With a reputation for innovation, charter schools in Texas and the Southwest are adapting quickly to classroom closures as emergency aid rolls in. But funding issues may prove more challenging in coming years, experts say.

“The big question is what is going to happen to school funding in future fiscal years,” said Drew Masterson, whose firm Masterson Advisers works with some of the largest charter school operators in Texas on bond financing. “There have been some assurances that next year won’t suffer a decline as it is the second year of the (state budget) biennium. Beyond that, we will almost certainly see declines.”

Charter schools were included in a sweeping outlook change to negative for all public finance sectors in an S&P Global Ratings report April 1.

“Compared to traditional public schools, most charter schools have limited revenue diversity and less financial flexibility,” analysts said. “In our opinion, schools at the lower end of the rating scale remain more vulnerable to revenue, debt service coverage, and covenant pressure than our higher-rated schools, which tend to have some fundraising capabilities and greater liquidity. Schools with limited liquidity and financial flexibility face greater risk.”

In a later report, S&P revised outlooks for 12 charter schools nationwide to stable from pre-pandemic positive.

“The previous upward momentum will likely be stunted by the challenges facing charter schools due to the COVID-19 pandemic and the recession,” analysts wrote.

Of the 12 schools with stable outlooks, five have the lowest investment-grade ratings of BBB-minus, and the others are speculative grade.

“Many states are facing a structural gap in fiscal 2020, although we believe the risk of state funding cuts and delays is greater for charter schools in fiscal 2021,” analysts said. “Specifically, cuts to state funding, or per-pupil funding could have a significant impact on liquidity and debt service coverage for certain charter schools.”

In an April 13 meeting of charter school directors, Angie Stallings, deputy superintendent of policy for the Utah State Board of Education, said that budget cuts for schools in the state could reach $30 million.

Confirmed deaths from COVID-19 in the United States are approaching 50,000.

The response to the pandemic has closed most physical public school locations nationwide, charter and traditional, triggering an abrupt shift to distance learning.

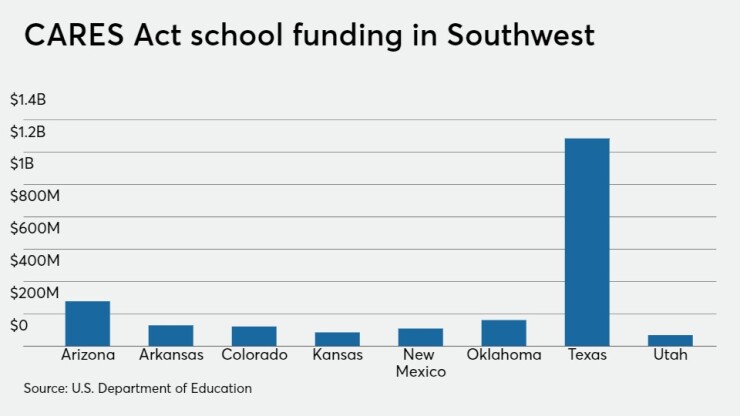

The recently passed federal Coronavirus Aid, Relief, and Economic Security (CARES) Act appropriates $150 billion across all state and local governments to offset costs related to the COVID-19 pandemic and alleviate liquidity pressures.

The Elementary And Secondary School Emergency Relief Fund and the Governor's Emergency Education Relief Fund combined will provide about $16 billion to K-12 education, including charter schools.

As traditional schools and charters have shifted to online instruction, state funding has continued as requirements for state testing and other regulations have been lifted.

The emergency federal COVID-19 relief financing is free to all qualifying charter schools with 150 or more students. Charter schools facing immediate cash needs have been able to access funds within as few as five days of completing the application process, according to the U.S. Department of Education. Federal law allows the funds to be used as charter school leaders deem appropriate.

About 80% of charter school funding in Texas comes from the state government, Masterson said. The balance is federal funding, charitable donations and student fees.

“The main message in Texas is that COVID-19 did not interrupt state funding,” Masterson told The Bond Buyer. “It may or may not interrupt federal funding related to providing meals but, if so, there is typically an offsetting cost reduction. Charitable donations are being affected but schools are getting creative to create online events and appeals. Additionally many schools did raise significant philanthropy to help with providing technology to low-income students.”

Of the $2.88 billion of Texas charter school debt outstanding as of Nov. 30, 2018, about $1.7 billion was backed by the Texas Permanent School Fund Bond Guarantee Program, according to the Texas Bond Review Board.

The Texas Legislature authorized the PSF backing for charter schools in 2013 under House Bill 885. The Texas Education Agency issued the first charter school bond guarantees in March 2014.

International Leadership of Texas, a Masterson client, accounted for the largest charter school transaction ever to come to market in 2018 with a $357.1 million deal managed by BB&T. The unrated deal did not qualify for PSF backing. IL Texas is a 33 school charter network with more than 18,000 students.

ILTexas bought $1.2 million in technology and provided every student a free Chromebook and equal access to virtual classrooms led by the same classroom teachers.

In Colorado, the American Academy Project charter school received an investment grade rating of Baa3 with a stable outlook from Moody’s Investors Service even after the pandemic closures.

“We do not see any material immediate credit risks for American Academy,” analyst Helen Cregger wrote. “However, the situation surrounding coronavirus is rapidly evolving and the longer term impact will depend on both the severity and duration of the crisis.”

American Academy’s $43 million refunding this month through the Colorado Educational and Cultural Facilities Authority is expected to save $600,000 in interest costs.

“The Charter School has not received any information from the District or State as to any reduction in per pupil revenue for the current school year or the 2020-21 school year, but anticipates there may be a reduction for fiscal year 2020-21, if the pandemic negatively impacts the economy,” according to the preliminary official statement.

In an April 16 report S&P worsened its outlook for the U.S. economy as a result of the global pandemic that has closed schools nationwide.

“S&P Global Economics now projects that U.S. GDP will contract by 5.3% in 2020,” the report said. “Although we expect the economy will begin to recover in the second half of 2020, we anticipate that the recovery will be gradual and will be constrained by some form of continued social distancing as fears persist over the continued spread of COVID-19. Given this rapid and severe economic shock, we believe upward rating movement is unlikely over the intermediate term.”