New York, Wisconsin and California issuers priced bonds on Tuesday as investor demand continued to support municipal debt, analysts and traders said. Deals ran the gamut from high-grade to high-yield.

Primary market

RBC Capital Markets held a second day of retail orders on New York City’s $809.555 million of tax-exempt general obligation bonds. The deal includes Fiscal 2019 Series A and B GOs and Fiscal 1994 Series H, Subseries H3 GOs. The deal will be priced for institutions on Wednesday.

Also on Wednesday, the city is competitively selling $60 million of taxable Fiscal 2018 Series C GOs.

The deals are rated Aa2 by Moody’s Investors Service, and AA by S&P Global Ratings and Fitch Ratings.

Jefferies priced the New York Triborough Bridge and Tunnel Authority’s $273 million of Series 2018B general revenue refunding bonds for institutions on Tuesday after holding a one-day retail order period.

The deal is rated Aa3 by Moody’s, AA-minus by S&P and Fitch and AA by Kroll Bond Rating Agency.

JPMorgan Securities priced the Wisconsin Health and Educational Facilities Authority’s $1.23 billion issue for the Advocate Aurora Health Credit Group consisting of tax-exempt and taxable bonds. The deal is rated Aa3 by Moody’s and AA by S&P and Fitch.

Bank of America Merrill Lynch priced the California Statewide Communities Development Authority’s $399.795 million of Series 2018A revenue bonds for the Loma Linda Medical Center. The deal is rated BB-minus by S&P and BB by Fitch.

Wells Fargo Securities priced the California Educational Facilities Authority’s $100 million of Series 2018A revenue bonds for the ArtCenter College of Design. The deal is rated Baa1 by Moody’s.

BAML priced as a remarketing the Oregon Business Development Commission’s $$141.855 million of Series 232 recovery zone facility bonds for the Intel Corp.The deal is rated A1 by Moody’s and A-plus by S&P.

BAL also priced as a remarketing the Industrial Development Authority of Chandler, Ariz.’s $281.57 million of Series 2005 and Series 2007 industrial development revenue bonds for Intel. The deal is rated A1 by Moody’s and A-plus by S&P.

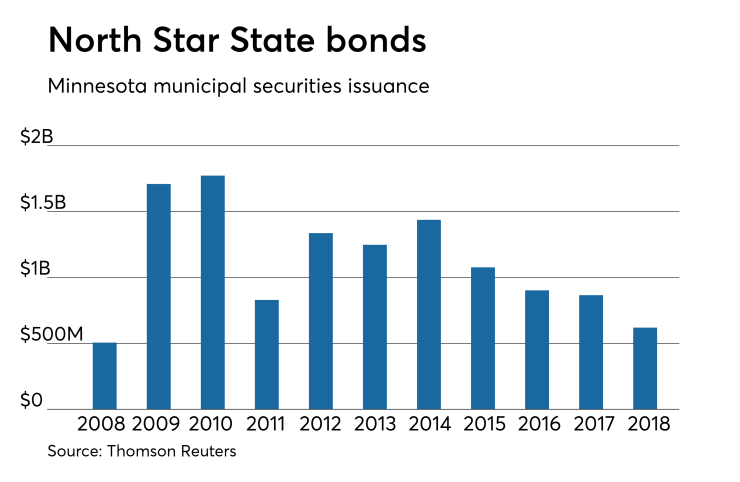

In the competitive arena on Tuesday, Minnesota offered $619.37 million of GOs in three sales.

Citigroup won the $397.72 million if Series 2018 various purpose bonds with a true interest cost of 3.1023%.

Morgan Stanley won the $206 million of Series 2018B trunk highway bonds with a TIC of 2.9989%. Morgan Stanley also won the $16 million of Series 2018C taxable various purpose bonds with a TIC of 3.3851%.

Public Resources Advisory Group is the financial advisor and Kutak Rock is the bond counsel. The deals are rated Aa1 by Moody's and AAA by S&P and Fitch.

The North Star State has sold over $12 billion of bonds since 2008, with the most issuance occurring in 2010 when it offered $1.8 billion of debt. It sold the least amount of bonds in 2008 when it issued $506.1 million of debt.

Michigan sold $149.2 million of environmental program GOs. Bank of America Merrill Lynch won the bonds with a TIC of 3.2243%.

Robert W. Baird is the financial advisor and Dickinson Wright is the bond counsel. The deal is rated Aa1 by Moody’s and AA by S&P and Fitch.

Michigan Treasurer Nick Khouri said the state’s sale garnered strong investor interest as 10 underwriters submitted competitive bids to purchase the tax-exempts, which had maturities ranging from 2027 to 2033.

“Today’s bond sale shows that investors are willing to put their dollars behind Michigan,” Khouri said in a press release. “As Standard & Poor’s acknowledged when they upgraded Michigan’s credit rating, our state has worked hard to improve its financial position and economy in recent years. I am very pleased with today’s sale, which continues to reaffirm Michigan’s comeback.”

The bonds are issued under the Great Lakes Protection and Clean Michigan Initiative Program and will primarily support environmental contamination remediation, water infrastructure, asset management plans, and water quality monitoring in communities across the state.

“Modern and reliable infrastructure play an important role in protecting public health and our state’s environment,” C. Heidi Grether, director of the Michigan Department of Environmental Quality, said in the release.

“These funds have allowed us to build a stronger environmental foundation while also investing in the state’s future by helping communities make critical updates and repairs to aging infrastructure,” she said.

Tuesday’s bond sales

New York

Michigan

Minnesota

Wisconsin

Oregon

Arizona

California

The healthy new issue supply this week should do well, Peter Block, managing director at Ramirez & Co., wrote in a weekly municipal report on Monday.

He cited the NYC GO deal and the Wisconsin health offering. “These transactions should do well given generally shorter maturities,” he said. Competitively, he said, Minnesota’s $619 million of GOs would also be enticing.

“We think YTD gross supply is higher than our projection at this point due primarily to higher-than-projected new money of $107 billion at 60% of the total and 16% ahead of our mid-year projection of $92 billion,” Block said. “Actual new money supply is likely running higher versus our projection due to still favorable borrowing costs and higher demand than expected, particularly in still high-tax states like California, New York, Illinois, Massachusetts,” Block said.

“The very strong demand has had the effect of compressing spreads, which to a degree mitigates some MMD rate increases, thereby lowering overall borrowing costs,” he continued.

For now, Block maintains the firm’s full-year supply projection at $317 billion as it estimated new money issuance will decelerate as rates move higher for the rest of the year.

Over the next 30 days, net muni market supply is negative $16.64 billion, comprised of $10.74 billion new issuance and $27.4 billion of maturing and called bonds combined, according to Block. “The states that stand to experience the largest change in outstanding debt include Texas, California, New Jersey, New York, and Minnesota.

Meanwhile, the technical imbalance of supply and demand is providing constructive support for the municipal market, according to Jeffrey Lipton, managing director at Oppenheimer & Co.

“Although the 30-day net supply deficit is about 54% of the figure from one month ago, there is still an obvious technical imbalance that supports continued demand for munis,” he wrote in a weekly municipal market report released on Tuesday.

“Against a backdrop of constructive market technicals and what may become a more visible flight-to-quality-bid through the balance of the year as geopolitical concerns, including global trade headwinds, evolve, price discovery could see more improvement and liquidity challenges may ease further,” Lipton said.

This week’s heavier calendar should be easily absorbed, Lipton said, given the available reinvestment proceeds and the “insatiable appetite likely to stick around at the end of the week.”

A 66% increase year-over-year in new money issuance may suggest that issuers are willing to bond for “meaningful and necessary capital projects” and may also suggest an existing pipeline of bond authorizations, according to Lipton.

Meanwhile outflows are likely to “episodically” return during the second half of the year, he said. “More prevalent inflows should be a key driver of market recovery and performance,” Lipton wrote. “We continue to believe that munis have the potential to unlock additional performance and finish the year with modest single digit positive returns.”

Lipton suggests investors follow relative value relationships as any appreciable underperformance by municipals can elevate ratios and provide more compelling entry points on an intermittent basis, according to Lipton.

With respect to July performance, municipals returned 24 basis points per the Bloomberg/Barclays indices, he noted.

“Year-to-date, the overall index has shown meaningful recovery and is down only one basis point as of July 31,” he wrote. “We note that after last week’s soft performance, there has been some retrenchment in returns.”

Oppenheimer prefers essential purpose revenue bonds with a lien on a dedicated revenue pledge and containing certain indenture covenants for the benefit of bondholders -- even within the context of the COFINA debate in the Puerto Rico Title III bankruptcy proceedings, Lipton said in his report..

“The states of Connecticut, Illinois and New Jersey as well as the U.S. territories of Guam, Puerto Rico and the Virgin Islands far outperformed the majority of states,” he said. “As far as Connecticut, Illinois, and New Jersey are concerned, we can attribute their monthly returns to a generally favorable state budgetary cycle and the fact that credit spreads have been wider for these states,” Lipton wrote. “The U.S. territories likely received a lift from positive developments coming out of Puerto Rico, not the least of which is news of a PREPA restructuring deal.”

Secondary market

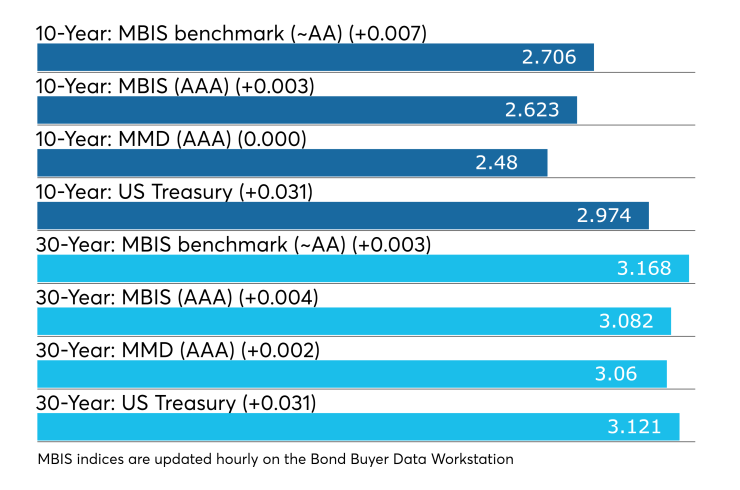

Municipal bonds were mostly weaker on Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose less than one basis point in the one-year and seven- to 30-year maturities, fell less than a basis point in the two- to five-year maturities and remained unchanged in the six-year maturity.

High-grade munis were also mostly weaker, with yields calculated on MBIS’ AAA scale rising less than one basis point in the one- and two-year and seven- to 30-year maturities, falling less than a basis point in the three- to five-year maturities and remaining unchanged in the six-year maturity.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation remaining unchanged while the yield on the 30-year muni maturity increased two basis points.

Treasury bonds were weaker as stocks traded higher.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 83.5% while the 30-year muni-to-Treasury ratio stood at 98.1%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 34,270 trades on Monday on volume of $10.87 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 14.761% of the market, the Empire State taking 11.788% and the Lone Star State taking 10.018%.

Treasury sells $70B 4-week bills

The Treasury Department Tuesday auctioned $70 billion of four-week bills at a 1.905% high yield, a price of 99.851833.

The coupon equivalent was 1.934%. The bid-to-cover ratio was 2.65.

Tenders at the high rate were allotted 32.20%. The median rate was 1.890%. The low rate was 1.860%.

Treasury auctions $34B 3-year notes

Treasury also auctioned $34 billion of three-year notes with a 2 3/4% coupon at a 2.765% high yield, a price of 99.957100. The bid-to-cover ratio was 2.65.

Tenders at the high yield were allotted 34.24%. All competitive tenders at lower yields were accepted in full. The median yield was 2.743%. The low yield was 2.630%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.