Municipal bond buyers feasted Tuesday on a big serving of California bonds that were offered up to retail investors.

Morgan Stanley priced California’s $2.19 billion of general obligation various purpose and refunding bonds for retail investors ahead of the institutional pricing on Wednesday.

The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

Bank of America Merrill Lynch is set to price the Oklahoma Development Finance Authority’s $1.2 billion of health system revenue and taxable bonds for the Oklahoma University Medicine Project.

The deal is rated Baa3 by Moody’s and BB-plus by S&P, but portions of the deal are expected to be insured by Assured Guaranty Municipal Corp., and will be rated AA by S&P.

Since 2008, the Oklahoma DFA has issued $3.68 billion of securities, with the most before this year occurring in 2015 when it sold $464 million and the least in 2013 when it sold $80.1 million.

Wells Fargo Securities priced the Clear Creek Independent School District, Texas’ $155.22 million of Series 2018 unlimited tax school building bonds.

The deal, backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s and Fitch.

BOK Financial Securities priced the Lake Travis Independent School District, Texas’s $108.74 million of Series 2018A unlimited tax school building bonds. The deal is backed by PSF and rated AAA by S&P and Fitch.

In the competitive arena, Washington state sold $604.36 million of GOs in two sales.

Morgan Stanley won the $491.95 million of various purpose GOs with a true interest cost of 3.6018%.

Morgan Stanley also won the $112.41 million of motor vehicle fuel tax GOs with a TIC of 3.6092%.

Both deals are rated Aa1 by Moody’s, AA-plus by S&P and Fitch.

Ohio sold $300 million of higher education GOs. JPMorgan Securities won the bonds with a TIC of 3.4512%. The deal is rated Aa1 by Moody's and AA-plus by S&P and Fitch.

Citigroup won Hamilton County, Tenn.’s $170.95 million of GOs with a TIC of 2.6584%. The deal is rated triple-A by Moody’s, S&P and Fitch.

Links to Tuesday’s bond sales

California bonds:

Hamilton County, Tenn., bonds:

Clear Creek Independent School District, Texas, bonds:

Ohio bonds:

Lake Travis ISD, Texas, bonds:

Bond Buyer 30-day visible supply at $11.47B

The Bond Buyer's 30-day visible supply calendar increased $532.2 million to $11.47 billion on Tuesday. The total is comprised of $4.92 billion of competitive sales and $6.55 billion of negotiated deals.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,088 trades on Monday on volume of $9.08 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 14.804% of the market, the Empire State taking 13.251% and the Lone Star State taking 9.97%.

Treasury sells $65B 4-week bills

The Treasury Department Tuesday auctioned $65 billion of four-week bills at a 1.550% high yield, a price of 99.879444. The coupon equivalent was 1.573%. The bid-to-cover ratio was 3.01.

Tenders at the high rate were allotted 35.02%. The median rate was 1.520%. The low rate was 1.490%.

Gary Siegel contributed to this report.

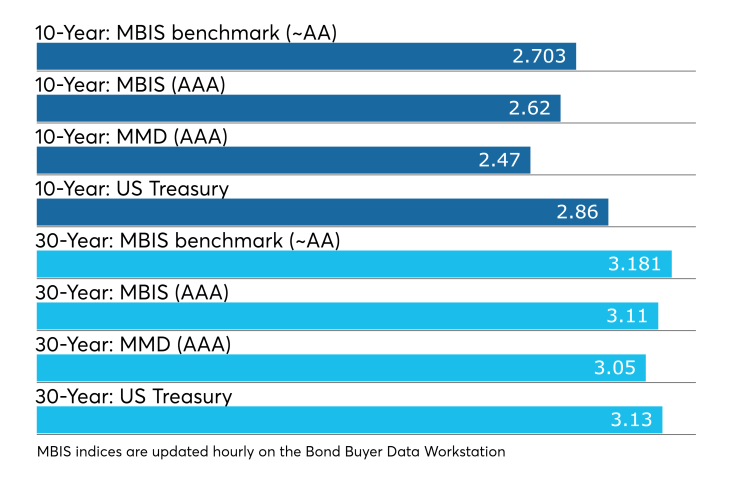

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.