Fitch Ratings returned Chicago’s outlook to stable after an infusion of $1.9 billion in federal COVID-19 pandemic aid and recovering tax collections eased strains that threatened the city’s investment grade status.

The rating agency moved the outlook from negative across Chicago's ratings including general obligation bonds that are rate BBB-minus and the Sales Tax Securitization Corp. rating of AA-minus. The city is refinancing bonds under both credits this year along with a tender offer. The city will take the savings up front to balance the 2021 budget.

“The outlook revision to stable reflects the ongoing revenue recovery across the city and the significant infusion of federal fiscal aid that ease pressure on the city's investment grade standing,” Fitch said. “Chicago still faces considerable financial challenges and the size of recent years' budget gaps illustrate its sensitivity to economic setbacks.”

The city’s high and growing long-term liability burden and constrained expenditure framework given a heavily unionized workforce and high cost of debt and pension funding hold the GO rating to the lowest investment grade.

The action comes ahead of the City Council’s vote Wednesday on Mayor Lori Lightfoot’s $

“The city of Chicago is on the road to recovery, and this year's budget will allow us to build a stronger and more prosperous city,” Lightfoot said in a statement on the Fitch action.

Fitch lowered its Chicago outlook to negative in October 2020 as the city contended with a pandemic-driven gaps of $798 million in its 2020 budget and $1.2 billion in fiscal 2021 against a corporate fund budget of roughly $4 billion.

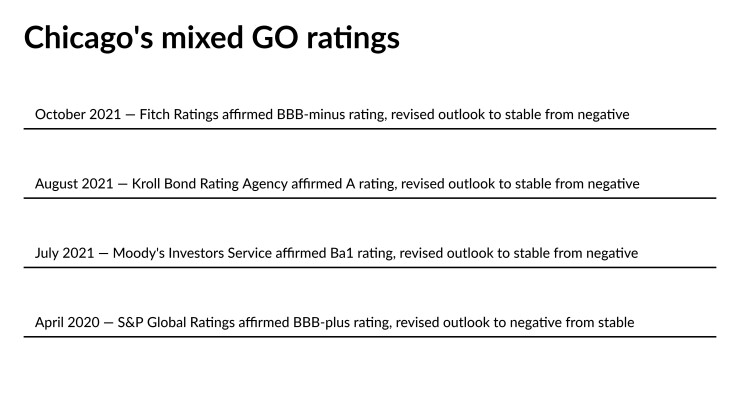

Kroll Bond Rating Agency, Moody’s Investors Service and S&P Global Ratings also moved the city’s outlook to negative last year.

Moody’s, which rates the city at the junk level of Ba1,

S&P has retained the negative outlook on its BBB-plus rating.

The Fitch report provides fresh commentary to back up the city finance team’s arguments against some council members who have pressed to delay repayment of a $450 million credit line or to tap reserves to avoid a consumer price index-driven $23 million hike in the property tax levy.

“The city's commitment to maintaining a sound reserve position is an important credit factor given the precarious nature of its budget and high revenue volatility,” Fitch said.

The city closed out 2020 with unrestricted general fund reserves totaling $328 million or 8.2% of total spending. The city also holds reserves of $724.5 million from past asset leases bringing the total cushion to $1.05 billion or 26.3% of spending.

While the city can’t directly use its share of the $1.9 billion of federal American Relief Plan Act relief to pay down the credit line, that money frees up other revenue the city can use to do so. The city took out the line last December to delay a scoop-and-toss debt restructuring proposed to help balance the 2020 budget, and another $500 million for the 2021 budget, with plans to cancel the maneuver if new federal aid came through.

While the city has so far navigated the pandemic’s wounds, Fitch warned “structural risks persist,” particularly its $33 billion of pension liabilities, and “meaningful cost-cutting actions will likely become more difficult to achieve over time, emphasizing the importance of Chicago's revenue recovery.”

Chicago’s $33 billion net pension liability weighs heavily on future stability. Contributions will rise by $461 million to $2.3 billion in 2022 as all four of the city's pension plans hit an actuarially-based contribution requirement. Future increases are more modest at $50 million or less in the coming years but weak funded ratios now ranging from 18 % to 44% persist for several decades.

The stronger AA-minus STSC rating reflects its bankruptcy remote, statutorily defined structure that involves what Fitch considers a “true sale of the pledged sales tax revenues.”