Primary market activity was a bit muted Wednesday after the biggest deal of the year — the Buckeye Tobacco Settlement Financing Authority's offering — priced a day earlier than expected.

Primary market

Jefferies received the written award on the Buckeye TSFA’s $5.352 billion of tobacco settlement asset-backed refunding senior and taxable bonds on Wednesday. The deal was originally scheduled to price Wednesday, but underwriters moved it up due to favorable market conditions.

The second largest deal ever done in the tobacco sector was wildly successful and hit every objective the state of Ohio laid out, underwriters said.

“We accelerated the deal by a day and clearly took advantage of the market backdrop, we were well prepared with our structure and had wind in our sails,” said Kym Arnone, managing director and joint head of municipal finance at Jefferies.

She noted that the deal had over 150 investors participate, and saw interest across the yield curve.

"We had a diverse structure with a variety of taxable and tax-exempt product including taxable fixed amortization serials, taxable turbos, tax-exempt turbos, senior capital appreciation bonds, etc.," she said.

Arnone added that going into the sale, they knew they were going to have significant replacement demand, as the transaction took out $5 billion of high-yield paper and replaced it with roughly $3.3 billion of high-yield paper.

“Based on the sizable order book, we were able to improve price several times both during the premarketing period and on the actual day of sale ultimately resulting in massive present-value savings to our client, the state of Ohio."

Bank of America Securities priced West Virginia University Board of Governors’ (Aa3/ /AA-/ ) $377.79 million of refunding revenue taxable bonds.

In the competitive arena, Baltimore County, Maryland (Aa1/AAA/AAA), sold $246 million of consolidated public improvement bonds. Morgan Stanley won with a true interest cost of 1.9697%.

Barclays priced Narragansett Bay Commission, Rhode Island’s ( /AA-/ / ) $196.205 million of wastewater system refunding revenue taxable green bonds.

Secondary market

“More fear and less yield — the operative words in the risk-off moves that are causing equity losses and bond gains,” said Kim Olsan, senior vice president of municipal bond trading at FHN Financial. “Municipals are not exempt from the trend to lower yields, moving intermediate levels below 1%. Should further improvements continue into the end of the month, February returns will nudge over 1.00%.”

She added that yields have descended into unchartered territory and that is where the value stands between munis and U.S. Treasuries.

“While it is counterintuitive, relative value has improved of its lows of the year. In mid-January the AAA/UST ratio stood at 70%,” she said. “The absolute yield gap between the two rates then was 52 basis points. As the 10-year AAA yield rallied to 1.00%, the ratio to its UST counterpart closed at 75%, but the yield gap compressed to 32 basis points as Treasuries have been much more reactive to the flight to quality.”

Munis were stronger on Wednesday on the MBIS benchmark scale, with yields dropping eight basis points in the 10-year maturity and one basis point in the 30-year maturity. High-grades were also stronger, with yields on MBIS' AAA scale decreasing by 10 basis points in the 10-year maturity and by two basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year muni GO and 30-year GO were unchanged from record lows of 0.98% and 1.57%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 75.0% while the 30-year muni-to-Treasury ratio stood at 87.6%, according to MMD.

Stocks started the day in green, but reversed course and turned negative and then were mixed as of press time. The U-turn can be traced to COVID-19 and worries about it spreading here in the U.S. with now 59 cases reported.

The Dow Jones Industrial Average was down about 0.23%, the S&P 500 index was lower by 0.08% and the Nasdaq gained roughly 0.47% late in the session Wednesday.

The three-month Treasury was yielding 1.531%, the Treasury two-year was yielding 1.157%, the five-year was yielding 1.154%, the 10-year was yielding 1.319% and the 30-year was yielding 1.803%.

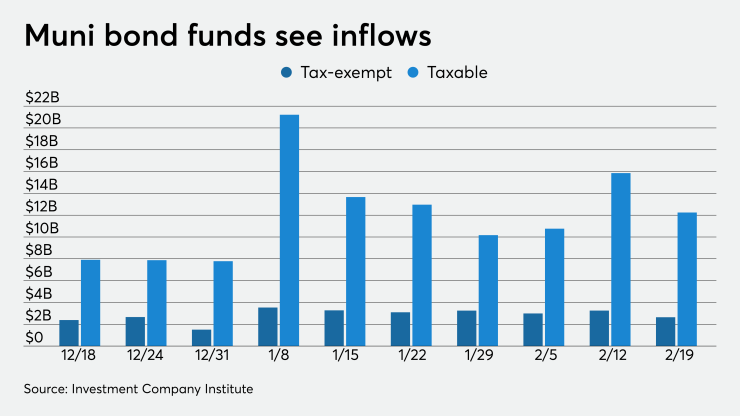

ICI: Muni funds see $2.6B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.643 billion in the week ended Feb. 19, the Investment Company Institute reported on Wednesday.

It was the 59th straight week of inflows into the tax-exempt mutual funds reported by ICI. The previous week, ended Feb. 12, saw $3.253 billion of inflows into the funds.

Long-term muni funds alone had an inflow of $2.357 billion after an inflow of $2.887 billion in the previous week; ETF muni funds alone saw an inflow of $286 million after an inflow of $366 million in the prior week.

Taxable bond funds saw combined inflows of $12.246 billion in the latest reporting week after revised inflows of $15.859 billion in the previous week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $16.208 billion after inflows of $27.659 billion in the prior week.

The biggest laggard of the week was domestic equities, which saw an outflow of $3.256 billion this past week, after an inflow of $4.357 billion the week before.

Previous session's activity

The MSRB reported 33,420 trades Tuesday on volume of $10.975 billion. The 30-day average trade summary showed on a par amount basis of $11.86 million that customers bought $5.91 million, customers sold $3.88 million and interdealer trades totaled $2.07 million.

California, Texas and New York were most traded, with the Golden State taking 15.17% of the market, the Lone Star State taking 13.144% and the Empire State taking 9.329%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp., restructured COFINA A-1 bonds, revenue, zeros of 2051, which traded 54 times on volume of $125.700 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.