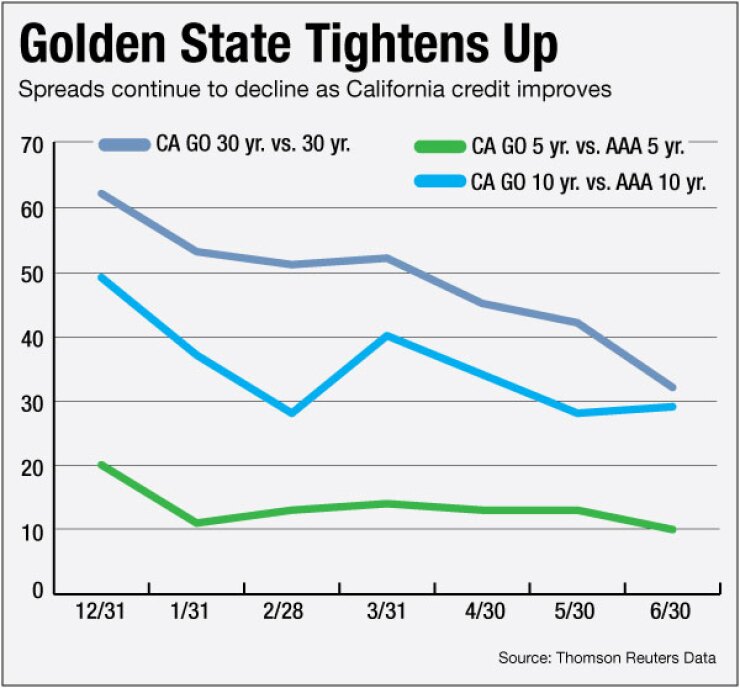

SAN FRANCISCO - Spreads between what a California general obligation bond yields and the rate on a triple A-rated bond have tightened since the state's rating was

The compression is a continuation of a greater trend that has seen yields fall as other favorable market conditions, including steady improvements in the state's financial health, and a light new issue supply in the overall municipal bond market, keep investor demand for California paper strong.

Such financial improvements, as well improvement in governance and a decline in debt, were cited when Moody's Investors Service upgraded California's GO bond rating to Aa3 from A1 on July 25.

Since then, the spreads for California's GO yields have contracted against Municipal Market Data's generic triple-A municipal bond — from 10 basis points on bonds maturing in five years on June 25 to 6 basis points as of July 23, according to data from Thomson Reuters.

In 10-year maturities, spreads have come down from 29 basis points to 25 basis points during that time frame. In 30-year maturities, spreads slightly widened from 36 basis points to 38 basis points.

"The recent rating upgrade of California has tightened spreads on the credit marginally more since the announcement," said Michael Pietronico, chief executive officer at Miller Tabak Asset Management in New York. "However, most of the spread compression occurred over the last few months as investors rightfully concluded that the Golden State was on firmer footing economically."

Since the beginning of the year, spreads have come down from a high of 29 basis points for five-year bonds, and 56 basis points for 10-year bonds. In the 30-year maturities, spreads have come down from 62 basis points.

"Right now the state general obligation bond is trading in the strong AA range so investors need to consider that much of the 'good news' may already be priced into the credit in the near term," Pietronico said.

Tom Dresslar, a spokesperson for California Treasurer Bill Lockyer, said the treasurer's office hasn't seen a dramatic narrowing of spreads in the wake of the Moody's upgrade.

"What likely is the case is that the market by that time had already priced in an upgrade, so the formality of the action didn't have a striking impact," he said. "If you look at where things stood, Standard & Poor's had upgraded us in January 2013, Fitch Ratings upgraded us in August 2013, and investors could see continued improvement in our fiscal condition and our financial management practices."

Both Standard & Poor's and Fitch Ratings upgraded the state's rating to A from A-minus last year. Standard & Poor's assigns a positive outlook, while Fitch gives a stable outlook.

Marilyn Cohen, founder of Envision Capital Management in Los Angeles, cited market conditions as one factor in the spread compression.

"What's really affected the market in California is the fact that new issuance has been very, very light," said Cohen, who manages $320 million of corporate and municipal bonds. "So it's hard to tell whether it's been the upgrade, or whether it's the fact that there are very few new issues, or both."

New issue supply for this year through June totaled around $150.5 billion, in 5,133 issues, according to Thomson Reuters data. That amount is a 16% decline from last year's $179.1 billion, in 6,542 issues, during the same time period.

And while new supply has remained low, there still continues to be a very strong demand for California paper, Cohen said.

"We have a lot of California municipal investors and like every other manager that does separate accounts like us, we're scratching around to find good quality paper," she said.

California, typically one of the largest issuers in the country, has more than $75 billion of GO debt outstanding. As of July 1, the state had about $25.9 billion in authorized but not-yet-issued long-term GO debt.

In the first half of this year, California sold $2.6 billion of debt in three issues, coming in second to Puerto Rico, which sold $3.5 billion of debt in one bond offering.

The state is expected to sell revenue anticipation notes at some point this year for cash-flow borrowing, but the timing or amount has not yet been decided, Dresslar said.

In the past, investors have gobbled up the state's bonds because they pay higher yields compared to other states.

High state income taxes -- which were raised even more to help balance the budget -- also make in-state debt attractive to wealthy Californians.

Until the Moody's upgrade, almost every state had a higher rating than California, with the exception of A1-rated New Jersey, and A3-rated Illinois.

Now California joins the ranks of Connecticut, Arizona, and, most recently, Pennsylvania at the bottom of Moody's double-A category.

Standard & Poor's and Fitch continue to rate the state in the single-A category, two notches lower than Moody's, but Matt Fabian, a managing director at Municipal Market Advisors, said it's hard to think of California as anything but AA.

"California's improving economy and finances allowed it a fairly well-constructed new budget, certainly the kind of budget employed by AA credits," he said. "States need to show dramatic weakness to fall out of the AA category, and California no longer is."

According to Moody's, the state's recent on-time budgets and a commitment to build a rainy day reserve fund put it in a better position to manage future fluctuations, including those that result from significant tax revenue volatility.

The ratings agency also noted that net tax-supported debt declined last year, from $95.8 billion at the end of 2012, to $94.5 billion at the end of 2013. Unfunded pension liabilities are large, but within range of California's peers, and annual pension costs will remain manageable, Moody's said.

Moody's also expects improving general accepted accounting principles-basis fund balances, which were negative $15 billion in fiscal year 2013, in the next two years as voter-approved temporary tax increases and actions to rein in spending allow prior payment deferrals to be repaid, analysts said in a report following the upgrade.

The state's rating from Moody's has hovered in the single-A category, with a short drop to the triple-B category in 2009 and 2010 after the financial crisis, for the past decade.

The last time it had a double-A rating was in 2001, when it carried a Aa3 rating.

"I think they have been a little bit fast on the trigger in upgrading California," Cohen said of the Moody's action.

While the state is in its best financial position for years, and it has a surplus, Cohen said it's too soon to tell whether the financial stability is here to stay.

"California is kind of like an unreliable lover," she said. "You never know when they're going to go astray."

She said she'd like to see the state show that it can, in fact, be fiscally responsible in the long run, reducing its debt and maintaining a rainy day fund.

"As a portfolio manager and as a California municipal investor, I fear that they will go back to their same old bad ways," Cohen said.

The state legislature passed a measure this year asking voters to require the state to deposit capital gains revenues greater than 8% of general fund tax revenues, aside from dedicated education funding, into a rainy day fund.

In addition, 1.5% of annual general fund revenues would also go into the rainy day fund each year.

The measure will go before voters on the November ballot.

Cohen said she believes the state's ratings should be kept at the single-A level, at least for a good amount of time, to make sure it doesn't fall back into its old financial habits.