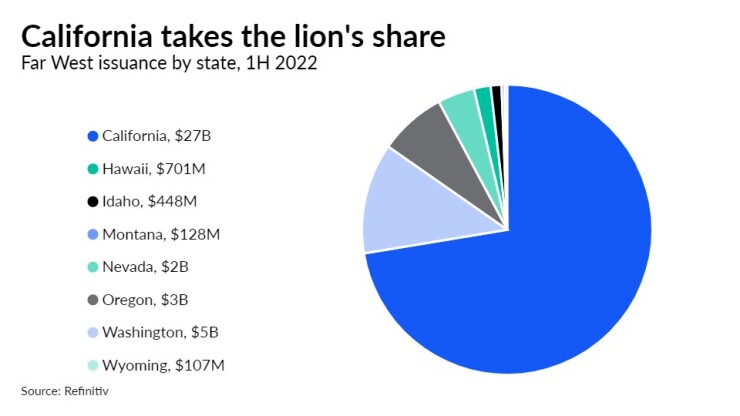

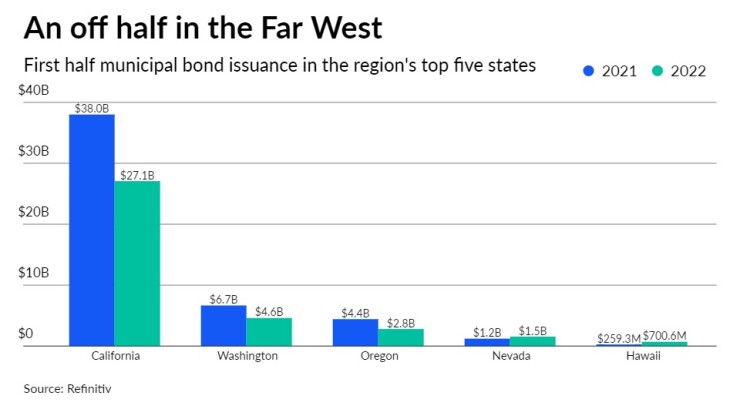

Issuers in the Far West sold $37.7 billion of municipal bonds in the first half of 2022, a 28.2% drop year-over-year from $52.6 billion.

New-money volume was down 18.8% to $25.6 billion, according to Refinitiv data, but refunding and combined new-money volume fell even further, by more than 42%.

In typical fashion, California set the tone for the region; and the state retained its status as the largest source of municipal bonds in the nation.

California volume dropped by 28.6% to $27.1 billion in 398 issuances, trailed by New York with $25.1 billion and Texas with $24.3 billion.

In California, the split between refundings and new-money deals changed from being roughly equal in the first half of 2021 to 88% new-money and 12% refundings in first half of 2022, according to data provided by the California State Treasurer's office.

Debt issued through the California State Treasurer's office is down 37% year-over-year, and most of that is refunding, said Tim Schaefer, deputy treasurer for finance.

Schaefer expects that "will get more pronounced" in the current budget year, because "the governor and the Legislature have

Going forward, Schaefer expects the decline in refundings will continue, because the state "picked off a lot of the low hanging fruit," when interest rates were at historically low levels.

The entire region saw a decline in tax-exempt debt by 17.3% to $29.5 billion, and as interest rates rose, taxable issuance fell by well more than half, to $6.4 billion from $15.2 billion.

The rising-rate environment largely eliminated the ability to sell taxable bonds to take out non-callable tax-exempt debt.

California's move to use cash to pay for projects rather than debt is also likely to keep the state's new-money issuance down over the next few years.

"It's a good thing for the state, but maybe not a good thing for the underwriter," Schaefer said. "The bottom line is we are off 35% first half 2022 vs 2021."

Sara Oberlies Brown, co-chair of Stifel's California practice, would agree with that.

The first half was particularly hard for underwriters chasing K-12 education deals.

"You can't go into any pricing or bond issue coming to market assuming investors who purchased a similar credit last week, let alone last month or two months ago, will be able to buy the subject credit on any particular day," Brown said.

The solutions that led to a successful outcome over the past six months have not been just about getting the bonds sold but making sure the issuers are comfortable with the rates, she said.

"The one constant has been, you can't assume that what worked last week is going to work this week," Brown said.

Another change is getting preliminary offering documents out more than just a few days before deals price, so that investors have more time to get comfortable with the credits, she said.

"May was challenging, April was tough — there were very large weeks with outflows that really made getting to a solution more complicated," Brown said, but added that June, July and August brought an improvement in the conditions that made getting deals done earlier in the year challenging.

What was a challenging market for issuers was a candy store for investors.

"The market has rallied so much in the past few weeks on a relative basis, compared to what you could buy in May and June when outflows were dramatic," said Craig Brothers, fixed income portfolio manager for Bel Air Investment Strategy. "When there were huge outflows, we weren't bidding against anyone. The mutual funds had to be sellers, and they got to $7 billion in outflows in the first half of the year."

"The calendar was average size and then the selling pressure from mutual fund redemption was huge," he said. "That made munis super attractive."

For investors, now the party is over.

"There has been a rally in treasuries, and munis and outflows are small," Brothers said. "And the relative value to treasuries are not as attractive, because munis have rallied more."

On the upside, Brothers said, "at least we are getting yields now that are attractive compared to what you could buy over the past 5 to 10 years."

K-12 in the Golden State took a pause between market conditions and trying to respond to all the changes wrought by the pandemic, Brown said.

Deal volume Refinitiv classified as the education category was down 54.1% to $5.3 billion in California, and down 52.7% to $7.2 billion across the region.

That's a switch from the prior year, when education deals were up in the entire region, hitting $15.2 billion in the region as the states modified classrooms to deal with COVID-19 and prepare students for in-person learning.

Every category except healthcare and electric power declined across the region. Healthcare more than doubled to $3.8 billion. Public facilities saw the biggest drop falling by 71.3% to $502 million.

Stifel's Brown also noted that she has seen less interest from clients in putting school bond measures on November's ballot, which might not affect upcoming deals in the near term but could be an issue a couple of years down the road when school districts start to hit their bond capacity.

The University of California Regents topped the tally of largest deals with a $3 billion sale in April. That single deal made the university system the Far West's most prolific issuer.

Washington's state government was the second-largest issuer at $2.3 billion. Its $1.3 billion

That single deal made California the number-three issuer by volume.

The bulk of UC Regents bond spending has gone to upgrade medical buildings to meet state earthquake standards.

Volume was down in seven of the Far West's nine state. The exceptions were Hawaii, where volume more than doubled volume selling $700.6 million in six sales, and Nevada, up 26.2% to $1.5 billion.

In Washington, the region's second largest issuer, sales fell by 30.0% to $4.6 billion in 53 issues.

BofA Securities secured the Far West's top underwriter ranking, credited by Refinitiv with $5.4 billion, followed by Morgan Stanley with $4.8 billion and J.P. Morgan Securities with $4.5 billion.

PFM Financial Advisors secured the top financial advisor slot, credited with $7 billion, followed by Public Resources Advisory Group with $5.1 billion and Swap Financial Group with $3 billion.

Orrick Herrington & Sutcliffe retained its long-time position as top bond counsel with $13.5 billion, followed by Stradling Yocca Carlson & Rauth with $4.7 billion and Foster Garvey PC with $3 billion.