CHICAGO – Chicago is the latest Illinois city to find itself facing the diversion of state funds to make up for pension contribution shortfalls.

The Chicago firefighters’ pension fund has joined the list of retirement systems triggering a state law that allows for the diversion of state-related funds to make up for the shortfalls. Chicago denies it owes any money to the fund and will contest the claims.

The Firemen’s Annuity and Benefit Fund of Chicago filed two claims for $3.3 million. They accuse the city of a $1.8 million shortage, plus interest, in its $199 million 2016 contribution owed under state statutes and a $1.5 million, plus interest, shortage in its $208 million 2017 contribution as of Sept. 1, according to the letter submitted to Comptroller Susana Mendoza’s office.

In Chicago's case, the comptroller can only intercept the city's grants from the state government; state-collected funds such as sales taxes are off limits.

“The board of trustees has a fiduciary duty to ensure that all monies due and owing to the fund are contributed to the fund consistent with the requirements of the Illinois Pension Code. On behalf of participants and beneficiaries, the board of trustees will continue to take all necessary steps to fulfill that duty,” firefighters fund board president Daniel Fortuna wrote in an emailed statement.

The fund sent several correspondences to the city and has attended meetings and conference calls with city representatives seeking the delinquent amounts, according to the claim submitted to the comptroller by attorney Sarah Boeckman, of Burke Burns & Pinelli Ltd., the fund’s fiduciary counsel.

“The city continues to allege that it fulfilled its statutory obligation…not withstanding the fact that the city has failed to pay the fund required statutory contributions for payments years 2016 and 2017,” the letter dated Sept. 4 continued.

Mayor Rahm Emanuel’s administration contends it hasn’t shortchanged the funds.

“The city has complied with its statutory contribution requirements and does not owe the Firemen’s Annuity and Benefit Fund the additional amount demanded. All amounts collected from the levy are remitted to the fund, as are the amounts deposited with the city treasurer. In accordance with past practice, the city also remitted to the Fund all 2016 and 2017 collections from prior year levies,” reads a statement.

Sources said the police fund may also soon act to cover what it considers are delinquencies. The fund’s director was not available until Tuesday. The muni and laborers’ new statutory contributions that ramp up to 2023 have only kicked in this year. The law is vague on priority status of claims and that issue was not resolved in the court during the recent Harvey intercept case because the parties settled the case.

Since receiving the claims, the comptroller’s office has set aside $1.3 million in grant payments.

The ball is now in the city’s court. It can allow the diversions to continue until the claim is paid in full or it can contest them within 60 days.

“We have put the funds on hold but we don’t forward them” until the contest period and review process are completed, said comptroller spokesman Abdon Pallasch.

If the city does not contest the withholding, the comptroller’s would eventually send the diverted grant funds to the fund until the claims are paid off. If the city contests the claim, the comptroller’s office would launch a review to determine its eligibility to claim city grant funds.

The pension fund is taking advantage of the new collection process created in statewide public safety funding reforms. It allows for the diversion of various state collected taxes dubbed “state funds” to make up for pension shortfalls. Harvey’s public safety systems were the first to act on the collection process earlier this year.

Chicago is not subject to the diversion of “state funds” but it is subject to the withholding of “state grants” under its own reform legislation that amended the state pension code.

“Should the recapture provisions of the pension code be invoked as a result of the city’s failure to contribute all or a portion of its required contribution, a reduction in state grant money may have a significant adverse impact on the city’s finances,” the city wrote in its 2018 annual financial analysis.

The city’s police and fire pension overhaul legislation also allows the funds to go to court to “bring a mandamus action in the Circuit Court of Cook County to compel the city to make the required payment, irrespective of other remedies that may be available to the fund,” the state law says.

Under that law, Chicago’s 2016 to 2020 contributions are set amounts under a payment ramp leading up to an actuarially based contribution in 2021.

The ramp ends with the 2020 contribution of $245 million jumping to $355 million the following year. The spike in public safety contributions that year and two years later for the municipal and laborers’ funds -- under legislation that became law last year for the latter two -- will result in a $1 billion increase by 2023 in the roughly $1 billion now paid toward pensions.

How to cover the ARC costs when they hit is the subject of heated debate and a driving factor behind the city’s exploration of a $10 billion pension bond issue.

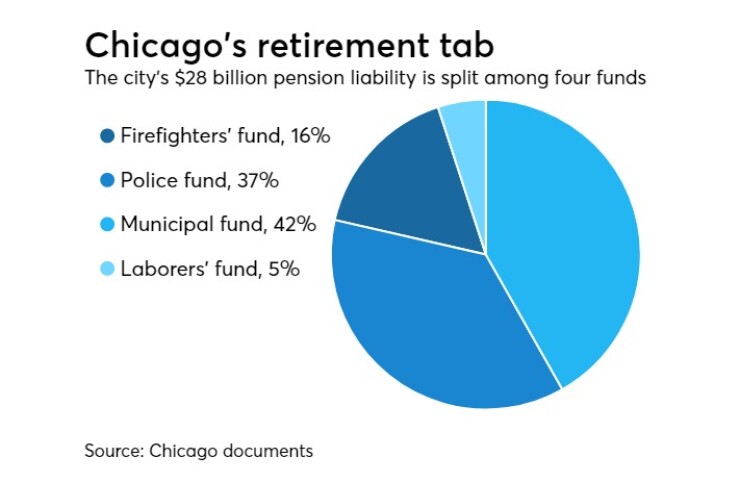

The firefighters' fund, which serves 9,600 members, accounts for $4.6 billion of the city’s 2017 $28 billion net pension liability, up from $4.1 billion in 2016. The fund is the weakest of the city’s four at a 20.1% funded ratio.

The city’s four funds are collectively funded at 26.5% and the legislative overhaul pushed through by the city is designed to put the funds on a path to a 90% goal by 2055 for public safety and 2058 for muni and laborers.

Earlier this year, the distressed Chicago suburb of Harvey was the first Illinois city hit by a pension-intercept claim. It drew widespread attention in part because of Harvey’s move to cut deeply into its police and firefighter ranks over the loss of funds.

The city challenged the claims in court and revenue bondholders also intervened as they feared the loss of state collected funds pledged to bond repayment. The comptroller’s office upheld the claims but the city and its funds agreed to a settlement that allowed the city to keep 65% of its “state funds.”

The North Chicago’s firefighters fund also filed a claim, which was settled. The Illinois Municipal Retirement Fund, which covers non-safety employees outside Chicago and Cook County, has filed claims against the Harvey Library District, the Ford Heights Public Library, the city of Centreville, and Centreville Township.

Municipal bond market participants watched the Harvey case because the new intercept raises short- and long-term questions. Rating agencies have warned a flood of other pension funds could follow the Harvey funds’ lead and there are several hundred Illinois police and firefighters’ systems that have been shorted by their government sponsors. The intercept also has sparked worries that bondholders’ legal claims will fall behind pensioners as distressed governments try to preserve funding for critical services.

Burke Burns & Pinelli, which also does business with the city and its sister agencies as bond counsel and underwriters’ counsel, has been fiduciary counsel to the firefighters' fund for more than 20 years.