New York City Mayor Bill de Blasio’s $92.2 billion preliminary Fiscal 2020 budget won praise for his effort to rein in spending before an expected economic slump, though some observers said he didn't go far enough.

In a first for his Administration, de Blasio’s budget includes a "program to eliminate the gap," or PEG, a move the mayor said he took in response to uncertain economic conditions ahead and current funding cuts and policy changes from the state and federal government. The mayor is also expanding a partial hiring freeze and will require $750 million more in savings from city agencies by April.

The preliminary budget released on Thursday at City Hall is up almost 2% from the November financial plan and 3% higher than the final Fiscal 2019 budget approved last year. Since de Blasio took office in 2014, spending has risen around 23%.

The largest component of the $3 billion increase from last year's budget is $1.5 billion for labor costs. Other items include $632 million for education, $358 million for debt service and $358 million for fringe benefits.

The budget contains $1.25 billion of reserves in each year of the financial plan, broken down into $1 billion in the general reserve and $250 million in the capital stabilization reserve. The Retiree Health benefits Trust Fund will see $4.5 billion of reserves under the budget.

“Given the recent slide in personal income tax revenue and other signs of economic uncertainty, the mayor’s proposed budget is appropriately cautious, with few new spending initiatives,” said Doug Turetsky, the New York City Independent Budget Office’s Chief of Staff. “But the city’s budget continues to grow and debt service is one key factor, rising from about $6.7 billion this year to nearly $9 billion by 2023. And this increase doesn’t reflect the additional capital spending that would be needed to build four proposed new jails or meet the major repair needs of the city’s subways and public housing.”

Office of Management and Budget Director Melanie Hartzog said that the debt service levels remained manageable.

“On debt service – I just want to point out, I think this is very important, that our debt service payments do not exceed 15% of our city tax revenue. This is the benchmark for responsible capital financing,” Hartzog said.

While giving the plan praise for its cautious tone and partial hiring freeze, the Citizens Budget Commission said more work needed to be done in the budget to ensure the city remains on a sound financial footing during the economic downturn that many predict will hit in 2020.

“Greater recurring savings from making government more efficient are needed to bolster reserves and make certain that the city can provide critical services to New Yorkers in both good times and bad,” the budget watchdog said. “Much bolder action is needed to ensure the city is prepared for an economic downturn. Spending growth should be limited to inflation and reserves should be increased. The PEG announced today should be developed with an eye to making operations more efficient and generating recurring savings.”

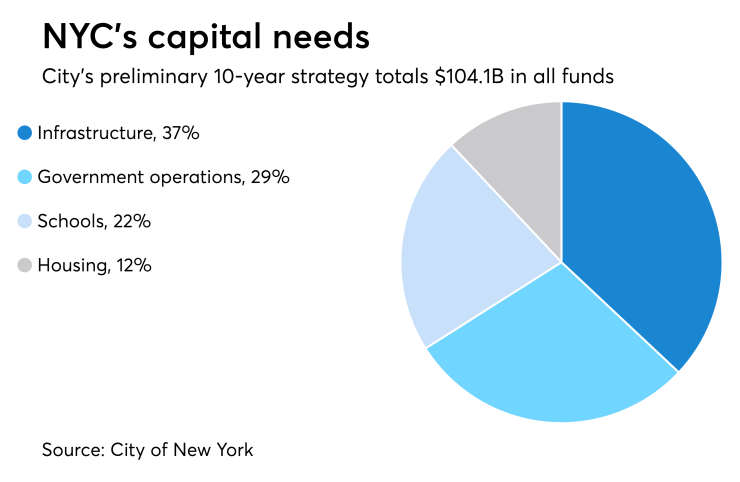

The city also released a preliminary 10-year $104.1 billion capital plan for Fiscal 2020 to 2029. The capital strategy plan aims to building affordable housing, repair roads and bridges, make streets safer for pedestrians and cyclists, maintain clean water, expand school capacity and prevent damage from climate change and severe weather.

“Our largest capital investment is in infrastructure,” Hartzog said.

According to the capital strategy, 37% will go to infrastructure, 29% to government operations, 22% to schools and 12% to housing.

The CBC said it will examine the details of the capital plan to assess whether the proposed projects are justified by improved service or return on investment.

The City Council said that while it shares the mayor’s sense of caution it wants to ensure that its fiscal and social goals are being met.

“It is critical the city adopts a secure and balanced budget that is fair for all New Yorkers and their families. The Fiscal Year 2020 Preliminary Budget marks the beginning of the budget negotiation process, our second with the de Blasio Administration,” the Council said in a joint statement released by Speaker and Acting Public Advocate Corey Johnson, Finance Chair Daniel Dromm and Capital Budget Chair Vanessa Gibson.

“But even while recognizing the challenges, we also know this city’s economy is strong and we will fight for a fiscally responsible plan that protects the social safety net,” the statement said. “The Council will detail our priorities, ways to save money and ensure that critical past investments are not diminished.”

The release of the preliminary budget marks the first step in in the overall budget process. The 51-member City Council will now hold a round of budget hearings.

At the end of April, the mayor will release his executive budget, a revised plans that takes into account some of the Council’s recommendations. The council will hold a second round of hearings after which it and the mayor will negotiate adjustments.

The Council by law must vote on a budget by July 1. The last three budgets were all approved well ahead of schedule.

City Comptroller Scott Stringer also warned of tough times ahead.

“While New York’s economy remains strong for now, there are many warning signs – from the state’s $2.3 billion budget gap, to the recent volatility in the markets, rising jobless claims and a looming trade war,” Stringer said. “I’m happy to see that the mayor plans to implement what I’ve been calling for now for several years, which is a real agency PEG program. It’s past time for city agencies to seriously evaluate how effective their spending really is in achieving results for New Yorkers.”

Stringer added that his office is now reviewing the preliminary budget and will release a comprehensive analysis in the coming weeks.

Moody’s Investors Service rates the city’s general obligation bonds Aa2, while S&P Global Ratings and Fitch Ratings rate them AA. All three assign stable outlooks.

Since July 1, 2018, the city has issued $1.2 billion in general obligation bonds for capital purposes and $831 million in GO refunding bonds.

The city has about $38 billion of general obligation debt as of Dec. 31, according to Stringer's office.

Looking ahead, the city's financing program projects $53.9 billion of long-term borrowing in fiscal 2019 through 2023 to support current capital programs. This excludes $737 million of building aid revenue bonds that will be sold for educational needs.