Incoming data continued to show massive hits from the efforts to stem the spread of COVID-19, with jobless claims doubling and the New York manufacturing sector hitting all-time lows in activity.

“As the developments on the virus worsen, the mitigation efforts will be subject to becoming more aggressive and the markets will be subject to more aches and pains,” said Marty Mitchell of the Mitchell Market Report. And with President Trump suggesting air travel could be “curtailed” in hot spots of the country, it “will not only hurt the airline industry further, it will likely damage the psyche of the American citizen and the sentiment in the markets.”

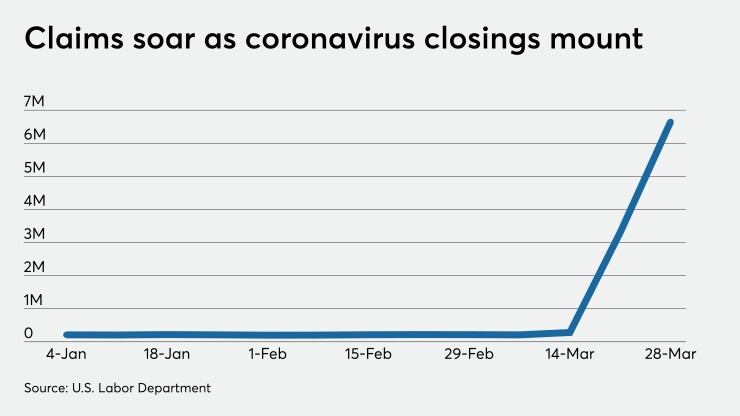

Initial jobless claims surged again in the week ended March 28, as expected, hitting an all-time high of a seasonally adjusted 6.648 million, the Labor Department said Thursday.

Economists polled by IFR Markets expected 3 million claims in the week.

The read for the previous week was revised up to 3.307 million from the initially reported 3.283 million.

For perspective, the February employment report showed 5.8 million people out of work.

California (878,727), Pennsylvania (405,880), New York (366,403) and Michigan (311,086) had the most claims.

The number of continuing claims jumped to 3.029 million in the week ended March 21 from 1.784 million a week earlier.

The Department said almost every state included a comment citing the coronavirus, with service industries hardest hit, especially accommodation and food services.

“Many states continued to cite the health care and social assistance, and manufacturing industries, while an increasing number of states identified the retail and wholesale trade and construction industries,” according to the report.

Calling this report “the best indicator as to what is happening in the labor market,” Edward Moya, senior market analyst, New York at OANDA, said, “The economy is in bad shape and doubts are growing that the recent fiscal rescue package to help businesses might not be enough to keep people on their payroll. It is unfortunate how bad these numbers are getting, and no one will be surprised if we see a few more terrible readings over the next few weeks. America needs the economy to reopen, but not at the cost of lives."

In other data released Thursday, the Commerce Department said the international trade balance narrowed to $39.9 billion in February from $45.5 billion in January.

Economists expected a $40.0 billion deficit.

Exports slid $800 million to $207.5 billion in the month, while imports fell $6.3 billion to $247.5 billion.

The trade deficit with China narrowed $4 billion to $19.7 billion in the month, as exports slipped to $7.5 billion while imports fell to $27.2 billion.

Separately, the Institute for Supply Management-New York’s Report on Business showed the lowest ever current business conditions index reading in March — 12.9, a whopping 39.0 points lower than a month earlier. The six-month outlook index dropped to 37.9 from 53.8, not the worst in history. In November 2008, the index fell to 31.0, and it was 33.0 in February 2009. “The six month outlook has been a reliable short run guide for current business conditions over time,” ISM-NY said in the release.

The employment index fell to 36.7 from 49.3. Current revenues fell to 28.6 from 58.3 and expected revenues dropped to 38.9 from 50.0, both the lowest numbers going back to February 2012, when they were first reported.