculated on MBIS' AAA scale rising less than one basis point in the four- to seven-year, 10- to 14-year and 18-27-year maturities, falling less than a basis point in the one- to three-year and 29- and 30-year maturities and remaining unchanged in the eight- and nine-year, 15- to 17-year and 28-year maturities.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity rising as much as two basis points.

Treasury bonds were weaker as stock prices traded higher.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.8% while the 30-year muni-to-Treasury ratio stood at 100.5%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 33,239 trades on Monday on volume of $7.68 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 16.083% of the market, the Lone Star State taking 11.338% and the Empire State taking 9.979%.

Treasury sells $45B 4-week bills

The Treasury Department Tuesday auctioned $45 billion of four-week bills at a 1.975% high yield, a price of 99.846389.

Tenders at the high rate were allotted 15.90%. The median rate was 1.950%. The low rate was 1.910%

The coupon equivalent was 2.006%. The bid-to-cover ratio was 2.97. The bills have an issue date of Sept. 13 and are due Oct. 11.

Tenders totaled $133,542,659,100 and the Treasury accepted $45,000,074,600, including $980,517,100 non-competitive. The Fed banks bought nothing for their own account.

Treasury auctions $26B 1-year bills

The Treasury Department Tuesday auctioned $26 billion of one-year bills at a 2.465% high yield, a price of 97.507611.

Tenders at the high rate were allotted 27.07%. The median rate was 2.450%. The low rate was 2.420%. The coupon equivalent was 2.547%. The bid-to-cover ratio was 3.76.

The bills have an issue date of Sept. 13 and are due Sept. 12, 2019.

Tenders totaled $97,749,733,300 and the Treasury accepted $26,000,254,400, including $596,208,300 non-competitive. The Fed banks bought nothing for their own account.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.